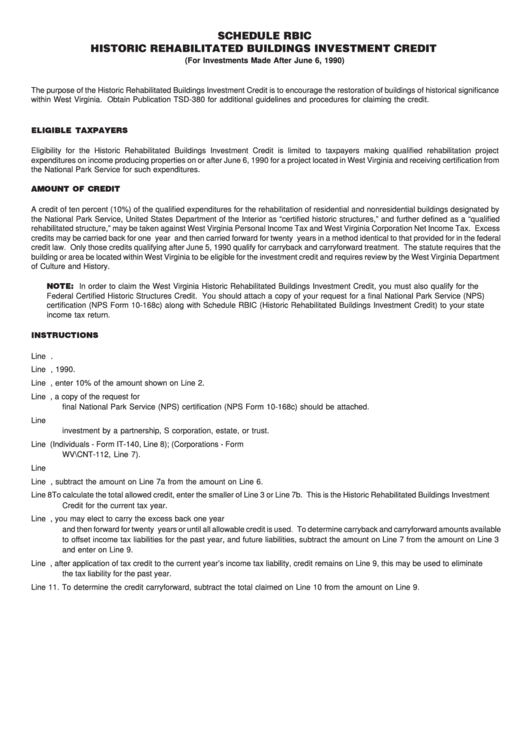

SCHEDULE RBIC

HISTORIC REHABILITATED BUILDINGS INVESTMENT CREDIT

(For Investments Made After June 6, 1990)

The purpose of the Historic Rehabilitated Buildings Investment Credit is to encourage the restoration of buildings of historical significance

within West Virginia. Obtain Publication TSD-380 for additional guidelines and procedures for claiming the credit.

ELIGIBLE TAXPAYERS

Eligibility for the Historic Rehabilitated Buildings Investment Credit is limited to taxpayers making qualified rehabilitation project

expenditures on income producing properties on or after June 6, 1990 for a project located in West Virginia and receiving certification from

the National Park Service for such expenditures.

AMOUNT OF CREDIT

A credit of ten percent (10%) of the qualified expenditures for the rehabilitation of residential and nonresidential buildings designated by

the National Park Service, United States Department of the Interior as “certified historic structures,” and further defined as a “qualified

rehabilitated structure,” may be taken against West Virginia Personal Income Tax and West Virginia Corporation Net Income Tax. Excess

credits may be carried back for one year and then carried forward for twenty years in a method identical to that provided for in the federal

credit law. Only those credits qualifying after June 5, 1990 qualify for carryback and carryforward treatment. The statute requires that the

building or area be located within West Virginia to be eligible for the investment credit and requires review by the West Virginia Department

of Culture and History.

NOTE: In order to claim the West Virginia Historic Rehabilitated Buildings Investment Credit, you must also qualify for the

Federal Certified Historic Structures Credit. You should attach a copy of your request for a final National Park Service (NPS)

certification (NPS Form 10-168c) along with Schedule RBIC (Historic Rehabilitated Buildings Investment Credit) to your state

income tax return.

INSTRUCTIONS

Line 1. Enter the amount of qualified rehabilitation expenditures for certified historic structures located within West Virginia.

Line 2. Enter the amount of qualified rehabilitation expenditures included on Line 1 that were incurred on or after June 6, 1990.

Line 3. To calculate the credit, enter 10% of the amount shown on Line 2.

Line 4. Enter the number assigned to the project by the National Park Service. In order to receive the credit, a copy of the request for

final National Park Service (NPS) certification (NPS Form 10-168c) should be attached.

Line 5. Enter the identifying number of the flow-through entity in the space provided if the credit is a flow-through resulting from an

investment by a partnership, S corporation, estate, or trust.

Line 6. Enter your West Virginia pre-credit tax liability for the current tax year. (Individuals - Form IT-140, Line 8); (Corporations - Form

WV\CNT-112, Line 7).

Line 7a. Enter amounts of all other allowable tax credits claimed on your return with the exception of Capital Company Credit.

Line 7b. To determine your maximum credit offset, subtract the amount on Line 7a from the amount on Line 6.

Line 8

To calculate the total allowed credit, enter the smaller of Line 3 or Line 7b. This is the Historic Rehabilitated Buildings Investment

Credit for the current tax year.

Line 9. If you are unable to utilize all the credit because Line 7 is less than Line 3, you may elect to carry the excess back one year

and then forward for twenty years or until all allowable credit is used. To determine carryback and carryforward amounts available

to offset income tax liabilities for the past year, and future liabilities, subtract the amount on Line 7 from the amount on Line 3

and enter on Line 9.

Line 10. If, after application of tax credit to the current year’s income tax liability, credit remains on Line 9, this may be used to eliminate

the tax liability for the past year.

Line 11. To determine the credit carryforward, subtract the total claimed on Line 10 from the amount on Line 9.

1

1 2

2