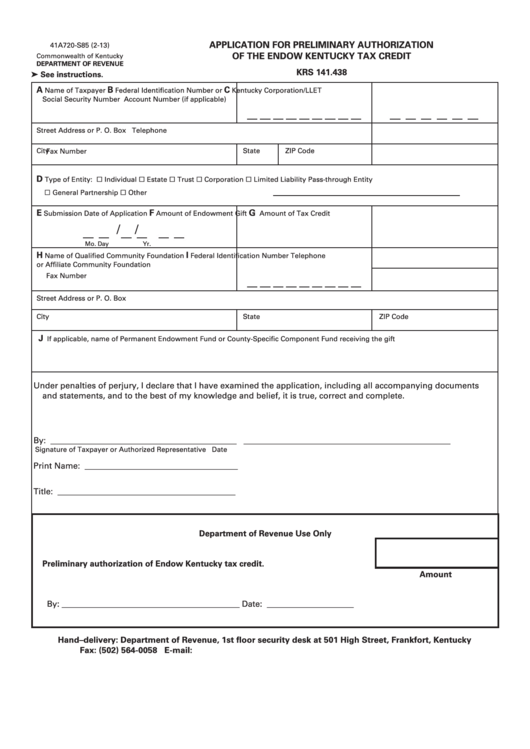

Form 41a720-S85 - Application For Preliminary Authorization Of The Endow Kentucky Tax Credit

ADVERTISEMENT

APPLICATION FOR PRELIMINARY AUTHORIZATION

41A720-S85 (2-13)

OF THE ENDOW KENTUCKY TAX CREDIT

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

KRS 141.438

➤ See instructions.

A

B

C

Name of Taxpayer

Federal Identification Number or

Kentucky Corporation/LLET

Social Security Number

Account Number (if applicable)

Street Address or P. O. Box

Telephone

City

State

ZIP Code

Fax Number

D

Type of Entity:

¨ Individual

¨ Estate

¨ Trust

¨ Corporation

¨ Limited Liability Pass-through Entity

¨ General Partnership

¨ Other

E

F

G

Submission Date of Application

Amount of Endowment Gift

Amount of Tax Credit

/

/

Mo.

Day

Yr.

H

I

Name of Qualified Community Foundation

Federal Identification Number

Telephone

or Affiliate Community Foundation

Fax Number

Street Address or P. O. Box

City

State

ZIP Code

J

If applicable, name of Permanent Endowment Fund or County-Specific Component Fund receiving the gift

Under penalties of perjury, I declare that I have examined the application, including all accompanying documents

and statements, and to the best of my knowledge and belief, it is true, correct and complete.

By: _____________________________________________

__________________________________________________

Signature of Taxpayer or Authorized Representative

Date

Print Name: _____________________________________

Title: ___________________________________________

Department of Revenue Use Only

Preliminary authorization of Endow Kentucky tax credit.

Amount

By: ___________________________________________

Date: _____________________

Hand–delivery: Department of Revenue, 1st floor security desk at 501 High Street, Frankfort, Kentucky

Fax: (502) 564-0058

E-mail: KRC.WEBResponseEconomicDevelopmentCredits@ky.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2