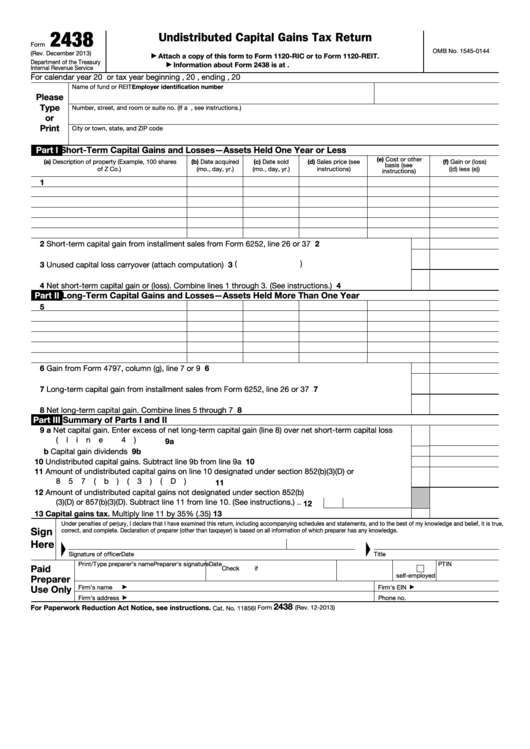

2438

Undistributed Capital Gains Tax Return

Form

OMB No. 1545-0144

(Rev. December 2013)

Attach a copy of this form to Form 1120-RIC or to Form 1120-REIT.

▶

Department of the Treasury

Information about Form 2438 is at

▶

Internal Revenue Service

For calendar year 20

or tax year beginning

, 20

, ending

, 20

Employer identification number

Name of fund or REIT

Please

Type

Number, street, and room or suite no. (If a P.O. box, see instructions.)

or

Print

City or town, state, and ZIP code

Part I

Short-Term Capital Gains and Losses—Assets Held One Year or Less

(e) Cost or other

(a) Description of property (Example, 100 shares

(b) Date acquired

(c) Date sold

(d) Sales price (see

(f) Gain or (loss)

basis (see

of Z Co.)

(mo., day, yr.)

(mo., day, yr.)

instructions)

((d) less (e))

instructions)

1

2

Short-term capital gain from installment sales from Form 6252, line 26 or 37 .

.

.

.

.

.

.

.

2

3 (

)

3

Unused capital loss carryover (attach computation) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

4

Net short-term capital gain or (loss). Combine lines 1 through 3. (See instructions.)

.

.

.

.

.

Part II

Long-Term Capital Gains and Losses—Assets Held More Than One Year

5

6

Gain from Form 4797, column (g), line 7 or 9

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

7

7

Long-term capital gain from installment sales from Form 6252, line 26 or 37 .

.

.

.

.

.

.

.

8

Net long-term capital gain. Combine lines 5 through 7 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

Part III

Summary of Parts I and II

9 a Net capital gain. Enter excess of net long-term capital gain (line 8) over net short-term capital loss

(line 4) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9a

b Capital gain dividends

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9b

10

10

Undistributed capital gains. Subtract line 9b from line 9a .

.

.

.

.

.

.

.

.

.

.

.

.

.

11

Amount of undistributed capital gains on line 10 designated under section 852(b)(3)(D) or

857(b)(3)(D)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11

12

Amount of undistributed capital gains not designated under section 852(b)

(3)(D) or 857(b)(3)(D). Subtract line 11 from line 10. (See instructions.) .

.

12

13

Capital gains tax. Multiply line 11 by 35% (.35) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true,

Sign

correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Here

Signature of officer

Date

Title

Print/Type preparer’s name

Preparer's signature

Date

PTIN

Paid

Check

if

self-employed

Preparer

Use Only

Firm’s name

Firm's EIN

▶

▶

Firm's address

Phone no.

▶

2438

For Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 12-2013)

Cat. No. 11856I

1

1 2

2 3

3 4

4