2014 North Dakota Form 40-ES

North Dakota estimated income tax for corporations for the 2014 taxable year

The amount of the 2013 overpayment will be

Estimated payments for short

General instructions

applied to the fi rst installment for 2014.

period returns

Who must pay estimated tax

Estimated payments for short period returns

Application of estimated income

If a corporation’s estimated state income

of less than 120 days are not required. For

tax payments

tax liability exceeds fi ve thousand dollars

short period returns in excess of 120 days, if

All payments submitted as 2013 estimated

($5,000) and previous year’s state income

the short period ends prior to any remaining

income tax and any overpayment credited

tax liability exceeded fi ve thousand dollars

due dates for payment of estimated tax,

from the 2012 taxable year must be reported

($5,000), the corporation is required to

the fi nal estimated tax payment is due on

on the 2013 North Dakota Corporation

make an estimated tax payment of at least

the 15th day of the last month of the short

Income Tax Return Form 40.

one-fourth of the amount due on each of

period.

four prescribed dates.

Extension of time to pay estimated tax

Understatement of estimated

cannot be granted.

Where to fi le

income tax

Estimated income tax payments should be

Interest charges will apply if the estimated

How to pay

mailed to the State Tax Commissioner,

income tax payment for any quarter

600 E. Boulevard Ave., Dept. 127, Bismarck,

(including overpayments from prior quarters)

Do not comingle estimated income tax

ND 58505-0599.

is less than 90% of the quarterly income tax

payments with any other payment to

liability or is less than the prior year’s North

the North Dakota Offi ce of State Tax

Dakota net tax liability divided by four.

Commissioner.

Which form to use

If estimated payments for the federal return

If payment for estimated income tax is

If payment for estimated income tax is

were made using the adjusted seasonal

to be made by check or money order,

to be made by check or money order, the

installment method or annualized income

make it payable to North Dakota State Tax

Form 40-ES voucher must be used to ensure

installment method as provided for in IRC

Commissioner.

that proper credit for the payment is applied

of 1986, as amended, Section 6655(e), the

to the correct account.

amount of each quarterly payment due (for

Payment for estimated income tax may

be made by electronic funds transfer.

Line 4) is calculated in the same manner

If payment is to be made electronically, do

as for Federal Form 2220, which must be

Information regarding electronic payments

not use the Form 40-ES voucher.

can be found on the department’s web site at

attached in that situation.

The Underpayment of Estimated North

, under Corporate Income,

Dakota Income Tax by Corporations Form

Time for fi ling

Electronic Payment, EFT.

40-UT must be attached to the North Dakota

Estimated income tax payments can also be

The fi rst estimated income tax payment is

Corporation Income Tax Return, Form 40

due no later than April 15 following the close

made using ACH “Debits”. However, ACH

when fi ling. The Form 40-UT is located within

of the calendar year.

debits can only be used when fi ling the 2013

the Form 40 booklet.

Corporations reporting on a fi scal year basis

return electronically using the Modernized

must pay the fi rst estimated tax installment

e-File program. The payment information is

no later than the 15th day of the fourth

entered when completing the 2013 return.

Interest

month following the close of their fi scal year.

The State Tax Commissioner will notify

No less than one-fourth of the estimated

the taxpayer of any interest owed on any

income tax must be paid with the fi rst

Amendments to estimated income

underpayment of estimated income tax. If

installment and with each of the three

tax

desired, interest owed may be computed

remaining installments on the 15th day of

by the taxpayer on Form 40-UT and added

If it is found that the total estimated income

the sixth and ninth months of the taxable

to the 2013 corporation income tax liability

tax is more or less than originally determined,

year and the fi rst month of the following

on Form 40, Page 1. Interest is calculated

adjust the next installment accordingly.

year.

at the rate of 12% per annum from the

installment due date to the earlier of the

Overpayment of estimated tax

No installment payment date is required

date the estimated tax is paid or the due

on your estimated payment form. The

date (without extension) of the return.

An overpayment of estimated income tax

payment will be applied to the quarter

from the prior taxable year may be credited

in which the payment is postmarked.

to the current year’s estimated payments.

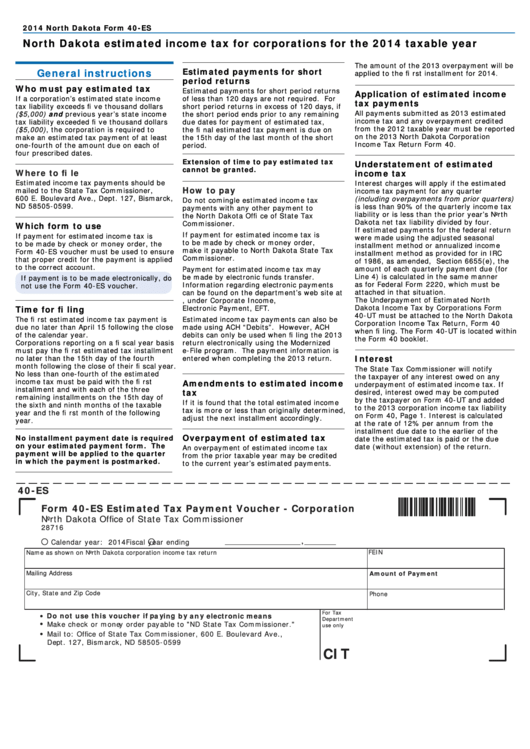

40-ES

Form 40-ES Estimated Tax Payment Voucher - Corporation

North Dakota Office of State Tax Commissioner

28716

Calendar year: 2014

Fiscal year ending

,

FEIN

Name as shown on North Dakota corporation income tax return

Mailing Address

Amount of Payment

City, State and Zip Code

Phone

For Tax

Do not use this voucher if paying by any electronic means

•

Department

Make check or money order payable to "ND State Tax Commissioner."

•

use only

Mail to: Office of State Tax Commissioner, 600 E. Boulevard Ave.,

•

Dept. 127, Bismarck, ND 58505-0599

CIT

1

1 2

2