Reset Form

Print Form

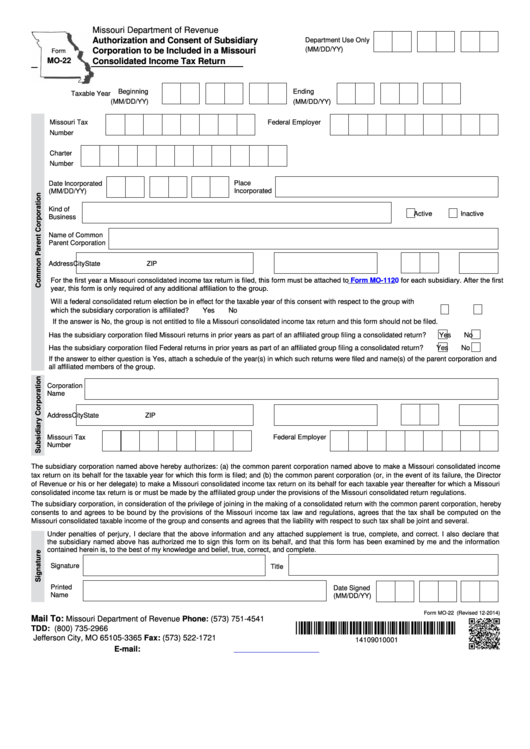

Missouri Department of Revenue

Authorization and Consent of Subsidiary

Department Use Only

(MM/DD/YY)

Corporation to be Included in a Missouri

Form

MO-22

Consolidated Income Tax Return

Beginning

Ending

Taxable Year

(MM/DD/YY)

(MM/DD/YY)

Missouri Tax I.D.

Federal Employer

Number

I.D. Number

Charter

Number

Place

Date Incorporated

(MM/DD/YY)

Incorporated

Kind of

Active

Inactive

Business

Name of Common

Parent Corporation

Address

City

State

ZIP

For the first year a Missouri consolidated income tax return is filed, this form must be attached to

for each subsidiary. After the first

Form MO-1120

year, this form is only required of any additional affiliation to the group.

Will a federal consolidated return election be in effect for the taxable year of this consent with respect to the group with

which the subsidiary corporation is affiliated? ................................................................................................................................

Yes

No

If the answer is No, the group is not entitled to file a Missouri consolidated income tax return and this form should not be filed.

Has the subsidiary corporation filed Missouri returns in prior years as part of an affiliated group filing a consolidated return? .....

Yes

No

Has the subsidiary corporation filed Federal returns in prior years as part of an affiliated group filing a consolidated return? ......

Yes

No

If the answer to either question is Yes, attach a schedule of the year(s) in which such returns were filed and name(s) of the parent corporation and

all affiliated members of the group.

Corporation

Name

Address

City

State

ZIP

Missouri Tax I.D.

Federal Employer

Number

I.D. Number

The subsidiary corporation named above hereby authorizes: (a) the common parent corporation named above to make a Missouri consolidated income

tax return on its behalf for the taxable year for which this form is filed; and (b) the common parent corporation (or, in the event of its failure, the Director

of Revenue or his or her delegate) to make a Missouri consolidated income tax return on its behalf for each taxable year thereafter for which a Missouri

consolidated income tax return is or must be made by the affiliated group under the provisions of the Missouri consolidated return regulations.

The subsidiary corporation, in consideration of the privilege of joining in the making of a consolidated return with the common parent corporation, hereby

consents to and agrees to be bound by the provisions of the Missouri income tax law and regulations, agrees that the tax shall be computed on the

Missouri consolidated taxable income of the group and consents and agrees that the liability with respect to such tax shall be joint and several.

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct. I also declare that

the subsidiary named above has authorized me to sign this form on its behalf, and that this form has been examined by me and the information

contained herein is, to the best of my knowledge and belief, true, correct, and complete.

Signature

Title

Printed

Date Signed

Name

(MM/DD/YY)

Form MO-22 (Revised 12-2014)

Mail To:

Missouri Department of Revenue

Phone: (573) 751-4541

*14109010001*

P.O. Box 3365

TDD: (800) 735-2966

Jefferson City, MO 65105-3365

Fax: (573) 522-1721

14109010001

E-mail:

corporate@dor.mo.gov

1

1