Reset Form

Michigan Department of Treasury

3862 (Rev. 08-12)

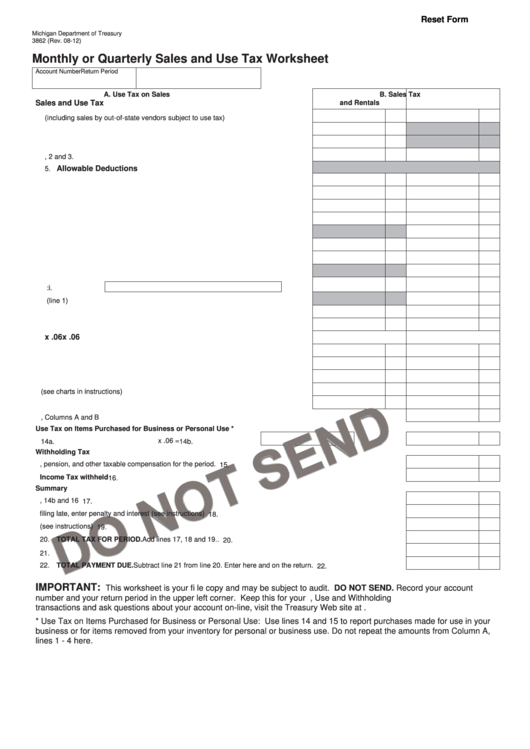

Monthly or Quarterly Sales and Use Tax Worksheet

Account Number

Return Period

A. Use Tax on Sales

B. Sales Tax

Sales and Use Tax

and Rentals

1. Gross sales (including sales by out-of-state vendors subject to use tax) .......

1.

2. Rentals of tangible property and/or accommodations ....................................

2.

3. Telecommunications services .........................................................................

3.

4. Add lines 1, 2 and 3. .......................................................................................

4.

Allowable Deductions

5.

a. Resale ............................................................................................................

5a.

b. Industrial processing or agricultural producing ...............................................

b.

c. Interstate commerce .......................................................................................

c.

d. Exempt services .............................................................................................

d.

e. Sales on which tax was paid to Secretary of State.........................................

e.

f. Food for human/home consumption ...............................................................

f.

g. Bad debts .......................................................................................................

g.

h. Michigan motor fuel or diesel fuel tax .............................................................

h.

i. Other. Identify:

i.

j. Tax included in gross sales (line 1).................................................................

j.

k. Total allowable deductions. Add lines 5a - 5j. .................................................

k.

6. Taxable balance. Subtract line 5k from line 4. ................................................

6.

x .06

x .06

7. Tax rate. ..........................................................................................................

7.

8. Tax due by rate. Multiply line 6 by line 7.. .......................................................

8.

9. Tax collected in excess of line 8. ....................................................................

9.

10. Add lines 8 and 9. ...........................................................................................

10.

11. Total discount allowed (see charts in instructions) .........................................

11.

12. Total tax due. Subtract line 11 from line 10. ....................................................

12.

13. Add line 12, Columns A and B .........................................................................................................................

13.

Use Tax on Items Purchased for Business or Personal Use *

14. Enter your taxable purchases ..............................................

x .06 =

14a.

14b.

Withholding Tax

15. Gross Michigan payroll, pension, and other taxable compensation for the period. ........................................

15.

16. Michigan Income Tax withheld ......................................................................................................................

16.

Summary

17. Payment due. Add lines 13, 14b and 16 ..........................................................................................................

17.

18. If fi ling late, enter penalty and interest (see instructions) ................................................................................

18.

19. Corporate Income Tax estimate (see instructions) ..........................................................................................

19.

20. TOTAL TAX FOR PERIOD. Add lines 17, 18 and 19.. ....................................................................................

20.

21. Enter any credit on your account for previous overpayments .........................................................................

21.

22. TOTAL PAYMENT DUE. Subtract line 21 from line 20. Enter here and on the return. ...................................

22.

IMPORTANT:

This worksheet is your fi le copy and may be subject to audit. DO NOT SEND. Record your account

number and your return period in the upper left corner. Keep this for your records.To check your Sales, Use and Withholding

transactions and ask questions about your account on-line, visit the Treasury Web site at

* Use Tax on Items Purchased for Business or Personal Use: Use lines 14 and 15 to report purchases made for use in your

business or for items removed from your inventory for personal or business use. Do not repeat the amounts from Column A,

lines 1 - 4 here.

1

1