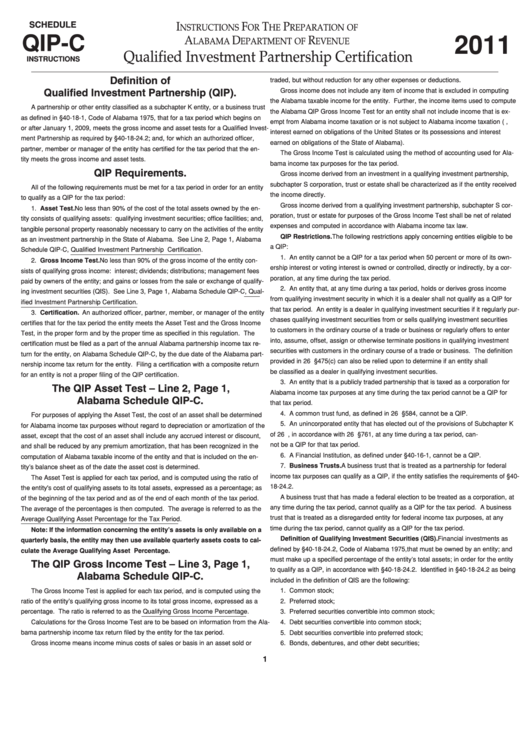

Schedule Qip-C Instructions - Qualified Investment Partnership Certification - 2011

ADVERTISEMENT

SCHEDULE

I

F

T

P

NSTRUCTIONS

OR

HE

REPARATION OF

QIP-C

2011

A

D

R

LABAMA

EPARTMENT OF

EVENUE

Qualified Investment Partnership Certification

INSTRUCTIONS

Definition of

traded, but without reduction for any other expenses or deductions.

Gross income does not include any item of income that is excluded in computing

Qualified Investment Partnership (QIP).

the Alabama taxable income for the entity. Further, the income items used to compute

A partnership or other entity classified as a subchapter K entity, or a business trust

the Alabama QIP Gross Income Test for an entity shall not include income that is ex-

as defined in §40-18-1, Code of Alabama 1975, that for a tax period which begins on

empt from Alabama income taxation or is not subject to Alabama income taxation (i.e.,

or after January 1, 2009, meets the gross income and asset tests for a Qualified Invest-

interest earned on obligations of the United States or its possessions and interest

ment Partnership as required by §40-18-24.2; and, for which an authorized officer,

earned on obligations of the State of Alabama).

partner, member or manager of the entity has certified for the tax period that the en-

The Gross Income Test is calculated using the method of accounting used for Ala-

tity meets the gross income and asset tests.

bama income tax purposes for the tax period.

QIP Requirements.

Gross income derived from an investment in a qualifying investment partnership,

subchapter S corporation, trust or estate shall be characterized as if the entity received

All of the following requirements must be met for a tax period in order for an entity

the income directly.

to qualify as a QIP for the tax period:

Gross income derived from a qualifying investment partnership, subchapter S cor-

1. Asset Test. No less than 90% of the cost of the total assets owned by the en-

poration, trust or estate for purposes of the Gross Income Test shall be net of related

tity consists of qualifying assets: qualifying investment securities; office facilities; and,

expenses and computed in accordance with Alabama income tax law.

tangible personal property reasonably necessary to carry on the activities of the entity

QIP Restrictions. The following restrictions apply concerning entities eligible to be

as an investment partnership in the State of Alabama. See Line 2, Page 1, Alabama

a QIP:

Schedule QIP-C, Qualified Investment Partnership Certification.

1. An entity cannot be a QIP for a tax period when 50 percent or more of its own-

2. Gross Income Test. No less than 90% of the gross income of the entity con-

ership interest or voting interest is owned or controlled, directly or indirectly, by a cor-

sists of qualifying gross income: interest; dividends; distributions; management fees

poration, at any time during the tax period.

paid by owners of the entity; and gains or losses from the sale or exchange of qualify-

2. An entity that, at any time during a tax period, holds or derives gross income

ing investment securities (QIS). See Line 3, Page 1, Alabama Schedule QIP-C, Qual-

from qualifying investment security in which it is a dealer shall not qualify as a QIP for

ified Investment Partnership Certification.

that tax period. An entity is a dealer in qualifying investment securities if it regularly pur-

3. Certification. An authorized officer, partner, member, or manager of the entity

chases qualifying investment securities from or sells qualifying investment securities

certifies that for the tax period the entity meets the Asset Test and the Gross Income

to customers in the ordinary course of a trade or business or regularly offers to enter

Test, in the proper form and by the proper time as specified in this regulation. The

into, assume, offset, assign or otherwise terminate positions in qualifying investment

certification must be filed as a part of the annual Alabama partnership income tax re-

securities with customers in the ordinary course of a trade or business. The definition

turn for the entity, on Alabama Schedule QIP-C, by the due date of the Alabama part-

provided in 26 U.S.C. §475(c) can also be relied upon to determine if an entity shall

nership income tax return for the entity. Filing a certification with a composite return

be classified as a dealer in qualifying investment securities.

for an entity is not a proper filing of the QIP certification.

3. An entity that is a publicly traded partnership that is taxed as a corporation for

The QIP Asset Test – Line 2, Page 1,

Alabama income tax purposes at any time during the tax period cannot be a QIP for

Alabama Schedule QIP-C.

that tax period.

4. A common trust fund, as defined in 26 U.S.C. §584, cannot be a QIP.

For purposes of applying the Asset Test, the cost of an asset shall be determined

5. An unincorporated entity that has elected out of the provisions of Subchapter K

for Alabama income tax purposes without regard to depreciation or amortization of the

of 26 U.S.C., in accordance with 26 U.S.C. §761, at any time during a tax period, can-

asset, except that the cost of an asset shall include any accrued interest or discount,

not be a QIP for that tax period.

and shall be reduced by any premium amortization, that has been recognized in the

6. A Financial Institution, as defined under §40-16-1, cannot be a QIP.

computation of Alabama taxable income of the entity and that is included on the en-

7. Business Trusts. A business trust that is treated as a partnership for federal

tity’s balance sheet as of the date the asset cost is determined.

income tax purposes can qualify as a QIP, if the entity satisfies the requirements of §40-

The Asset Test is applied for each tax period, and is computed using the ratio of

18-24.2.

the entity's cost of qualifying assets to its total assets, expressed as a percentage; as

A business trust that has made a federal election to be treated as a corporation, at

of the beginning of the tax period and as of the end of each month of the tax period.

any time during the tax period, cannot qualify as a QIP for the tax period. A business

The average of the percentages is then computed. The average is referred to as the

trust that is treated as a disregarded entity for federal income tax purposes, at any

Average Qualifying Asset Percentage for the Tax Period.

time during the tax period, cannot qualify as a QIP for the tax period.

Note: If the information concerning the entity’s assets is only available on a

Definition of Qualifying Investment Securities (QIS). Financial investments as

quarterly basis, the entity may then use available quarterly assets costs to cal-

defined by §40-18-24.2, Code of Alabama 1975, that must be owned by an entity; and

culate the Average Qualifying Asset Percentage.

must make up a specified percentage of the entity’s total assets; in order for the entity

The QIP Gross Income Test – Line 3, Page 1,

to qualify as a QIP, in accordance with §40-18-24.2. Identified in §40-18-24.2 as being

Alabama Schedule QIP-C.

included in the definition of QIS are the following:

The Gross Income Test is applied for each tax period, and is computed using the

1. Common stock;

ratio of the entity’s qualifying gross income to its total gross income, expressed as a

2. Preferred stock;

percentage. The ratio is referred to as the Qualifying Gross Income Percentage.

3. Preferred securities convertible into common stock;

Calculations for the Gross Income Test are to be based on information from the Ala-

4. Debt securities convertible into common stock;

bama partnership income tax return filed by the entity for the tax period.

5. Debt securities convertible into preferred stock;

Gross income means income minus costs of sales or basis in an asset sold or

6. Bonds, debentures, and other debt securities;

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2