Contract With Independent Contractor

ADVERTISEMENT

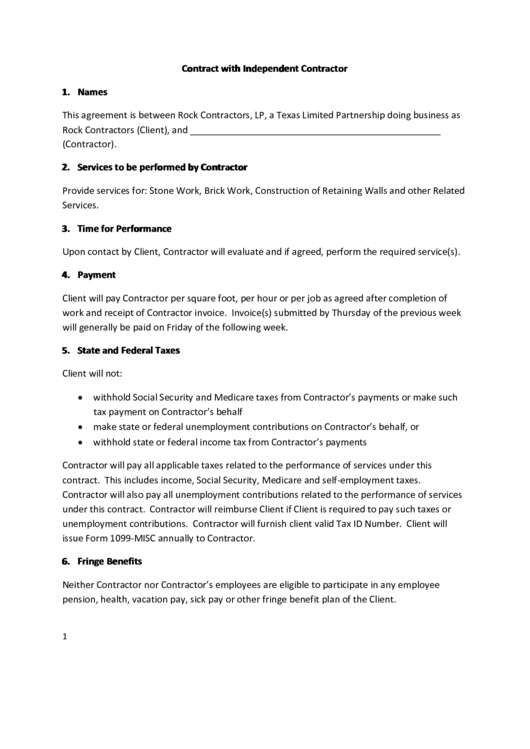

Contract with Independent Contractor

1. Names

This agreement is between Rock Contractors, LP, a Texas Limited Partnership doing business as

Rock Contractors (Client), and _________________________________________________

(Contractor).

2. Services to be performed by Contractor

Provide services for: Stone Work, Brick Work, Construction of Retaining Walls and other Related

Services.

3. Time for Performance

Upon contact by Client, Contractor will evaluate and if agreed, perform the required service(s).

4. Payment

Client will pay Contractor per square foot, per hour or per job as agreed after completion of

work and receipt of Contractor invoice. Invoice(s) submitted by Thursday of the previous week

will generally be paid on Friday of the following week.

5. State and Federal Taxes

Client will not:

withhold Social Security and Medicare taxes from Contractor’s payments or make such

tax payment on Contractor’s behalf

make state or federal unemployment contributions on Contractor’s behalf, or

withhold state or federal income tax from Contractor’s payments

Contractor will pay all applicable taxes related to the performance of services under this

contract. This includes income, Social Security, Medicare and self‐employment taxes.

Contractor will also pay all unemployment contributions related to the performance of services

under this contract. Contractor will reimburse Client if Client is required to pay such taxes or

unemployment contributions. Contractor will furnish client valid Tax ID Number. Client will

issue Form 1099‐MISC annually to Contractor.

6. Fringe Benefits

Neither Contractor nor Contractor’s employees are eligible to participate in any employee

pension, health, vacation pay, sick pay or other fringe benefit plan of the Client.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4