Form Dtf-728 - Application For Entertainment Promoter Certificate

ADVERTISEMENT

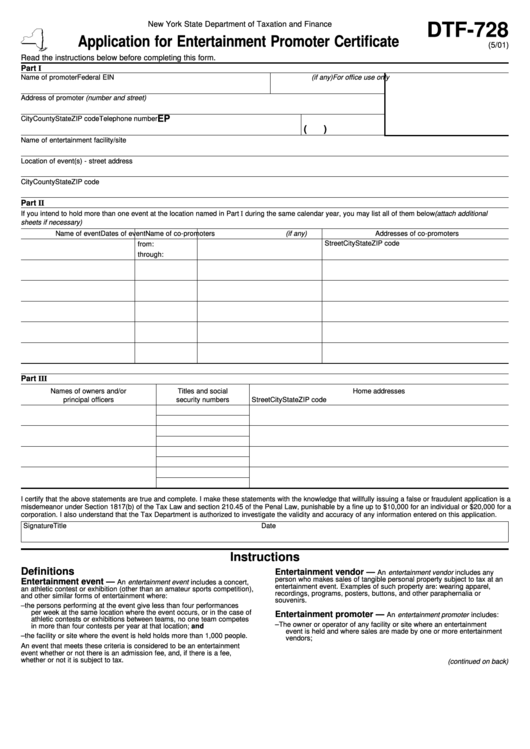

New York State Department of Taxation and Finance

DTF-728

Application for Entertainment Promoter Certificate

(5/01)

Read the instructions below before completing this form.

Part I

Name of promoter

Federal EIN (if any)

For office use only

Address of promoter (number and street)

EP

City

County

State

ZIP code

Telephone number

(

)

Name of entertainment facility/site

Location of event(s) - street address

City

County

State

ZIP code

Part II

If you intend to hold more than one event at the location named in Part I during the same calendar year, you may list all of them below (attach additional

sheets if necessary)

Name of event

Dates of event

Name of co-promoters (if any)

Addresses of co-promoters

Street

City

State

ZIP code

from:

through:

Part III

Names of owners and/or

Titles and social

Home addresses

principal officers

security numbers

Street

City

State

ZIP code

I certify that the above statements are true and complete. I make these statements with the knowledge that willfully issuing a false or fraudulent application is a

misdemeanor under Section 1817(b) of the Tax Law and section 210.45 of the Penal Law, punishable by a fine up to $10,000 for an individual or $20,000 for a

corporation. I also understand that the Tax Department is authorized to investigate the validity and accuracy of any information entered on this application.

Signature

Title

Date

Instructions

Definitions

Entertainment vendor —

An entertainment vendor includes any

person who makes sales of tangible personal property subject to tax at an

Entertainment event —

An entertainment event includes a concert,

entertainment event. Examples of such property are: wearing apparel,

an athletic contest or exhibition (other than an amateur sports competition),

recordings, programs, posters, buttons, and other paraphernalia or

and other similar forms of entertainment where:

souvenirs.

– the persons performing at the event give less than four performances

per week at the same location where the event occurs, or in the case of

Entertainment promoter —

An entertainment promoter includes:

athletic contests or exhibitions between teams, no one team competes

– The owner or operator of any facility or site where an entertainment

in more than four contests per year at that location; and

event is held and where sales are made by one or more entertainment

– the facility or site where the event is held holds more than 1,000 people.

vendors;

An event that meets these criteria is considered to be an entertainment

event whether or not there is an admission fee, and, if there is a fee,

whether or not it is subject to tax.

(continued on back)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2