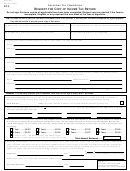

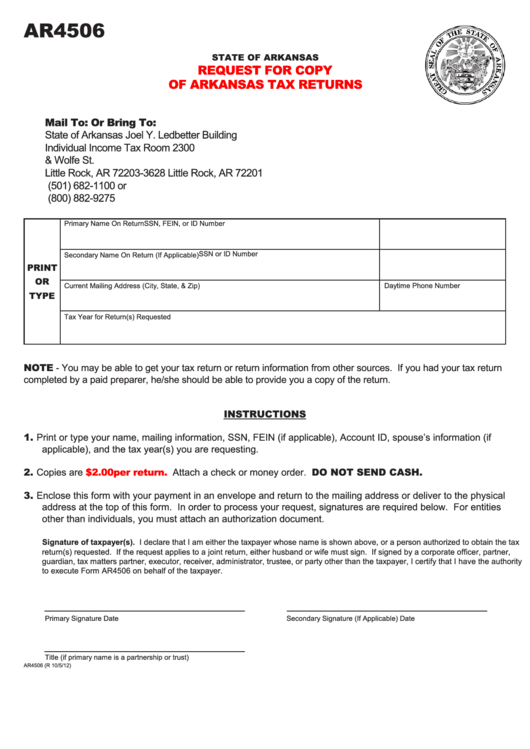

AR4506

STATE OF ARKANSAS

REQUEST FOR COPY

OF ARKANSAS TAX RETURNS

Mail To:

Or Bring To:

State of Arkansas

Joel Y. Ledbetter Building

Individual Income Tax

Room 2300

P.O. Box 3628

7th & Wolfe St.

Little Rock, AR 72203-3628

Little Rock, AR 72201

(501) 682-1100 or

(800) 882-9275

Primary Name On Return

SSN, FEIN, or ID Number

SSN or ID Number

Secondary Name On Return (If Applicable)

PRINT

OR

Daytime Phone Number

Current Mailing Address (City, State, & Zip)

TYPE

Tax Year for Return(s) Requested

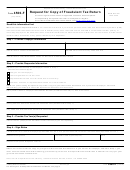

NOTE - You may be able to get your tax return or return information from other sources. If you had your tax return

completed by a paid preparer, he/she should be able to provide you a copy of the return.

INSTRUCTIONS

1. Print or type your name, mailing information, SSN, FEIN (if applicable), Account ID, spouse’s information (if

applicable), and the tax year(s) you are requesting.

2. Copies are

$2.00 per return.

Attach a check or money order. DO NOT SEND CASH.

3. Enclose this form with your payment in an envelope and return to the mailing address or deliver to the physical

address at the top of this form. In order to process your request, signatures are required below. For entities

other than individuals, you must attach an authorization document.

Signature of taxpayer(s). I declare that I am either the taxpayer whose name is shown above, or a person authorized to obtain the tax

return(s) requested. If the request applies to a joint return, either husband or wife must sign. If signed by a corporate officer, partner,

guardian, tax matters partner, executor, receiver, administrator, trustee, or party other than the taxpayer, I certify that I have the authority

to execute Form AR4506 on behalf of the taxpayer.

Primary Signature

Date

Secondary Signature (If Applicable)

Date

Title (if primary name is a partnership or trust)

AR4506 (R 10/5/12)

1

1