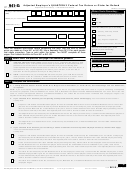

Name (not your trade name)

Employer Identification Number (EIN)

Calendar Year (YYYY)

Part 3:

Enter the corrections for the calendar year you are correcting. If any line does not apply, leave it blank.

Column 2

Column 3

Column 4

Column 1

Amount originally

Difference

=

Total corrected

reported or as

(If this amount is a

—

amount (for ALL

previously corrected

negative number, use

employees)

(for ALL employees)

a minus sign.)

Tax correction

Total wages subject to social

6.

=

—

× .124* =

security tax

.

.

.

.

(Form 943, line 2)

*If you are correcting a 2011 or 2012 return , use .104. If you are correcting

your employer share only, use .062. See instructions.

Total wages subject to

7.

=

—

Medicare tax

× .029* =

.

.

.

.

(Form 943, line 4)

*If you are correcting your employer share only, use .0145. See

instructions.

8.

Federal income tax withheld

=

Copy Column

—

.

.

.

.

3 here

▶

(Form 943, line 6)

*Complete lines

9a. Number of qualified

=

—

9a and 9b only

employees paid exempt

for corrections

wages April 1 – December 31,

to the 2010

Form 943.

2010 (Form 943, line 7a)*

9b. Exempt wages paid to

=

—

.

.

.

× .062 =

.

qualified employees April 1 –

December 31, 2010

(Form 943, line 7b)*

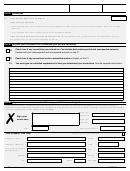

Tax adjustments

=

10.

—

See

.

.

.

.

instructions

(Form 943, line 8)

Special addition to wages for

11.

=

See

—

.

.

.

.

instructions

federal income tax

Special addition to wages for

=

12.

See

—

.

.

.

.

instructions

social security taxes

Special addition to wages for

=

13.

—

See

.

.

.

.

instructions

Medicare taxes

14.

Subtotal: Combine the amounts in lines 6–13 of Column 4 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

15.

Advance earned income

=

See

—

credit (EIC) payments made

.

.

.

.

instructions

to employees (Form 943, line

10; only for years ending before

January 1, 2011)

16a. COBRA premium assistance

=

—

See

payments (Form 943, line 11a (line

.

.

.

.

instructions

13a for years ending before

January 1, 2011))

16b. Number of individuals provided

=

—

*Complete lines

COBRA premium assistance

16c and 16d

(Form 943, line 11b (line 13b for years

only for

corrections to

ending before January 1, 2011))

the 2010

16c. Number of qualified

Form 943.

=

—

employees paid exempt

wages March 19–31, 2010

(Form 943, line 13c)*

16d. Exempt wages paid to

=

—

.

.

.

× .062 =

.

qualified employees March

19–31, 2010 (Form 943,

line 13d)*

17.

Total. Combine the amounts in lines 14–16d of Column 4. Continue to next page.

.

.

.

.

.

.

.

.

.

.

.

.

Next

▶

■

2

943-X

Page

Form

(Rev. 2-2013)

1

1 2

2 3

3 4

4