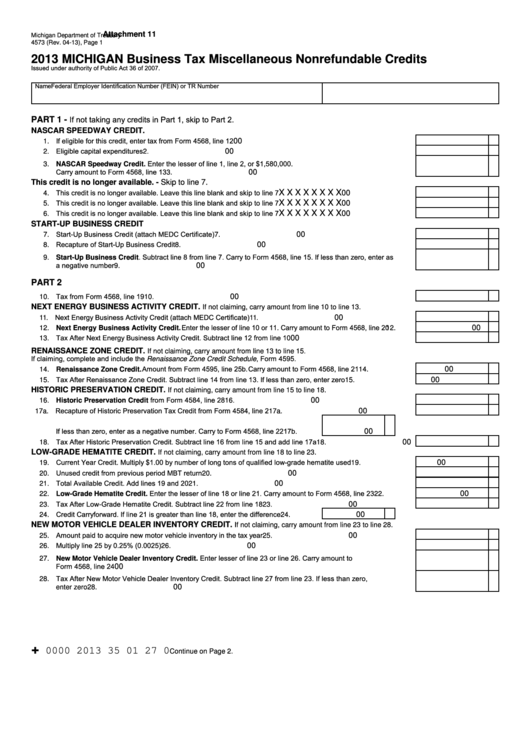

Form 4573 - Michigan Business Tax Miscellaneous Nonrefundable Credits - 2013

ADVERTISEMENT

Attachment 11

Michigan Department of Treasury

4573 (Rev. 04-13), Page 1

2013 MICHIGAN Business Tax Miscellaneous Nonrefundable Credits

Issued under authority of Public Act 36 of 2007.

Name

Federal Employer Identification Number (FEIN) or TR Number

If not taking any credits in Part 1, skip to Part 2.

PART 1 -

NASCAR SPEEDWAY CREDIT.

1. If eligible for this credit, enter tax from Form 4568, line 12.....................................................................................

00

1.

2. Eligible capital expenditures ...................................................................................................................................

00

2.

3. NASCAR Speedway Credit. Enter the lesser of line 1, line 2, or $1,580,000.

Carry amount to Form 4568, line 13 .......................................................................................................................

00

3.

This credit is no longer available. - Skip to line 7.

4. This credit is no longer available. Leave this line blank and skip to line 7..............................................................

X X X X X X X X

00

4.

5. This credit is no longer available. Leave this line blank and skip to line 7..............................................................

X X X X X X X X

00

5.

6. This credit is no longer available. Leave this line blank and skip to line 7..............................................................

X X X X X X X X

00

6.

START-UP BUSINESS CREDIT

7. Start-Up Business Credit (attach MEDC Certificate) ..............................................................................................

00

7.

8. Recapture of Start-Up Business Credit ..................................................................................................................

00

8.

9. Start-Up Business Credit. Subtract line 8 from line 7. Carry to Form 4568, line 15. If less than zero, enter as

a negative number ..................................................................................................................................................

00

9.

PART 2

10. Tax from Form 4568, line 19 ...................................................................................................................................

00

10.

NEXT ENERGY BUSINESS ACTIVITY CREDIT.

If not claiming, carry amount from line 10 to line 13.

11. Next Energy Business Activity Credit (attach MEDC Certificate) ...........................................................................

00

11.

12. Next Energy Business Activity Credit. Enter the lesser of line 10 or 11. Carry amount to Form 4568, line 20 ....

00

12.

13. Tax After Next Energy Business Activity Credit. Subtract line 12 from line 10........................................................

00

13.

RENAISSANCE ZONE CREDIT.

If not claiming, carry amount from line 13 to line 15.

If claiming, complete and include the Renaissance Zone Credit Schedule, Form 4595.

14. Renaissance Zone Credit. Amount from Form 4595, line 25b. Carry amount to Form 4568, line 21 ...................

00

14.

15. Tax After Renaissance Zone Credit. Subtract line 14 from line 13. If less than zero, enter zero ...........................

00

15.

HISTORIC PRESERVATION CREDIT.

If not claiming, carry amount from line 15 to line 18.

16. Historic Preservation Credit from Form 4584, line 28 .........................................................................................

00

16.

17a. Recapture of Historic Preservation Tax Credit from Form 4584, line 2 .................................................................. 17a.

00

17b. Historic Preservation Credit Net of Recapture. Subtract line 17a from line 16.

If less than zero, enter as a negative number. Carry to Form 4568, line 22 ......... 17b.

00

18. Tax After Historic Preservation Credit. Subtract line 16 from line 15 and add line 17a ..........................................

00

18.

LOW-GRADE HEMATITE CREDIT.

If not claiming, carry amount from line 18 to line 23.

19. Current Year Credit. Multiply $1.00 by number of long tons of qualified low-grade hematite used ........................

00

19.

20. Unused credit from previous period MBT return .....................................................................................................

00

20.

21. Total Available Credit. Add lines 19 and 20 ............................................................................................................

00

21.

22. Low-Grade Hematite Credit. Enter the lesser of line 18 or line 21. Carry amount to Form 4568, line 23 ............

00

22.

23. Tax After Low-Grade Hematite Credit. Subtract line 22 from line 18 ......................................................................

00

23.

24. Credit Carryforward. If line 21 is greater than line 18, enter the difference ...........

00

24.

NEW MOTOR VEHICLE DEALER INVENTORY CREDIT.

If not claiming, carry amount from line 23 to line 28.

25. Amount paid to acquire new motor vehicle inventory in the tax year .....................................................................

00

25.

26. Multiply line 25 by 0.25% (0.0025) .........................................................................................................................

00

26.

27. New Motor Vehicle Dealer Inventory Credit. Enter lesser of line 23 or line 26. Carry amount to

Form 4568, line 24..................................................................................................................................................

00

27.

28. Tax After New Motor Vehicle Dealer Inventory Credit. Subtract line 27 from line 23. If less than zero,

00

enter zero ............................................................................................................................................................

28.

+

0000 2013 35 01 27 0

Continue on Page 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11