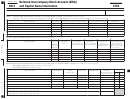

Section C – Long-Term Capital Gains and Losses-Assets Held More Than One Year. Use additional sheets if necessary .

(a)

(b)

(c)

(d)

(e)

(f)

Taxable year

Description of

Date of disposal

Fair market value

Cost or

Gain (loss)

property

(mm/dd/yyyy)

or gross sales price

other basis

(d) less (e)

9

10 Long-term capital gains (losses). Total amounts in column (f) . Enter here and on Form 100 or Form 100W, Side 6,

Schedule D, Part II, line 5, column (f) or Schedule D (100S), Section A or Section B, Part II, line 4, column (f) .

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

General Information

2 . Commonly controlled group – Commonly

Part II – Assets Transferred

controlled group exists when stock

from Insurance Company to

A Purpose

possessing more than 50% of the voting

power is owned, or constructively owned,

Other Companies

Use form FTB 3725, Assets Transferred from

by a common parent corporation (or chains

Parent Corporation to Insurance Company

of corporations connected through the

Section B – Short-Term Capital Gains

Subsidiary, to track the assets transferred from

common parent) or by members of the

a parent corporation to an insurance company

and Losses- Assets Held One Year or

same family, see R&TC Section 25105 .

subsidiary . In addition, use this form to figure

Also, a commonly controlled group includes

Less and

capital gains (losses) if the parent corporation

corporations that are stapled entities,

Section C – Long-Term Capital Gains

transferred assets to an insurance company

see R&TC Section 25105(b)(3) . Special

and Losses-Assets Held More Than

subsidiary beginning on or after June 23, 2004 .

rules are provided in R&TC Section 25105

One Year

California Revenue and Taxation Code (R&TC)

for partnerships, trusts, and transfers of

Section 24465 provides that when a parent

voting power by proxy, voting trust, written

Report short-term or long-term capital gains

corporation transfers appreciated property

shareholder agreement, etc .

(losses) based on the length of time the parent

to an insurance company subsidiary, the

corporation held the assets .

Specific Line Instructions

gain is deferred if the property transferred to

Line 7 and Line 9, column (b) – Description of

the insurer is used in the active conduct of

Part I – Assets Transferred

property. Describe the assets that the insurance

a trade or business of the insurer . The gain

company sells to another company; or the

from Parent Corporation to

must be recognized as income if any of the

transferred assets that the insurance company

following apply:

Insurance Company Subsidiary

does not use in its active trade or business .

• The transferred property is no longer owned

Line 7 and Line 9, column (d) – Fair market

by an insurer in the taxpayer’s commonly

Section A – Information on

value or gross sales price. Enter the FMV of the

controlled group (or a member of the

Properties Transferred

assets as of the date that the insurance company

taxpayer’s combined reporting group) .

no longer uses the assets in its active trade or

• The property is no longer used in the active

Line 1 – Enter the insurance company’s California

business . Or, enter the gross sales price of the

conduct of the insurer’s trade or business (or

corporation number or federal employer

assets if the insurance company sells the assets

the trade or business of another member in

identification number (FEIN) . If the insurance

to another company .

the taxpayer’s combined reporting group) .

company does not have one of these numbers,

• The holder of the property is no longer held

Line 8 – Short-term capital gains (losses). Total

enter “not applicable” and continue with line 2 .

by an insurer in the commonly controlled

amounts in column (f) . Enter total short-term

group of the transferor (or a member of the

capital gains (losses) here and on Form 100 or

Section B – Deferred Capital Gains

taxpayer’s combined reporting group) .

Form 100W, Side 6, Schedule D, Part I, line 1,

Line 3, column (b) – Description of property.

column (f) or Schedule D (100S), Section A or

R&TC Section 24465 applies to transactions

Describe the assets the parent corporation

Section B, Part I, line 1, column (f) . Write on

entered into on or after June 23, 2004 . For more

transferred to an insurance company subsidiary .

Schedule D, under column (a) Description of

information, refer to R&TC Section 24465 .

property: “FTB 3725” and attach a copy of form

Line 3, column (e) – Fair market value at date of

Note: In completing this form, the “transferor”

FTB 3725 to the tax return .

transfer. FMV is the price that the property would

of the appreciated property can be a parent

sell for in the open market .

Line 10 – Long-term capital gains (losses).

corporation or other taxpayer (or a member of the

Total amounts in column (f) . Enter total long-term

Line 3, column (f) – Cost or other basis. In

taxpayer’s combined reporting group) .

capital gains (losses) here and on Form 100 or

general, the cost or other basis is the cost of

B Definitions

Form 100W, Side 6, Schedule D, Part II, line 5,

the property plus purchase commissions and

column (f) or Schedule D (100S), Section A or

improvements minus depreciation, amortization,

1 . Appreciated property – Appreciated property

Section B, Part II, line 4, column (f) . Write on

and depletion . Enter the cost or adjusted basis of

means property whose fair market value

Schedule D, under column (a) Description of

the asset for California purpose .

(FMV), as of the date of the transfer, exceeds

property: “FTB 3725” and attach a copy of form

its adjusted basis as of that date .

FTB 3725 to the tax return .

Side 2

FTB 3725 2013

7432133

1

1 2

2