Employer’s Voucher for Payment of Virginia Income Tax Withheld (Semi-Weekly)

Electronic Filing Mandate: All employers required to file semi-

regarding EFT, please refer to the Department’s Electronic

weekly must file all returns and make all payments electronically

Funds Transfer (EFT) Guide. A guide may be obtained from the

using eForms, Business iFile, Web Upload or ACH Credit. See

Department’s website, at (804) 440-2541.

for information on these electronic filing

Semi-Weekly Filing: If an employer’s average monthly withholding

options.

tax liability is $1,000 or more, semi-weekly filing status will be

assigned. If the Virginia income tax withheld as of the close of

The Tax Commissioner has the authority to waive the electronic

any federal period is more than $500, a payment must be made

filing/payment requirement should this cause undue hardship

within three banking days. Federal cut-off days for withholding

for the employer. The waiver must be requested in writing by

deposits are generally Tuesday and Friday of each week. Semi-

fax to 804-367-3015 or mail to Virginia Department of Taxation,

weekly payments are usually made with Form VA-15, if a hardship

Hardship Waiver Request, PO Box 27423, Richmond, VA 23261.

waiver has been granted or by EFT. Do not submit Form VA-15

General: An employer who pays wages to one or more employees

if no payment is due. At the end of each calendar quarter, a

is required to deduct and withhold state income tax from those

reconciliation must be filed on Form VA-16, along with payment

wages. Virginia law substantially conforms to the federal definition

of any remaining tax due for the quarter.

of “wages.” Therefore, Virginia withholding is generally required

If granted a waiver mail your VA-15 and payment to Virginia

on any payment for which federal withholding is required, except

Department of Taxation, P.O. Box 27264, Richmond, VA

amounts paid pursuant to individual retirement accounts and

23261-7264.

simplified employee pension plans as defined in Sections 7701(a)

(37) and 408(c) of the Internal Revenue Code.

Change of Ownership: If there has been a change of ownership,

do not use the return with the name and account number of

Filing Procedure: An employer’s filing status is determined by

the former owner. Send the return with notice of change to the

the average amount of income tax withheld each month. When

Virginia Department of Taxation, P.O. Box 1114, Richmond,

registering a business, an employer is asked to estimate this

Virginia 23218-1114. You can register a new dealer and/or

figure so the Department can assign a filing status. Based on

locations, by either completing a Form R-1, Business Registration

that information, the Department assigns a quarterly, monthly,

Application, or electronically using iReg on the Department’s

semi-weekly, or seasonal filing status. In addition, all employers

website, . A Form R-1 can be obtained

must file an annual summary. Employers are not responsible for

from the Department’s website or by calling the Department’s

monitoring their monthly tax liabilities to see if a status change

Forms Request Unit at (804) 440-2541.

is needed. The Department reviews each account annually and

makes any necessary changes. Notices of change in filing status

Change of Address/Out-of-Business: If you change your

are usually mailed during December of each year and become

business mailing address or discontinue your business, either

effective on January 1.

send a completed Form R-3, Registration Change Request, or

a letter to the Virginia Department of Taxation, P.O. Box 1114,

If granted a hardship waiver, payments may be made by check,

Richmond, Virginia 23218-1114. A Form R-3 can be obtained

otherwise your payment must be made electronically, or by

from the Department’s website, , or by

Electronic Funds Transfer

(EFT).

Payments returned by the bank

calling the Department’s Forms Request Unit at (804) 440-2541.

will be subject to a returned payment fee in addition to any other

penalties that may be incurred.

Questions: If you have any questions about this voucher,

please call (804) 367-8037 or write the Virginia Department

Paying by EFT eliminates your requirement to submit Form VA-

of Taxation, P.O. Box 1115, Richmond, Virginia 23218-1115.

15, however payments must be made by the same dates that

the Form VA-15 would have been due. For additional information

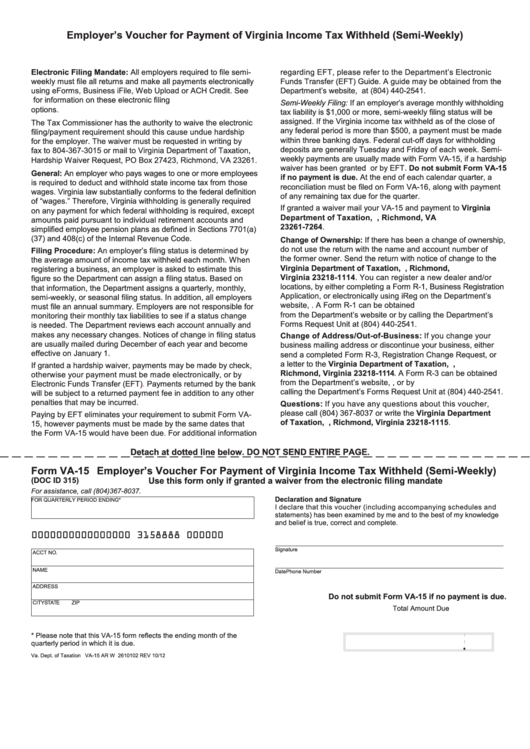

Detach at dotted line below. DO NOT SEND ENTIRE PAGE.

Form VA-15

Employer’s Voucher For Payment of Virginia Income Tax Withheld (Semi-Weekly)

(DOC ID 315)

Use this form only if granted a waiver from the electronic filing mandate

For assistance, call (804)367-8037.

Declaration and Signature

FOR QUARTERLY PERIOD ENDING*

I declare that this voucher (including accompanying schedules and

statements) has been examined by me and to the best of my knowledge

and belief is true, correct and complete.

0000000000000000 3158888 000000

Signature

ACCT NO.

NAME

Date

Phone Number

ADDRESS

Do not submit Form VA-15 if no payment is due.

CITY

STATE

ZIP

Total Amount Due

* Please note that this VA-15 form reflects the ending month of the

quarterly period in which it is due.

.

Va. Dept. of Taxation VA-15 AR W 2610102 REV 10/12

1

1