Form Rev-1175 Ct - Schedule Ar

Download a blank fillable Form Rev-1175 Ct - Schedule Ar in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Rev-1175 Ct - Schedule Ar with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

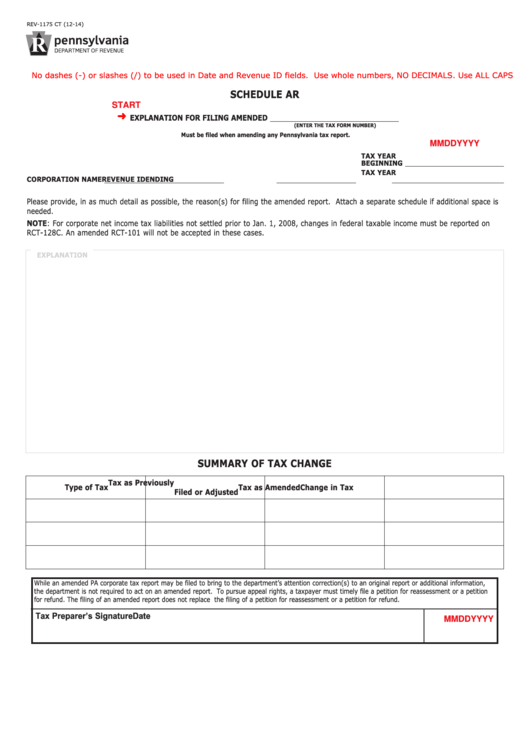

REV-1175 CT (12-14)

No dashes (-) or slashes (/) to be used in Date and Revenue ID fields. Use whole numbers, NO DECIMALS. Use ALL CAPS

SCHEDULE AR

START

EXPLANATION FOR FILING AMENDED

(ENTER THE TAX FORM NUMBER)

Must be filed when amending any Pennsylvania tax report.

MMDDYYYY

TAX YEAR

BEGINNING

TAX YEAR

CORPORATION NAME

REVENUE ID

ENDING

Please provide, in as much detail as possible, the reason(s) for filing the amended report. Attach a separate schedule if additional space is

needed.

NOTE: For corporate net income tax liabilities not settled prior to Jan. 1, 2008, changes in federal taxable income must be reported on

RCT-128C. An amended RCT-101 will not be accepted in these cases.

EXPLANATION

SUMMARY OF TAX CHANGE

Tax as Previously

Type of Tax

Tax as Amended

Change in Tax

Filed or Adjusted

While an amended PA corporate tax report may be filed to bring to the department’s attention correction(s) to an original report or additional information,

the department is not required to act on an amended report. To pursue appeal rights, a taxpayer must timely file a petition for reassessment or a petition

for refund. The filing of an amended report does not replace the filing of a petition for reassessment or a petition for refund.

Tax Preparer’s Signature

Date

MMDDYYYY

PRINT FORM

Reset Entire Form

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1