PRINT FORM

RESET FORM

Form

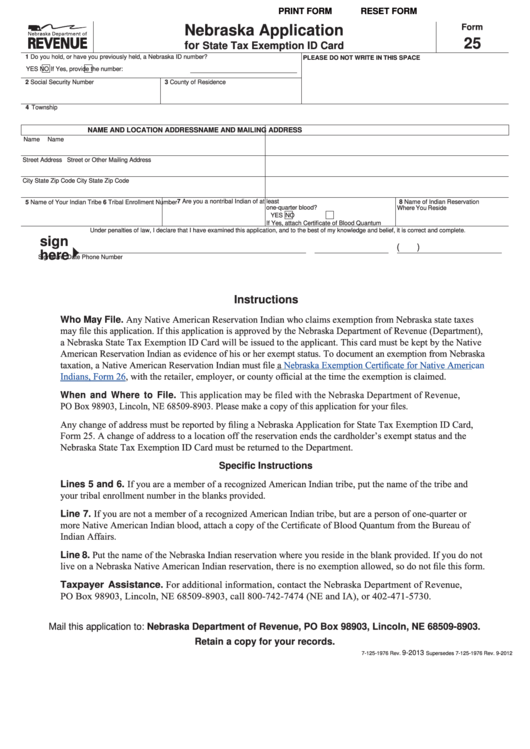

Nebraska Application

25

for

State Tax Exemption ID Card

1 Do you hold, or have you previously held, a Nebraska ID number?

PLEASE DO NOT WRITE IN THIS SPACE

YES

NO

If Yes, provide the number:

2 Social Security Number

3 County of Residence

4 Township

NAME AND LOCATION ADDRESS

NAME AND MAILING ADDRESS

Name

Name

Street Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

7 Are you a nontribal Indian of at least

8 Name of Indian Reservation

5 Name of Your Indian Tribe

6 Tribal Enrollment Number

one-quarter blood?

Where You Reside

YES

NO

If Yes, attach Certificate of Blood Quantum

Under penalties of law, I declare that I have examined this application, and to the best of my knowledge and belief, it is correct and complete.

sign

(

)

here

Signature

Date

Phone Number

Instructions

Who May File. Any Native American Reservation Indian who claims exemption from Nebraska state taxes

may file this application. If this application is approved by the Nebraska Department of Revenue (Department),

a Nebraska State Tax Exemption ID Card will be issued to the applicant. This card must be kept by the Native

American Reservation Indian as evidence of his or her exempt status. To document an exemption from Nebraska

taxation, a Native American Reservation Indian must file a

Nebraska Exemption Certificate for Native American

Indians, Form

26, with the retailer, employer, or county official at the time the exemption is claimed.

When and Where to File. This application may be filed with the Nebraska Department of Revenue,

PO Box 98903, Lincoln, NE 68509-8903. Please make a copy of this application for your files.

Any change of address must be reported by filing a Nebraska Application for State Tax Exemption ID Card,

Form 25. A change of address to a location off the reservation ends the cardholder’s exempt status and the

Nebraska State Tax Exemption ID Card must be returned to the Department.

Specific Instructions

Lines 5 and 6. If you are a member of a recognized American Indian tribe, put the name of the tribe and

your tribal enrollment number in the blanks provided.

Line 7. If you are not a member of a recognized American Indian tribe, but are a person of one-quarter or

more Native American Indian blood, attach a copy of the Certificate of Blood Quantum from the Bureau of

Indian Affairs.

Line 8. Put the name of the Nebraska Indian reservation where you reside in the blank provided. If you do not

live on a Nebraska Native American Indian reservation, there is no exemption allowed, so do not file this form.

Taxpayer Assistance. For additional information, contact the Nebraska Department of Revenue,

PO Box 98903, Lincoln, NE 68509-8903, call 800-742-7474 (NE and IA), or 402-471-5730.

Mail this application to: Nebraska Department of Revenue, PO Box 98903, Lincoln, NE 68509-8903.

Retain a copy for your records.

9-2013

7-125-1976 Rev.

Supersedes 7-125-1976 Rev. 9-2012

1

1