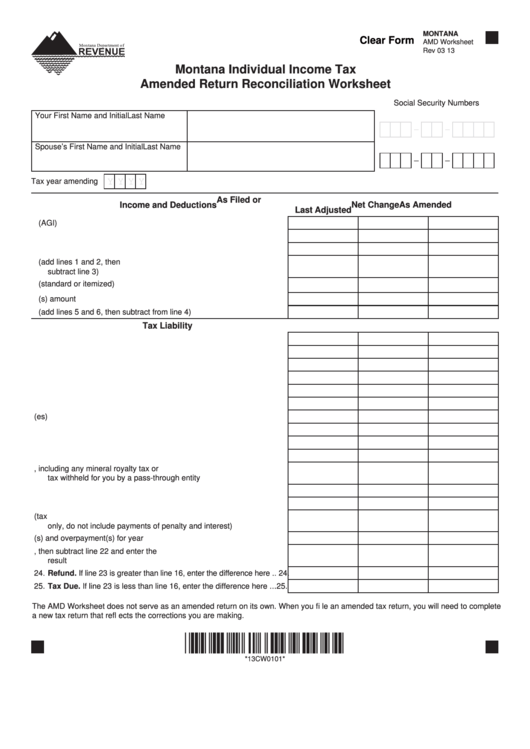

MONTANA

Clear Form

AMD Worksheet

Rev 03 13

Montana Individual Income Tax

Amended Return Reconciliation Worksheet

Social Security Numbers

Your First Name and Initial

Last Name

-

-

Spouse’s First Name and Initial

Last Name

-

-

Y Y Y Y

Tax year amending

As Filed or

Income and Deductions

Net Change

As Amended

Last Adjusted

1. Federal adjusted gross income (AGI) ................................................ 1.

2. Montana additions to federal adjusted gross income ........................ 2.

3. Montana subtractions from federal adjusted gross income ............... 3.

4. Montana adjusted gross income (add lines 1 and 2, then

subtract line 3) ................................................................................... 4.

5. Deductions (standard or itemized)..................................................... 5.

6. Exemption(s) amount ........................................................................ 6.

7. Taxable income (add lines 5 and 6, then subtract from line 4) .......... 7.

Tax Liability

8. Tax ..................................................................................................... 8.

9. Tax on lump sum distributions ........................................................... 9.

10. Add lines 8 and 9 and enter the result here..................................... 10.

11. Capital gains tax credit .....................................................................11.

12. Nonrefundable tax credits................................................................ 12.

13. Subtract lines 11 and 12 from line 10 and enter the result here ...... 13.

14. Recapture tax(es) ............................................................................ 14.

15. Voluntary check-off contribution programs ...................................... 15.

16. Add lines 13 through 15 and enter the result here .......................... 16.

17. Montana income tax withheld .......................................................... 17.

18. Other income tax withheld, including any mineral royalty tax or

tax withheld for you by a pass-through entity .................................. 18.

19. Estimated and extension payments................................................. 19.

20. Refundable credits........................................................................... 20.

21. Tax paid with original return plus subsequent payments (tax

only, do not include payments of penalty and interest) .................... 21.

22. Total refund(s) and overpayment(s) for year amending................... 22.

23. Add lines 17 through 21, then subtract line 22 and enter the

result here........................................................................................ 23.

24. Refund. If line 23 is greater than line 16, enter the difference here .. 24.

25. Tax Due. If line 23 is less than line 16, enter the difference here ... 25.

The AMD Worksheet does not serve as an amended return on its own. When you fi le an amended tax return, you will need to complete

a new tax return that refl ects the corrections you are making.

*13CW0101*

*13CW0101*

1

1 2

2 3

3