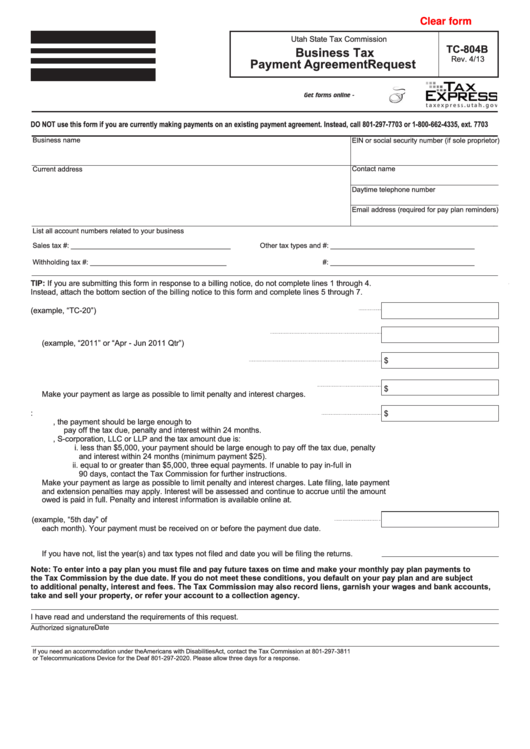

Clear form

Utah State Tax Commission

TC-804B

Business Tax

Rev. 4/13

Payment Agreement Request

Get forms online - tax.utah.gov

DO NOT use this form if you are currently making payments on an existing payment agreement. Instead, call 801-297-7703 or 1-800-662-4335, ext. 7703

Business name

EIN or social security number (if sole proprietor)

Current address

Contact name

Daytime telephone number

Email address (required for pay plan reminders)

List all account numbers related to your business

Sales tax #: _________________________________________

Other tax types and #: _____________________________________

Withholding tax #: ___________________________________

#: _____________________________________

TIP: If you are submitting this form in response to a billing notice, do not complete lines 1 through 4.

Instead, attach the bottom section of the billing notice to this form and complete lines 5 through 7.

1. Enter the tax return form number for which you are making this request (example, “TC-20”)

2. Enter the tax year or period for which you are making this request

(example, “2011” or “Apr - Jun 2011 Qtr”)

3. Enter the total amount you owe as shown on your tax return

$

4. Enter the amount of any payment you are making with your tax return or notice

$

Make your payment as large as possible to limit penalty and interest charges.

5. Enter the amount you can pay each month. Minimum payment requirements are:

$

a. If the business is a sole proprietor or partnership, the payment should be large enough to

pay off the tax due, penalty and interest within 24 months.

b. If the business is a corporation, S-corporation, LLC or LLP and the tax amount due is:

i. less than $5,000, your payment should be large enough to pay off the tax due, penalty

and interest within 24 months (minimum payment $25).

ii. equal to or greater than $5,000, three equal payments. If unable to pay in-full in

90 days, contact the Tax Commission for further instructions.

Make your payment as large as possible to limit penalty and interest charges. Late filing, late payment

and extension penalties may apply. Interest will be assessed and continue to accrue until the amount

owed is paid in full. Penalty and interest information is available online at

tax.utah.gov

.

6. Enter the day of the month you want your payments to be due (example, “5th day” of

each month). Your payment must be received on or before the payment due date.

7. You must have filed tax returns for all prior filing periods before your pay

plan

will be approved.

If you have not, list the year(s) and tax types not filed and date you will be filing the returns.

Note: To enter into a pay plan you must file and pay future taxes on time and make your monthly pay plan payments to

the Tax Commission by the due date. If you do not meet these conditions, you default on your pay plan and are subject

to additional penalty, interest and fees. The Tax Commission may also record liens, garnish your wages and bank accounts,

take and sell your property, or refer your account to a collection agency.

I have read and understand the requirements of this request.

Date

Authorized signature

If you need an accommodation under the Americans with Disabilities Act, contact the Tax Commission at 801-297-3811

or Telecommunications Device for the Deaf 801-297-2020. Please allow three days for a response.

1

1 2

2