Arizona Individual Income Tax Filing Requirements For Same-Sex Couples - 2013

ADVERTISEMENT

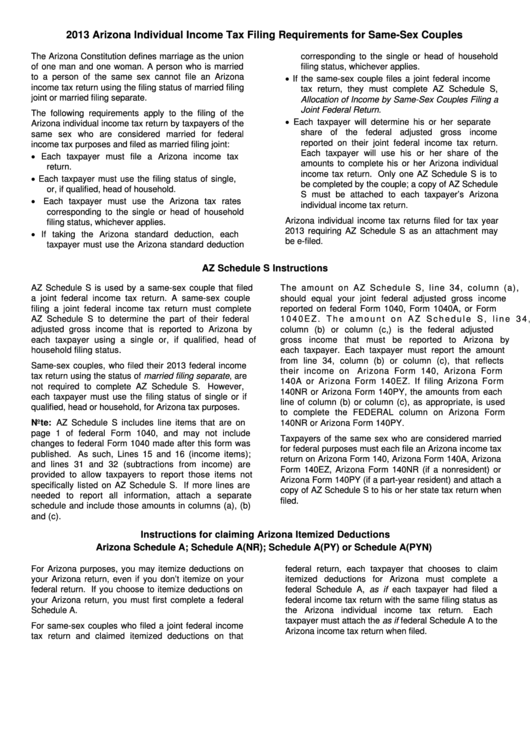

2013 Arizona Individual Income Tax Filing Requirements for Same-Sex Couples

The Arizona Constitution defines marriage as the union

corresponding to the single or head of household

of one man and one woman. A person who is married

filing status, whichever applies.

to a person of the same sex cannot file an Arizona

If the same-sex couple files a joint federal income

income tax return using the filing status of married filing

tax return, they must complete AZ Schedule S,

joint or married filing separate.

Allocation of Income by Same-Sex Couples Filing a

Joint Federal Return.

The following requirements apply to the filing of the

Each taxpayer will determine his or her separate

Arizona individual income tax return by taxpayers of the

share of the federal adjusted gross income

same sex who are considered married for federal

reported on their joint federal income tax return.

income tax purposes and filed as married filing joint:

Each taxpayer will use his or her share of the

Each taxpayer must file a Arizona income tax

amounts to complete his or her Arizona individual

return.

income tax return. Only one AZ Schedule S is to

Each taxpayer must use the filing status of single,

be completed by the couple; a copy of AZ Schedule

or, if qualified, head of household.

S must be attached to each taxpayer’s Arizona

Each taxpayer must use the Arizona tax rates

individual income tax return.

corresponding to the single or head of household

Arizona individual income tax returns filed for tax year

filing status, whichever applies.

2013 requiring AZ Schedule S as an attachment may

If taking the Arizona standard deduction, each

be e-filed.

taxpayer must use the Arizona standard deduction

AZ Schedule S Instructions

AZ Schedule S is used by a same-sex couple that filed

The amount on AZ Schedule S, line 34, column (a),

a joint federal income tax return. A same-sex couple

should equal your joint federal adjusted gross income

filing a joint federal income tax return must complete

reported on federal Form 1040, Form 1040A, or Form

AZ Schedule S to determine the part of their federal

1040EZ. The amount on A Z S c h e d u l e S , line 34,

adjusted gross income that is reported to Arizona by

column (b) or c o l u m n (c,) is the federal adjusted

each taxpayer using a single or, if qualified, head of

gross income that must be reported to Arizona by

household filing status.

each taxpayer. Each taxpayer must report the amount

from line 34, column (b) or column (c), that reflects

Same-sex couples, who filed their 2013 federal income

their income on

Arizona Form 140, Arizona Form

tax return using the status of married filing separate, are

140A or Arizona Form 140EZ. If filing Arizona Form

not required to complete AZ Schedule S.

However,

140NR or Arizona Form 140PY, the amounts from each

each taxpayer must use the filing status of single or if

line of column (b) or column (c), as appropriate, is used

qualified, head or household, for Arizona tax purposes.

to complete the FEDERAL column on Arizona Form

Note: AZ Schedule S includes line items that are on

140NR or Arizona Form 140PY.

page 1 of federal Form 1040, and may not include

Taxpayers of the same sex who are considered married

changes to federal Form 1040 made after this form was

for federal purposes must each file an Arizona income tax

published. As such, Lines 15 and 16 (income items);

return on Arizona Form 140, Arizona Form 140A, Arizona

and lines 31 and 32 (subtractions from income) are

Form 140EZ, Arizona Form 140NR (if a nonresident) or

provided to allow taxpayers to report those items not

Arizona Form 140PY (if a part-year resident) and attach a

specifically listed on AZ Schedule S. If more lines are

copy of AZ Schedule S to his or her state tax return when

needed to report all information, attach a separate

filed.

schedule and include those amounts in columns (a), (b)

and (c).

Instructions for claiming Arizona Itemized Deductions

Arizona Schedule A; Schedule A(NR); Schedule A(PY) or Schedule A(PYN)

For Arizona purposes, you may itemize deductions on

federal return, each taxpayer that chooses to claim

your Arizona return, even if you don’t itemize on your

itemized deductions for Arizona must complete a

federal return. If you choose to itemize deductions on

federal Schedule A, as if each taxpayer had filed a

your Arizona return, you must first complete a federal

federal income tax return with the same filing status as

Schedule A.

the Arizona individual income tax return.

Each

taxpayer must attach the as if federal Schedule A to the

For same-sex couples who filed a joint federal income

Arizona income tax return when filed.

tax return and claimed itemized deductions on that

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1