Form 41a720sl - Application For Six-Month Extension Of Time To File Kentucky Corporation Or Limited Liability Pass-Through Entity Return

ADVERTISEMENT

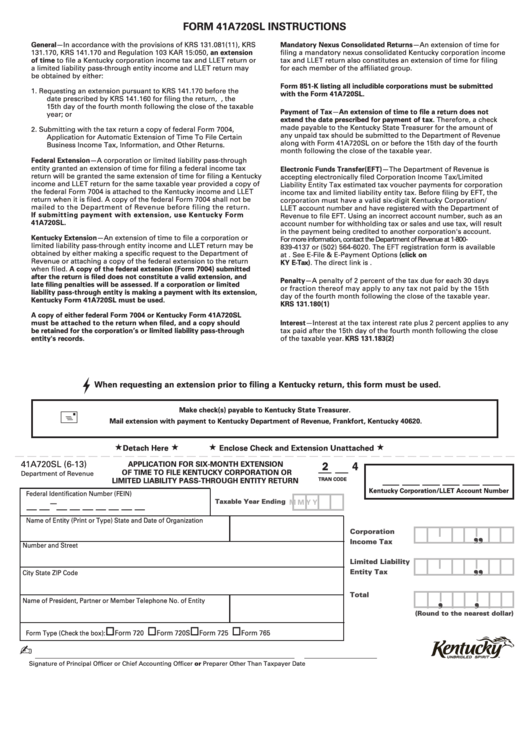

FORM 41A720SL INSTRUCTIONS

General—In accordance with the provisions of KRS 131.081(11), KRS

Mandatory Nexus Consolidated Returns—An extension of time for

131.170, KRS 141.170 and Regulation 103 KAR 15:050, an extension

filing a mandatory nexus consolidated Kentucky corporation income

of time to file a Kentucky corporation income tax and LLET return or

tax and LLET return also constitutes an extension of time for filing

a limited liability pass-through entity income and LLET return may

for each member of the affiliated group.

be obtained by either:

Form 851-K listing all includible corporations must be submitted

1.

Requesting an extension pursuant to KRS 141.170 before the

with the Form 41A720SL.

date prescribed by KRS 141.160 for filing the return, i.e., the

15th day of the fourth month following the close of the taxable

Payment of Tax—An extension of time to file a return does not

year; or

extend the date prescribed for payment of tax. Therefore, a check

made payable to the Kentucky State Treasurer for the amount of

2.

Submitting with the tax return a copy of federal Form 7004,

any unpaid tax should be submitted to the Department of Revenue

Application for Automatic Extension of Time To File Certain

along with Form 41A720SL on or before the 15th day of the fourth

Business Income Tax, Information, and Other Returns.

month following the close of the taxable year.

Federal Extension—A corporation or limited liability pass-through

entity granted an extension of time for filing a federal income tax

Electronic Funds Transfer (EFT)—The Department of Revenue is

return will be granted the same extension of time for filing a Kentucky

accepting electronically filed Corporation Income Tax/Limited

income and LLET return for the same taxable year provided a copy of

Liability Entity Tax estimated tax voucher payments for corporation

the federal Form 7004 is attached to the Kentucky income and LLET

income tax and limited liability entity tax. Before filing by EFT, the

return when it is filed. A copy of the federal Form 7004 shall not be

corporation must have a valid six-digit Kentucky Corporation/

mailed to the Department of Revenue before filing the return.

LLET account number and have registered with the Department of

If submitting payment with extension, use Kentucky Form

Revenue to file EFT. Using an incorrect account number, such as an

41A720SL.

account number for withholding tax or sales and use tax, will result

in the payment being credited to another corporation's account.

Kentucky Extension—An extension of time to file a corporation or

For more information, contact the Department of Revenue at 1-800-

limited liability pass-through entity income and LLET return may be

839-4137 or (502) 564-6020. The EFT registration form is available

obtained by either making a specific request to the Department of

at See E-File & E-Payment Options (click on

Revenue or attaching a copy of the federal extension to the return

KY E-Tax). The direct link is

when filed. A copy of the federal extension (Form 7004) submitted

after the return is filed does not constitute a valid extension, and

Penalty—A penalty of 2 percent of the tax due for each 30 days

late filing penalties will be assessed. If a corporation or limited

or fraction thereof may apply to any tax not paid by the 15th

liability pass-through entity is making a payment with its extension,

day of the fourth month following the close of the taxable year.

Kentucky Form 41A720SL must be used.

KRS 131.180(1)

A copy of either federal Form 7004 or Kentucky Form 41A720SL

must be attached to the return when filed, and a copy should

Interest—Interest at the tax interest rate plus 2 percent applies to any

be retained for the corporation’s or limited liability pass-through

tax paid after the 15th day of the fourth month following the close

entity's records.

of the taxable year. KRS 131.183(2)

When requesting an extension prior to filing a Kentucky return, this form must be used.

Make check(s) payable to Kentucky State Treasurer.

Mail extension with payment to Kentucky Department of Revenue, Frankfort, Kentucky 40620.

Detach Here

Enclose Check and Extension Unattached

41A720SL (6-13)

__ __

2 4

APPLICATION FOR SIX-MONTH EXTENSION

OF TIME TO FILE KENTUCKY CORPORATION OR

Department of Revenue

LIMITED LIABILITY PASS-THROUGH ENTITY RETURN

TRAN CODE

Kentucky Corporation/LLET Account Number

Federal Identification Number (FEIN)

Taxable Year Ending

—

M M Y

Y

Name of Entity (Print or Type)

State and Date of Organization

Corporation

❜

❜

Income Tax

Number and Street

Limited Liability

Entity Tax

City

State

ZIP Code

❜

❜

Total

Name of President, Partner or Member

Telephone No. of Entity

❜

❜

(Round to the nearest dollar)

Form 720

Form 720S

Form 725

Form 765

Form Type (Check the box):

✍

Signature of Principal Officer or Chief Accounting Officer or Preparer Other Than Taxpayer

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1