Form Ct-32-A - Banking Corporation Combined Franchise Tax Return - 2014

ADVERTISEMENT

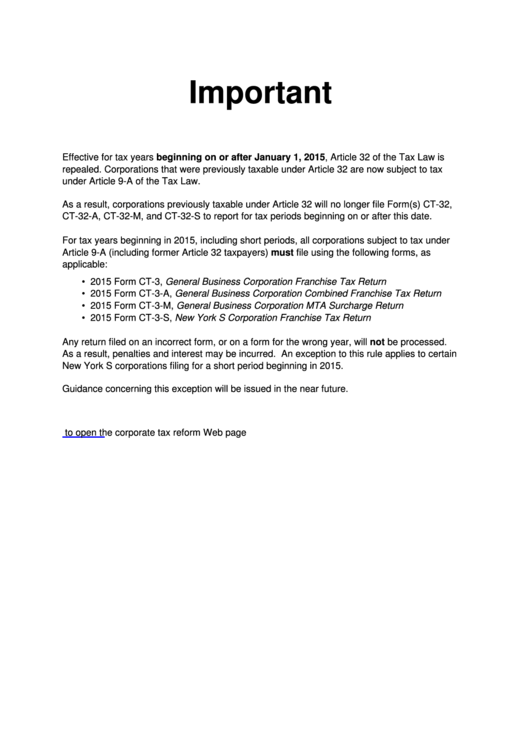

Important

Effective for tax years beginning on or after January 1, 2015, Article 32 of the Tax Law is

repealed. Corporations that were previously taxable under Article 32 are now subject to tax

under Article 9-A of the Tax Law.

As a result, corporations previously taxable under Article 32 will no longer file Form(s) CT-32,

CT-32-A, CT-32-M, and CT-32-S to report for tax periods beginning on or after this date.

For tax years beginning in 2015, including short periods, all corporations subject to tax under

Article 9-A (including former Article 32 taxpayers) must file using the following forms, as

applicable:

• 2015 Form CT-3, General Business Corporation Franchise Tax Return

• 2015 Form CT-3-A, General Business Corporation Combined Franchise Tax Return

• 2015 Form CT-3-M, General Business Corporation MTA Surcharge Return

• 2015 Form CT-3-S, New York S Corporation Franchise Tax Return

Any return filed on an incorrect form, or on a form for the wrong year, will not be processed.

As a result, penalties and interest may be incurred. An exception to this rule applies to certain

New York S corporations filing for a short period beginning in 2015.

Guidance concerning this exception will be issued in the near future.

Click here

to open the corporate tax reform Web page

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15