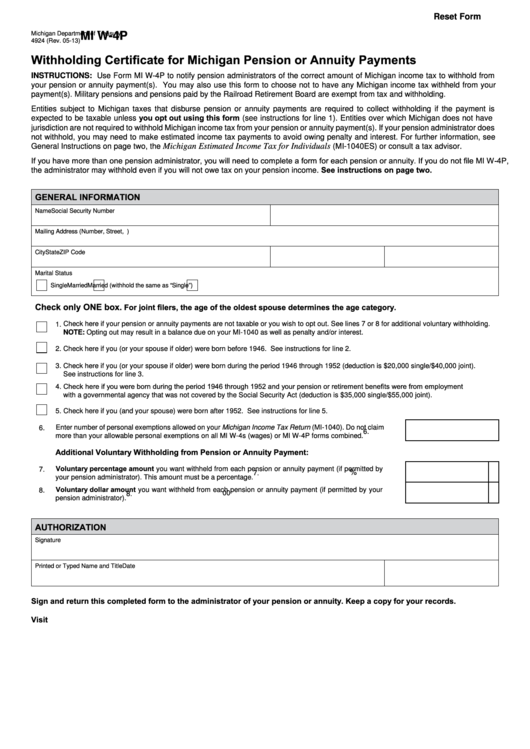

Reset Form

Michigan Department of Treasury

MI W-4P

4924 (Rev. 05-13)

Withholding Certificate for Michigan Pension or Annuity Payments

INSTRUCTIONS: Use Form MI W-4P to notify pension administrators of the correct amount of Michigan income tax to withhold from

your pension or annuity payment(s). You may also use this form to choose not to have any Michigan income tax withheld from your

payment(s). Military pensions and pensions paid by the Railroad Retirement Board are exempt from tax and withholding.

Entities subject to Michigan taxes that disburse pension or annuity payments are required to collect withholding if the payment is

expected to be taxable unless you opt out using this form (see instructions for line 1). Entities over which Michigan does not have

jurisdiction are not required to withhold Michigan income tax from your pension or annuity payment(s). If your pension administrator does

not withhold, you may need to make estimated income tax payments to avoid owing penalty and interest. For further information, see

General Instructions on page two, the

Michigan Estimated Income Tax for Individuals

(MI-1040ES) or consult a tax advisor.

If you have more than one pension administrator, you will need to complete a form for each pension or annuity. If you do not file MI W-4P,

the administrator may withhold even if you will not owe tax on your pension income. See instructions on page two.

GENERAL INFORMATION

Name

Social Security Number

Mailing Address (Number, Street, P.O. Box)

City

State

ZIP Code

Marital Status

Single

Married

Married (withhold the same as “Single”)

Check only ONE box.

For joint filers, the age of the oldest spouse determines the age category.

1. Check here if your pension or annuity payments are not taxable or you wish to opt out. See lines 7 or 8 for additional voluntary withholding.

NOTE: Opting out may result in a balance due on your MI-1040 as well as penalty and/or interest.

2. Check here if you (or your spouse if older) were born before 1946. See instructions for line 2.

3. Check here if you (or your spouse if older) were born during the period 1946 through 1952 (deduction is $20,000 single/$40,000 joint).

See instructions for line 3.

4. Check here if you were born during the period 1946 through 1952 and your pension or retirement benefits were from employment

with a governmental agency that was not covered by the Social Security Act (deduction is $35,000 single/$55,000 joint).

5. Check here if you (and your spouse) were born after 1952. See instructions for line 5.

Enter number of personal exemptions allowed on your Michigan Income Tax Return (MI-1040). Do not claim

6.

6.

more than your allowable personal exemptions on all MI W-4s (wages) or MI W-4P forms combined.

Additional Voluntary Withholding from Pension or Annuity Payment:

Voluntary percentage amount you want withheld from each pension or annuity payment (if permitted by

7.

%

7.

your pension administrator). This amount must be a percentage.

Voluntary dollar amount you want withheld from each pension or annuity payment (if permitted by your

8.

00

8.

pension administrator).

AUTHORIZATION

Signature

Printed or Typed Name and Title

Date

Sign and return this completed form to the administrator of your pension or annuity. Keep a copy for your records.

Visit for additional information.

1

1 2

2