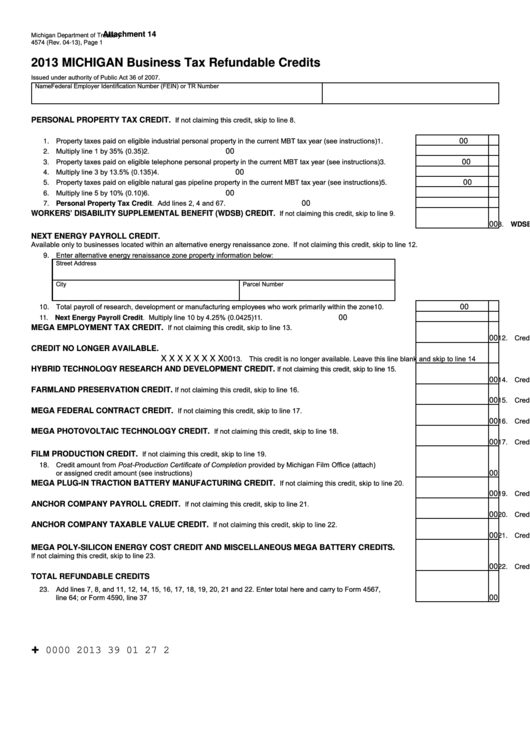

Form 4574 - Michigan Business Tax Refundable Credits - 2013

ADVERTISEMENT

Attachment 14

Michigan Department of Treasury

4574 (Rev. 04-13), Page 1

2013 MICHIGAN Business Tax Refundable Credits

Issued under authority of Public Act 36 of 2007.

Name

Federal Employer Identification Number (FEIN) or TR Number

If not claiming this credit, skip to line 8.

PERSONAL PROPERTY TAX CREDIT.

1. Property taxes paid on eligible industrial personal property in the current MBT tax year (see instructions) ..........

00

1.

2. Multiply line 1 by 35% (0.35) ..................................................................................................................................

00

2.

3. Property taxes paid on eligible telephone personal property in the current MBT tax year (see instructions) ..........

00

3.

4. Multiply line 3 by 13.5% (0.135) .............................................................................................................................

00

4.

5. Property taxes paid on eligible natural gas pipeline property in the current MBT tax year (see instructions) ........

00

5.

6. Multiply line 5 by 10% (0.10) ..................................................................................................................................

00

6.

7. Personal Property Tax Credit. Add lines 2, 4 and 6 ............................................................................................

00

7.

If not claiming this credit, skip to line 9.

WORKERS’ DISABILITY SUPPLEMENTAL BENEFIT (WDSB) CREDIT.

8. WDSB Credit allowed by the Workers’ Compensation Agency .............................................................................

00

8.

NEXT ENERGY PAYROLL CREDIT.

Available only to businesses located within an alternative energy renaissance zone. If not claiming this credit, skip to line 12.

9. Enter alternative energy renaissance zone property information below:

Street Address

Parcel Number

City

10. Total payroll of research, development or manufacturing employees who work primarily within the zone ............

00

10.

11. Next Energy Payroll Credit. Multiply line 10 by 4.25% (0.0425) .........................................................................

00

11.

If not claiming this credit, skip to line 13.

MEGA EMPLOYMENT TAX CREDIT.

12. Credit amount from MEDC Annual Tax Credit Certificate (attach) .........................................................................

00

12.

CREDIT NO LONGER AVAILABLE.

13. This credit is no longer available. Leave this line blank and skip to line 14 ...........................................................

X X X X X X X X

00

13.

If not claiming this credit, skip to line 15.

HYBRID TECHNOLOGY RESEARCH AND DEVELOPMENT CREDIT.

14. Credit amount from MEDC Annual Tax Credit Certificate (attach). Cannot exceed $2,000,000 ............................

00

14.

If not claiming this credit, skip to line 16.

FARMLAND PRESERVATION CREDIT.

15. Credit amount from Form 4594, line 29 ..................................................................................................................

00

15.

If not claiming this credit, skip to line 17.

MEGA FEDERAL CONTRACT CREDIT.

16. Credit amount from Form 4584, line 35a ................................................................................................................

00

16.

If not claiming this credit, skip to line 18.

MEGA PHOTOVOLTAIC TECHNOLOGY CREDIT.

17. Credit amount from Certificate provided by MEDC (attach) or assigned credit amount .........................................

00

17.

If not claiming this credit, skip to line 19.

FILM PRODUCTION CREDIT.

18. Credit amount from Post-Production Certificate of Completion provided by Michigan Film Office (attach)

or assigned credit amount (see instructions) ..........................................................................................................

00

18.

If not claiming this credit, skip to line 20.

MEGA PLUG-IN TRACTION BATTERY MANUFACTURING CREDIT.

19. Credit amount from Form 4584, line 62a ................................................................................................................

00

19.

If not claiming this credit, skip to line 21.

ANCHOR COMPANY PAYROLL CREDIT.

20. Credit amount from Form 4584, line 70a ................................................................................................................

00

20.

If not claiming this credit, skip to line 22.

ANCHOR COMPANY TAXABLE VALUE CREDIT.

21. Credit amount from Form 4584, line 78a ...............................................................................................................

00

21.

MEGA POLY-SILICON ENERGY COST CREDIT AND MISCELLANEOUS MEGA BATTERY CREDITS.

If not claiming this credit, skip to line 23.

22. Credit amount from Form 4584, line 86a ................................................................................................................

00

22.

TOTAL REFUNDABLE CREDITS

23. Add lines 7, 8, and 11, 12, 14, 15, 16, 17, 18, 19, 20, 21 and 22. Enter total here and carry to Form 4567,

line 64; or Form 4590, line 37 .................................................................................................................................

00

23.

+

0000 2013 39 01 27 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6