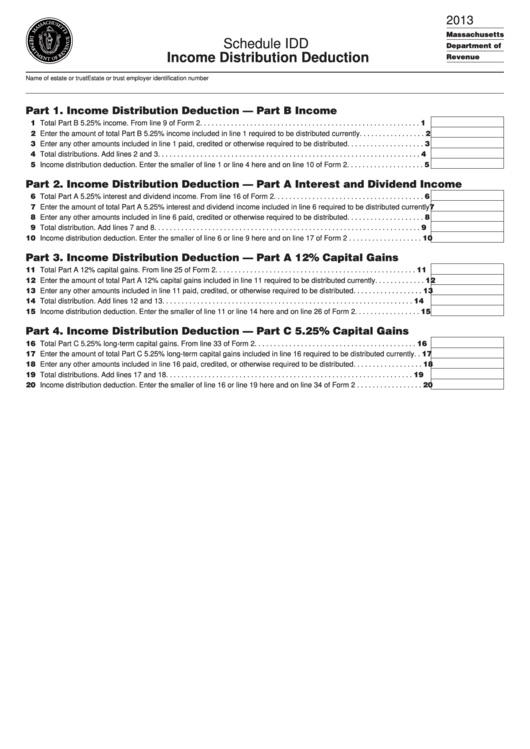

2013

Massachusetts

Schedule IDD

Department of

Income Distribution Deduction

Revenue

Name of estate or trust

Estate or trust employer identification number

Part 1. Income Distribution Deduction — Part B Income

11 Total Part B 5.25% income. From line 9 of Form 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

12 Enter the amount of total Part B 5.25% income included in line 1 required to be distributed currently . . . . . . . . . . . . . . . . . 2

13 Enter any other amounts included in line 1 paid, credited or otherwise required to be distributed . . . . . . . . . . . . . . . . . . . . 3

14 Total distributions. Add lines 2 and 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

15 Income distribution deduction. Enter the smaller of line 1 or line 4 here and on line 10 of Form 2 . . . . . . . . . . . . . . . . . . . . 5

Part 2. Income Distribution Deduction — Part

Interest and Dividend Income

16 Total Part A 5.25% interest and dividend income. From line 16 of Form 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

17 Enter the amount of total Part A 5.25% interest and dividend income included in line 6 required to be distributed currently 7

18 Enter any other amounts included in line 6 paid, credited or otherwise required to be distributed . . . . . . . . . . . . . . . . . . . . 8

19 Total distribution. Add lines 7 and 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Income distribution deduction. Enter the smaller of line 6 or line 9 here and on line 17 of Form 2 . . . . . . . . . . . . . . . . . . . 10

Part 3. Income Distribution Deduction — Part

12% Capital Gains

11 Total Part A 12% capital gains. From line 25 of Form 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Enter the amount of total Part A 12% capital gains included in line 11 required to be distributed currently. . . . . . . . . . . . . 12

13 Enter any other amounts included in line 11 paid, credited, or otherwise required to be distributed . . . . . . . . . . . . . . . . . . 13

14 Total distribution. Add lines 12 and 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Income distribution deduction. Enter the smaller of line 11 or line 14 here and on line 26 of Form 2 . . . . . . . . . . . . . . . . . 15

Part 4. Income Distribution Deduction — Part C 5.25% Capital Gains

16 Total Part C 5.25% long-term capital gains. From line 33 of Form 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Enter the amount of total Part C 5.25% long-term capital gains included in line 16 required to be distributed currently . . 17

18 Enter any other amounts included in line 16 paid, credited, or otherwise required to be distributed. . . . . . . . . . . . . . . . . . 18

19 Total distributions. Add lines 17 and 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Income distribution deduction. Enter the smaller of line 16 or line 19 here and on line 34 of Form 2 . . . . . . . . . . . . . . . . . 20

1

1