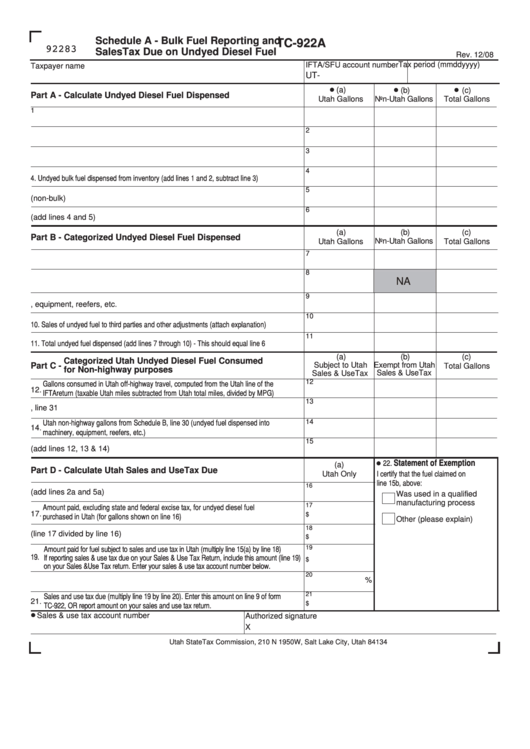

Schedule A - Bulk Fuel Reporting and

TC-922A

92283

Sales Tax Due on Undyed Diesel Fuel

Rev. 12/08

IFTA/SFU account number

Tax period (mmddyyyy)

Taxpayer name

UT-

(a)

(b)

(c)

Part A - Calculate Undyed Diesel Fuel Dispensed

Utah Gallons

Non-Utah Gallons

Total Gallons

1

1. Beginning undyed

bulk

fuel inventory

2

2. Undyed fuel purchased in bulk

3

3. Ending undyed bulk fuel inventory

4

4. Undyed bulk fuel dispensed from inventory (add lines 1 and 2, subtract line 3)

5

5. Undyed fuel purchased at service stations (non-bulk)

6

6. Total undyed fuel dispensed (add lines 4 and 5)

(a)

(b)

(c)

Part B - Categorized Undyed Diesel Fuel Dispensed

Utah Gallons

Non-Utah Gallons

Total Gallons

7

7. Total undyed fuel dispensed into Utah IFTA fleet

8

NA

8. Total undyed fuel dispensed into Utah Special Fuel User fleet

9

9. Total undyed fuel dispensed into machinery, equipment, reefers, etc.

10

10. Sales of undyed fuel to third parties and other adjustments (attach explanation)

11

11. Total undyed fuel dispensed (add lines 7 through 10) - This should equal line 6

(b)

(c)

(a)

Categorized Utah Undyed Diesel Fuel Consumed

Subject to Utah

Exempt from Utah

Part C -

Total Gallons

for Non-highway purposes

Sales & Use Tax

Sales & Use Tax

12

Gallons consumed in Utah off-highway travel, computed from the Utah line of the

12.

IFTA return (taxable Utah miles subtracted from Utah total miles, divided by MPG)

13

13. Utah PTO gallons from Schedule B, line 31

14

Utah non-highway gallons from Schedule B, line 30 (undyed fuel dispensed into

14.

machinery, equipment, reefers, etc.)

15

15. Total gallons (add lines 12, 13 & 14)

Statement of Exemption

22.

(a)

Part D - Calculate Utah Sales and Use Tax Due

Utah Only

I certify that the fuel claimed on

line 15b, above:

16

16. Undyed diesel fuel purchased in Utah (add lines 2a and 5a)

Was used in a qualified

manufacturing process

17

Amount paid, excluding state and federal excise tax, for undyed diesel fuel

17.

$

purchased in Utah (for gallons shown on line 16)

Other (please explain)

18

18. Average price per gallon (line 17 divided by line 16)

$

19

Amount paid for fuel subject to sales and use tax in Utah (multiply line 15(a) by line 18)

19.

If reporting sales & use tax due on your Sales & Use Tax Return, include this amount (line 19)

$

on your Sales &Use Tax return. Enter your sales & use tax account number below.

20

%

20. Sales tax rate - see instructions

21

Sales and use tax due (multiply line 19 by line 20). Enter this amount on line 9 of form

21.

$

TC-922, OR report amount on your sales and use tax return.

Sales & use tax account number

Authorized signature

X

Utah State Tax Commission, 210 N 1950 W, Salt Lake City, Utah 84134

1

1 2

2