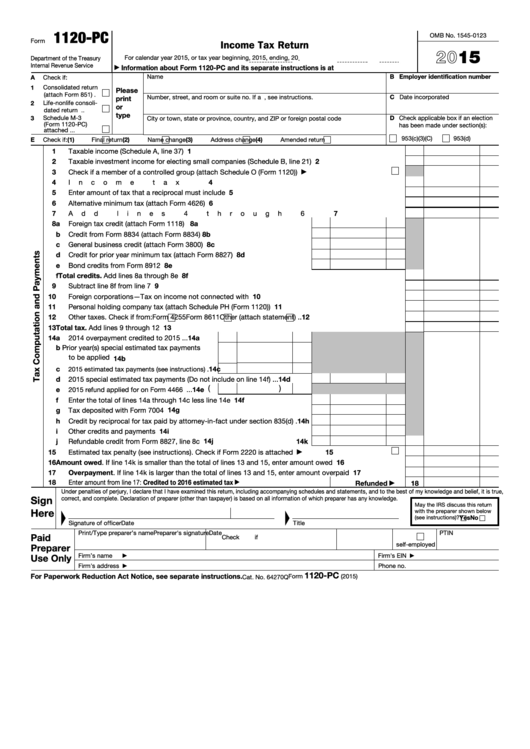

1120-PC

U.S. Property and Casualty Insurance Company

OMB No. 1545-0123

Form

Income Tax Return

2015

For calendar year 2015, or tax year beginning

, 2015, ending

, 20

Department of the Treasury

.

Internal Revenue Service

Information about Form 1120-PC and its separate instructions is at

▶

Name

B Employer identification number

A

Check if:

1

Consolidated return

Please

(attach Form 851) .

Number, street, and room or suite no. If a P.O. box, see instructions.

C Date incorporated

print

2

Life-nonlife consoli-

or

dated return .

.

type

D Check applicable box if an election

Schedule M-3

City or town, state or province, country, and ZIP or foreign postal code

3

(Form 1120-PC)

has been made under section(s):

attached .

.

.

953(c)(3)(C)

953(d)

E

Check if:

(1)

Final return

(2)

Name change

(3)

Address change

(4)

Amended return

1

Taxable income (Schedule A, line 37) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1

2

2

Taxable investment income for electing small companies (Schedule B, line 21) .

.

.

.

.

.

.

.

.

3

Check if a member of a controlled group (attach Schedule O (Form 1120)) .

.

.

.

.

.

.

.

▶

4

Income tax

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5

5

Enter amount of tax that a reciprocal must include .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

Alternative minimum tax (attach Form 4626) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

7

Add lines 4 through 6

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8a

8a

Foreign tax credit (attach Form 1118) .

.

.

.

.

.

.

.

.

.

.

.

b

Credit from Form 8834 (attach Form 8834)

.

.

.

.

.

.

.

.

.

.

8b

c

General business credit (attach Form 3800) .

.

.

.

.

.

.

.

.

.

8c

d

Credit for prior year minimum tax (attach Form 8827)

.

.

.

.

.

.

.

8d

e

8e

Bond credits from Form 8912 .

.

.

.

.

.

.

.

.

.

.

.

.

.

f

Total credits. Add lines 8a through 8e

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8f

9

Subtract line 8f from line 7 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

10

10

Foreign corporations—Tax on income not connected with U.S. business

.

.

.

.

.

.

.

.

.

.

11

Personal holding company tax (attach Schedule PH (Form 1120))

.

.

.

.

.

.

.

.

.

.

.

.

11

12

Other taxes. Check if from:

Form 4255

Form 8611

Other (attach statement)

.

.

12

13

Total tax. Add lines 9 through 12 .

13

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

14a

2014 overpayment credited to 2015

.

.

.

14a

b

Prior year(s) special estimated tax payments

to be applied .

.

.

.

.

.

.

.

.

.

14b

c

14c

2015 estimated tax payments (see instructions) .

d

2015 special estimated tax payments (Do not include on line 14f)

.

.

.

14d

(

)

e

2015 refund applied for on Form 4466 .

.

.

14e

f

14f

Enter the total of lines 14a through 14c less line 14e

.

.

.

.

.

.

.

14g

g

Tax deposited with Form 7004 .

.

.

.

.

.

.

.

.

.

.

.

.

.

h

Credit by reciprocal for tax paid by attorney-in-fact under section 835(d)

.

14h

i

14i

Other credits and payments

.

.

.

.

.

.

.

.

.

.

.

.

.

.

14j

j

Refundable credit from Form 8827, line 8c

.

.

.

.

.

.

.

.

.

.

14k

15

Estimated tax penalty (see instructions). Check if Form 2220 is attached

.

.

.

.

.

.

.

.

15

▶

16

Amount owed. If line 14k is smaller than the total of lines 13 and 15, enter amount owed

.

.

.

.

.

16

17

Overpayment. If line 14k is larger than the total of lines 13 and 15, enter amount overpaid .

17

.

.

.

.

18

Enter amount from line 17: Credited to 2016 estimated tax

Refunded

18

▶

▶

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true,

Sign

correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

May the IRS discuss this return

Here

with the preparer shown below

Yes

No

(see instructions)?

Signature of officer

Date

Title

Print/Type preparer’s name

Preparer's signature

Date

PTIN

Paid

Check

if

self-employed

Preparer

Firm’s name

Firm's EIN

Use Only

▶

▶

Firm's address

Phone no.

▶

1120-PC

For Paperwork Reduction Act Notice, see separate instructions.

Form

(2015)

Cat. No. 64270Q

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8