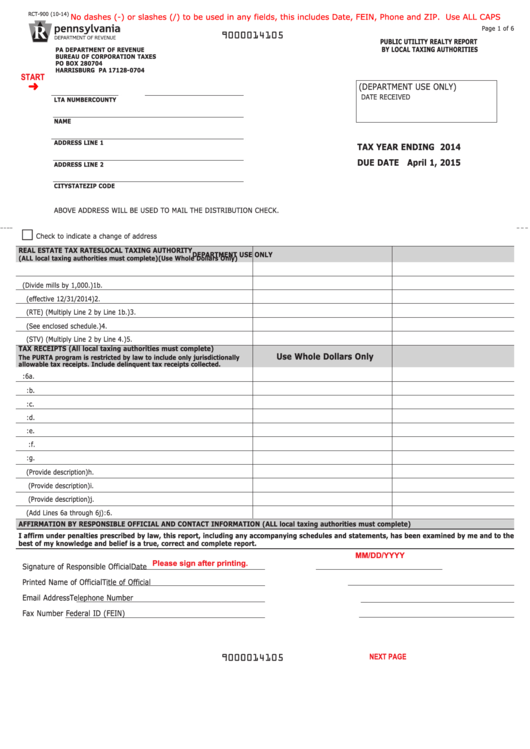

No dashes (-) or slashes (/) to be used in any fields, this includes Date, FEIN, Phone and ZIP. Use ALL CAPS

RCT-900 (10-14)

Page 1 of 6

9000014105

PUBLIC UTILITY REALTY REPORT

PA DEPARTMENT OF REVENUE

BY LOCAL TAXING AUTHORITIES

BUREAU OF CORPORATION TAXES

PO BOX 280704

HARRISBURG PA 17128-0704

START

(DEPARTMENT USE ONLY)

DATE RECEIVED

LTA NUMBER

COUNTY

NAME

ADDRESS LINE 1

TAX YEAR ENDING 2014

DUE DATE April 1, 2015

ADDRESS LINE 2

CITY

STATE

ZIP CODE

ABOVE ADDRESS WILL BE USED TO MAIL THE DISTRIBUTION CHECK.

£

Check to indicate a change of address

REAL ESTATE TAX RATES

LOCAL TAXING AUTHORITY

DEPARTMENT USE ONLY

(ALL local taxing authorities must complete)

(Use Whole Dollars Only)

1a. Local real estate tax rate in mills

1a.

1b. Local real estate tax rate in decimal form (Divide mills by 1,000.)

1b.

2. Assessed value of all PURTA property (effective 12/31/2014)

2.

3. Realty Tax Equivalent (RTE) (Multiply Line 2 by Line 1b.)

3.

4. Common Level Ratio Factor (See enclosed schedule.)

4.

5. State Taxable Value (STV) (Multiply Line 2 by Line 4.)

5.

TAX RECEIPTS (All local taxing authorities must complete)

Use Whole Dollars Only

The PURTA program is restricted by law to include only jurisdictionally

allowable tax receipts. Include delinquent tax receipts collected.

6a. Real Estate Taxes:

6a.

b. Per Capita Taxes:

b.

c. Wage Taxes:

c.

d. Earned Income Taxes:

d.

e. Occupational Privilege Taxes/EMS Tax:

e.

f. Occupational Assessment Taxes:

f.

g. Realty Transfer Taxes:

g.

h. Other (Provide description)

h.

i. Other (Provide description)

i.

j. Other (Provide description)

j.

6. TOTAL TAX RECEIPTS (Add Lines 6a through 6j):

6.

AFFIRMATION BY RESPONSIBLE OFFICIAL AND CONTACT INFORMATION (ALL local taxing authorities must complete)

I affirm under penalties prescribed by law, this report, including any accompanying schedules and statements, has been examined by me and to the

best of my knowledge and belief is a true, correct and complete report.

MM/DD/YYYY

Please sign after printing.

Signature of Responsible Official

Date

Printed Name of Official

Title of Official

Email Address

Telephone Number

Fax Number

Federal ID (FEIN)

PRINT

NEXT PAGE

9000014105

1

1 2

2 3

3 4

4 5

5 6

6