Form Mt-650 - Stock Transfer Tax Quarterly Return Of Stock Transfer Taxes Withheld

ADVERTISEMENT

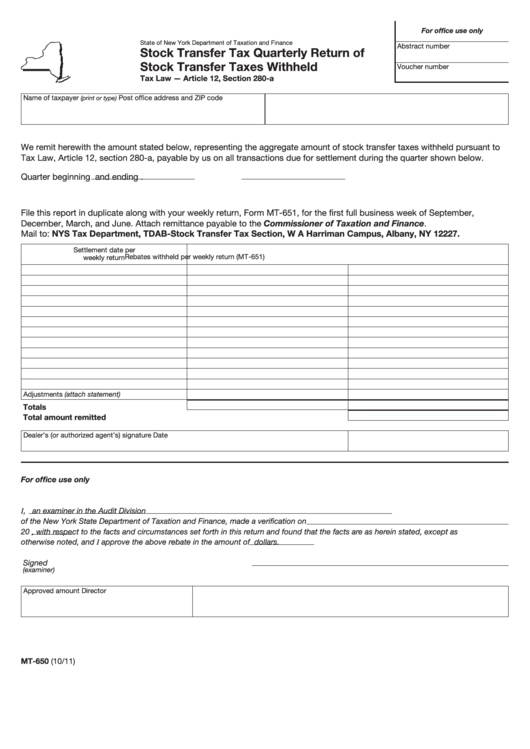

For office use only

State of New York Department of Taxation and Finance

Abstract number

Stock Transfer Tax Quarterly Return of

Stock Transfer Taxes Withheld

Voucher number

Tax Law — Article 12, Section 280-a

Name of taxpayer

Post office address and ZIP code

(print or type)

We remit herewith the amount stated below, representing the aggregate amount of stock transfer taxes withheld pursuant to

Tax Law, Article 12, section 280-a, payable by us on all transactions due for settlement during the quarter shown below.

Quarter beginning

and ending

.

File this report in duplicate along with your weekly return, Form MT-651, for the first full business week of September,

December, March, and June. Attach remittance payable to the Commissioner of Taxation and Finance.

Mail to: NYS Tax Department, TDAB-Stock Transfer Tax Section, W A Harriman Campus, Albany, NY 12227.

Settlement date per

Rebates withheld per weekly return (MT-651)

weekly return

Adjustments (attach statement)

Totals

Total amount remitted

Dealer’s (or authorized agent’s) signature

Date

For office use only

an examiner in the Audit Division

I,

of the New York State Department of Taxation and Finance, made a verification on

20

, with respect to the facts and circumstances set forth in this return and found that the facts are as herein stated, except as

otherwise noted, and I approve the above rebate in the amount of

dollars.

Signed

(examiner)

Approved amount

Director

MT-650 (10/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1