Form 33 - Power Of Attorney

Download a blank fillable Form 33 - Power Of Attorney in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 33 - Power Of Attorney with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

RESET

PRINT

FORM

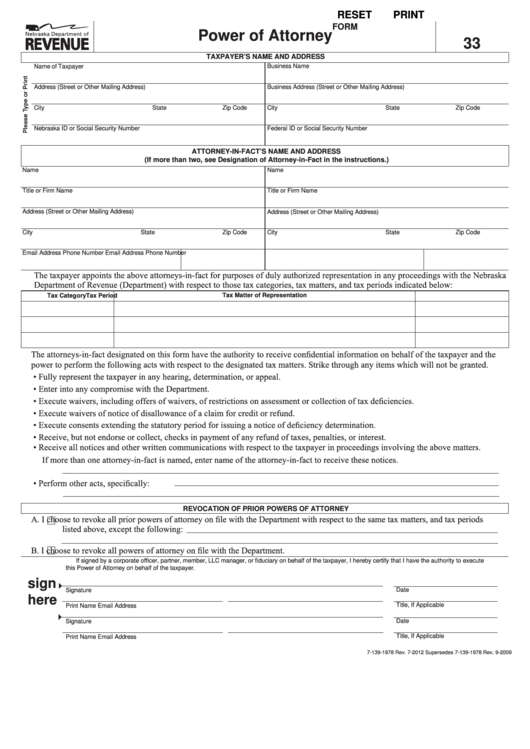

Power of Attorney

33

TAXPAYER’S NAME AND ADDRESS

Name of Taxpayer

Business Name

Address (Street or Other Mailing Address)

Business Address (Street or Other Mailing Address)

City

State

Zip Code

City

State

Zip Code

Nebraska ID or Social Security Number

Federal ID or Social Security Number

ATTORNEY-IN-FACT’S NAME AND ADDRESS

(If more than two, see Designation of Attorney-in-Fact in the instructions.)

Name

Name

Title or Firm Name

Title or Firm Name

Address (Street or Other Mailing Address)

Address (Street or Other Mailing Address)

City

State

Zip Code

City

State

Zip Code

Email Address

Phone Number

Email Address

Phone Number

The taxpayer appoints the above attorneys-in-fact for purposes of duly authorized representation in any proceedings with the Nebraska

Department of Revenue (Department) with respect to those tax categories, tax matters, and tax periods indicated below:

Tax Matter of Representation

Tax Category

Tax Period

The attorneys-in-fact designated on this form have the authority to receive confidential information on behalf of the taxpayer and the

power to perform the following acts with respect to the designated tax matters. Strike through any items which will not be granted.

•

Fully represent the taxpayer in any hearing, determination, or appeal.

•

Enter into any compromise with the Department.

•

Execute waivers, including offers of waivers, of restrictions on assessment or collection of tax deficiencies.

•

Execute waivers of notice of disallowance of a claim for credit or refund.

•

Execute consents extending the statutory period for issuing a notice of deficiency determination.

•

Receive, but not endorse or collect, checks in payment of any refund of taxes, penalties, or interest.

•

Receive all notices and other written communications with respect to the taxpayer in proceedings involving the above matters.

If more than one attorney-in-fact is named, enter name of the attorney-in-fact to receive these notices.

•

Perform other acts, specifically:

REVOCATION OF PRIOR POWERS OF ATTORNEY

A.

I choose to revoke all prior powers of attorney on file with the Department with respect to the same tax matters, and tax periods

listed above, except the following:

B.

I choose to revoke all powers of attorney on file with the Department.

If signed by a corporate officer, partner, member, LLC manager, or fiduciary on behalf of the taxpayer, I hereby certify that I have the authority to execute

this Power of Attorney on behalf of the taxpayer.

sign

Signature

Date

here

Title, If Applicable

Print Name

Email Address

Signature

Date

Title, If Applicable

Print Name

Email Address

7-139-1978 Rev. 7-2012 Supersedes 7-139-1978 Rev. 9-2009

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2