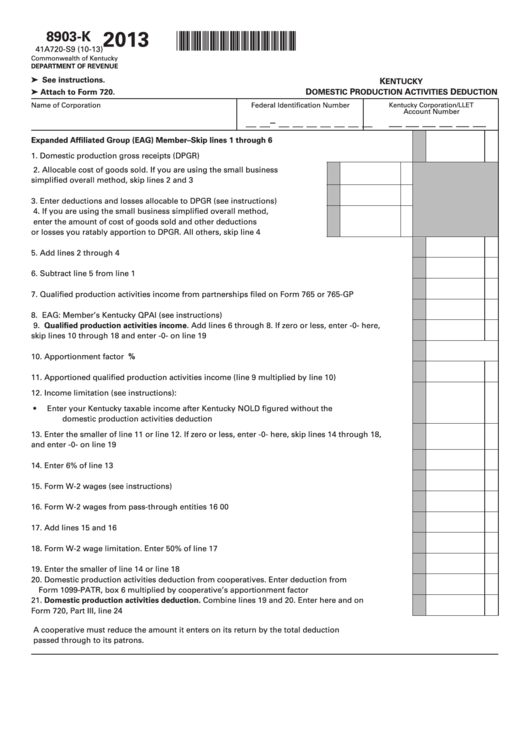

Form 8903-K - Kentucky Domestic Production Activities Deduction - 2013

ADVERTISEMENT

2013

8903-K

*1300010210*

41A720-S9 (10-13)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

➤ See instructions.

K

ENTUCKY

D

P

A

D

➤ Attach to Form 720.

OMESTIC

RODUCTION

CTIVITIES

EDUCTION

Name of Corporation

Federal Identification Number

Kentucky Corporation/LLET

Account Number

__ __ __ __ __ __

__ __– __ __ __ __ __ __ __

Expanded Affiliated Group (EAG) Member–Skip lines 1 through 6

1. Domestic production gross receipts (DPGR) .............................................................................................

1

00

2. Allocable cost of goods sold. If you are using the small business

simplified overall method, skip lines 2 and 3 ....................................................

2

00

3. Enter deductions and losses allocable to DPGR (see instructions) .................

3

00

4. If you are using the small business simplified overall method,

enter the amount of cost of goods sold and other deductions

or losses you ratably apportion to DPGR. All others, skip line 4 ....................

4

00

5. Add lines 2 through 4 ..................................................................................................................................

5

00

6. Subtract line 5 from line 1 ..........................................................................................................................

6

00

7. Qualified production activities income from partnerships filed on Form 765 or 765-GP ......................

7

00

8. EAG: Member’s Kentucky QPAI (see instructions) ...................................................................................

8

00

9. Qualified production activities income. Add lines 6 through 8. If zero or less, enter -0- here,

skip lines 10 through 18 and enter -0- on line 19 ......................................................................................

9

00

10. Apportionment factor .................................................................................................................................. 10

%

11. Apportioned qualified production activities income (line 9 multiplied by line 10) ................................ 11

00

12. Income limitation (see instructions):

•

Enter your Kentucky taxable income after Kentucky NOLD figured without the

domestic production activities deduction .......................................................................................... 12

00

13. Enter the smaller of line 11 or line 12. If zero or less, enter -0- here, skip lines 14 through 18,

and enter -0- on line 19 ............................................................................................................................... 13

00

14. Enter 6% of line 13 ....................................................................................................................................... 14

00

15. Form W-2 wages (see instructions) ........................................................................................................... 15

00

16. Form W-2 wages from pass-through entities ........................................................................................... 16

00

17. Add lines 15 and 16 ..................................................................................................................................... 17

00

18. Form W-2 wage limitation. Enter 50% of line 17 ...................................................................................... 18

00

19. Enter the smaller of line 14 or line 18 ........................................................................................................ 19

00

20. Domestic production activities deduction from cooperatives. Enter deduction from

Form 1099-PATR, box 6 multiplied by cooperative’s apportionment factor .......................................... 20

00

21. Domestic production activities deduction. Combine lines 19 and 20. Enter here and on

Form 720, Part III, line 24 ............................................................................................................................ 21

00

A cooperative must reduce the amount it enters on its return by the total deduction

passed through to its patrons.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2