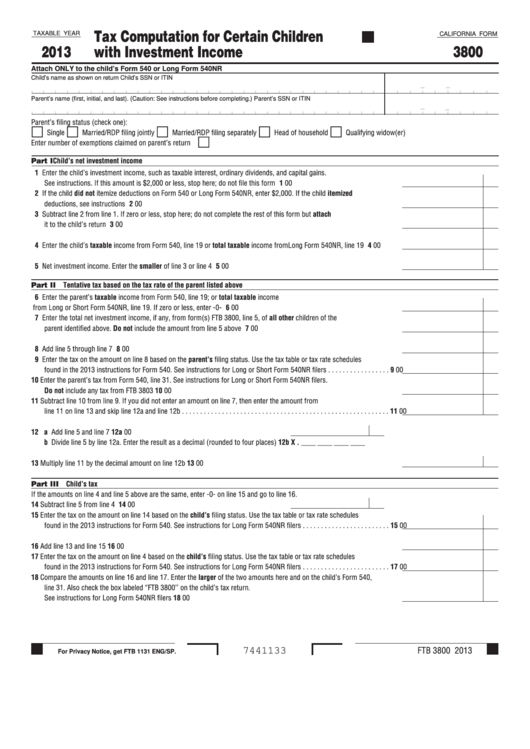

Tax Computation for Certain Children

TAXABLE YEAR

CALIFORNIA FORM

3800

2013

with Investment Income

Attach ONLY to the child’s Form 540 or Long Form 540NR

Child’s name as shown on return

Child’s SSN or ITIN

-

-

Parent’s name (first, initial, and last). (Caution: See instructions before completing.)

Parent’s SSN or ITIN

-

-

Parent’s filing status (check one):

Single

Married/RDP filing jointly

Married/RDP filing separately

Head of household

Qualifying widow(er)

Enter number of exemptions claimed on parent’s return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part I Child’s net investment income

1 Enter the child’s investment income, such as taxable interest, ordinary dividends, and capital gains .

See instructions . If this amount is $2,000 or less, stop here; do not file this form . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

00

2 If the child did not itemize deductions on Form 540 or Long Form 540NR, enter $2,000 . If the child itemized

deductions, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

00

3 Subtract line 2 from line 1 . If zero or less, stop here; do not complete the rest of this form but attach

it to the child’s return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

00

4 Enter the child’s taxable income from Form 540, line 19 or total taxable income from Long Form 540NR, line 19 . . . . . . 4

00

5 Net investment income . Enter the smaller of line 3 or line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

00

Part II Tentative tax based on the tax rate of the parent listed above

6 Enter the parent’s taxable income from Form 540, line 19; or total taxable income

from Long or Short Form 540NR, line 19 . If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

00

7 Enter the total net investment income, if any, from form(s) FTB 3800, line 5, of all other children of the

parent identified above . Do not include the amount from line 5 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

00

8 Add line 5 through line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

00

9 Enter the tax on the amount on line 8 based on the parent’s filing status . Use the tax table or tax rate schedules

found in the 2013 instructions for Form 540 . See instructions for Long or Short Form 540NR filers . . . . . . . . . . . . . . . . . 9

00

10 Enter the parent’s tax from Form 540, line 31 . See instructions for Long or Short Form 540NR filers .

Do not include any tax from FTB 3803 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

00

11 Subtract line 10 from line 9 . If you did not enter an amount on line 7, then enter the amount from

line 11 on line 13 and skip line 12a and line 12b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

00

12 a Add line 5 and line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12a

00

b Divide line 5 by line 12a . Enter the result as a decimal (rounded to four places) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12b X . ____ ____ ____ ____

13 Multiply line 11 by the decimal amount on line 12b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

00

Part III Child’s tax

If the amounts on line 4 and line 5 above are the same, enter -0- on line 15 and go to line 16 .

14 Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

00

15 Enter the tax on the amount on line 14 based on the child’s filing status . Use the tax table or tax rate schedules

found in the 2013 instructions for Form 540 . See instructions for Long Form 540NR filers . . . . . . . . . . . . . . . . . . . . . . . . 15

00

16 Add line 13 and line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

00

17 Enter the tax on the amount on line 4 based on the child’s filing status . Use the tax table or tax rate schedules

found in the 2013 instructions for Form 540 . See instructions for Long Form 540NR filers . . . . . . . . . . . . . . . . . . . . . . . . 17

00

18 Compare the amounts on line 16 and line 17 . Enter the larger of the two amounts here and on the child’s Form 540,

line 31 . Also check the box labeled “FTB 3800’’ on the child’s tax return .

See instructions for Long Form 540NR filers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

00

FTB 3800 2013

7441133

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2 3

3