Instructions For Form Rct-900 - Public Utility Realty Report

ADVERTISEMENT

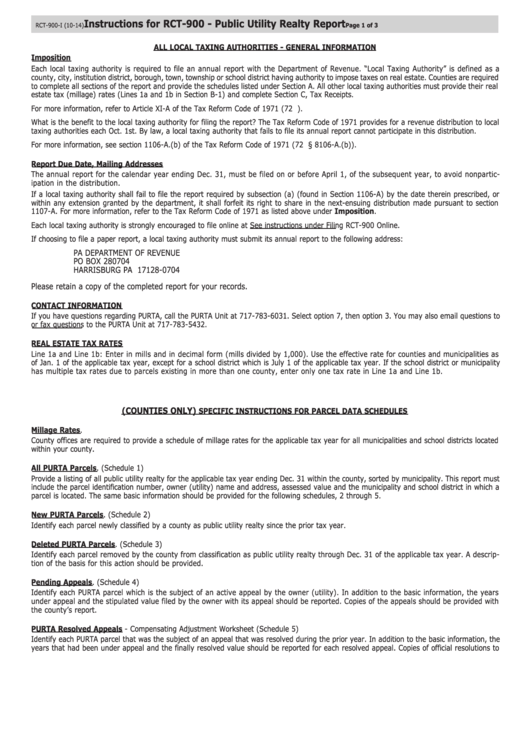

Instructions for RCT-900 - Public Utility Realty Report

RCT-900-I (10-14)

Page 1 of 3

ALL LOCAL TAXING AUTHORITIES - GENERAL INFORMATION

Imposition

Each local taxing authority is required to file an annual report with the Department of Revenue. “Local Taxing Authority” is defined as a

county, city, institution district, borough, town, township or school district having authority to impose taxes on real estate. Counties are required

to complete all sections of the report and provide the schedules listed under Section A. All other local taxing authorities must provide their real

estate tax (millage) rates (Lines 1a and 1b in Section B-1) and complete Section C, Tax Receipts.

For more information, refer to Article XI-A of the Tax Reform Code of 1971 (72 P.S. 8101-A et seq.).

What is the benefit to the local taxing authority for filing the report? The Tax Reform Code of 1971 provides for a revenue distribution to local

taxing authorities each Oct. 1st. By law, a local taxing authority that fails to file its annual report cannot participate in this distribution.

For more information, see section 1106-A.(b) of the Tax Reform Code of 1971 (72 P.S. § 8106-A.(b)).

Report Due Date, Mailing Addresses

The annual report for the calendar year ending Dec. 31, must be filed on or before April 1, of the subsequent year, to avoid nonpartic-

ipation in the distribution.

If a local taxing authority shall fail to file the report required by subsection (a) (found in Section 1106-A) by the date therein prescribed, or

within any extension granted by the department, it shall forfeit its right to share in the next-ensuing distribution made pursuant to section

1107-A. For more information, refer to the Tax Reform Code of 1971 as listed above under Imposition.

Each local taxing authority is strongly encouraged to file online at See instructions under Filing RCT-900 Online.

If choosing to file a paper report, a local taxing authority must submit its annual report to the following address:

PA DEPARTMENT OF REVENUE

PO BOX 280704

HARRISBURG PA 17128-0704

Please retain a copy of the completed report for your records.

CONTACT INFORMATION

If you have questions regarding PURTA, call the PURTA Unit at 717-783-6031. Select option 7, then option 3. You may also email questions to

purta@pa.gov or fax questions to the PURTA Unit at 717-783-5432.

REAL ESTATE TAX RATES

Line 1a and Line 1b: Enter in mills and in decimal form (mills divided by 1,000). Use the effective rate for counties and municipalities as

of Jan. 1 of the applicable tax year, except for a school district which is July 1 of the applicable tax year. If the school district or municipality

has multiple tax rates due to parcels existing in more than one county, enter only one tax rate in Line 1a and Line 1b.

(COUNTIES ONLY)

SPECIFIC INSTRUCTIONS FOR PARCEL DATA SCHEDULES

Millage Rates.

County offices are required to provide a schedule of millage rates for the applicable tax year for all municipalities and school districts located

within your county.

All PURTA Parcels. (Schedule 1)

Provide a listing of all public utility realty for the applicable tax year ending Dec. 31 within the county, sorted by municipality. This report must

include the parcel identification number, owner (utility) name and address, assessed value and the municipality and school district in which a

parcel is located. The same basic information should be provided for the following schedules, 2 through 5.

New PURTA Parcels. (Schedule 2)

Identify each parcel newly classified by a county as public utility realty since the prior tax year.

Deleted PURTA Parcels. (Schedule 3)

Identify each parcel removed by the county from classification as public utility realty through Dec. 31 of the applicable tax year. A descrip-

tion of the basis for this action should be provided.

Pending Appeals. (Schedule 4)

Identify each PURTA parcel which is the subject of an active appeal by the owner (utility). In addition to the basic information, the years

under appeal and the stipulated value filed by the owner with its appeal should be reported. Copies of the appeals should be provided with

the county’s report.

PURTA Resolved Appeals - Compensating Adjustment Worksheet (Schedule 5)

Identify each PURTA parcel that was the subject of an appeal that was resolved during the prior year. In addition to the basic information, the

years that had been under appeal and the finally resolved value should be reported for each resolved appeal. Copies of official resolutions to

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3