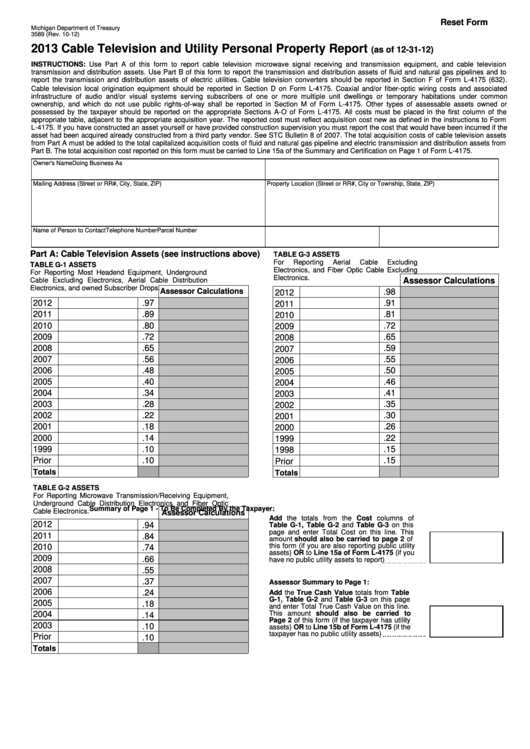

Reset Form

Michigan Department of Treasury

3589 (Rev. 10-12)

2013 Cable Television and Utility Personal Property Report

(as of 12-31-12)

INSTRUCTIONS: Use Part A of this form to report cable television microwave signal receiving and transmission equipment, and cable television

transmission and distribution assets. Use Part B of this form to report the transmission and distribution assets of fluid and natural gas pipelines and to

report the transmission and distribution assets of electric utilities. Cable television converters should be reported in Section F of Form L-4175 (632).

Cable television local origination equipment should be reported in Section D on Form L-4175. Coaxial and/or fiber-optic wiring costs and associated

infrastructure of audio and/or visual systems serving subscribers of one or more multiple unit dwellings or temporary habitations under common

ownership, and which do not use public rights-of-way shall be reported in Section M of Form L-4175. Other types of assessable assets owned or

possessed by the taxpayer should be reported on the appropriate Sections A-O of Form L-4175. All costs must be placed in the first column of the

appropriate table, adjacent to the appropriate acquisition year. The reported cost must reflect acquisition cost new as defined in the instructions to Form

L-4175. If you have constructed an asset yourself or have provided construction supervision you must report the cost that would have been incurred if the

asset had been acquired already constructed from a third party vendor. See STC Bulletin 8 of 2007. The total acquisition costs of cable television assets

from Part A must be added to the total capitalized acquisition costs of fluid and natural gas pipeline and electric transmission and distribution assets from

Part B. The total acquisition cost reported on this form must be carried to Line 15a of the Summary and Certification on Page 1 of Form L-4175.

Owner's Name

Doing Business As

Mailing Address (Street or RR#, City, State, ZIP)

Property Location (Street or RR#, City or Township, State, ZIP)

Name of Person to Contact

Telephone Number

Parcel Number

Part A: Cable Television Assets (see instructions above)

TABLE G-3 ASSETS

For

Reporting

Aerial

Cable

Excluding

TABLE G-1 ASSETS

Electronics, and Fiber Optic Cable Excluding

For Reporting Most Headend Equipment, Underground

Electronics.

Assessor Calculations

Cable Excluding Electronics, Aerial Cable Distribution

Electronics, and owned Subscriber Drops.

Assessor Calculations

.98

2012

2012

.97

.91

2011

2011

.89

.81

2010

2010

.80

.72

2009

2009

.72

.65

2008

2008

.65

.59

2007

2007

.56

.55

2006

2006

.48

.50

2005

2005

.40

.46

2004

2004

.34

.41

2003

2003

.28

.35

2002

2002

.22

.30

2001

2001

.18

.26

2000

2000

.14

.22

1999

1999

.10

.15

1998

Prior

.10

.15

Prior

Totals

Totals

TABLE G-2 ASSETS

For Reporting Microwave Transmission/Receiving Equipment,

Underground Cable Distribution Electronics and Fiber Optic

Summary of Page 1 - To Be Completed By the Taxpayer:

Cable Electronics.

Assessor Calculations

Add the totals from the Cost columns of

2012

.94

Table G-1, Table G-2 and Table G-3 on this

page and enter Total Cost on this line. This

2011

.84

amount should also be carried to page 2 of

this form (if you are also reporting public utility

2010

.74

assets) OR to Line 15a of Form L-4175 (if you

2009

.66

have no public utility assets to report)

2008

.55

2007

.37

Assessor Summary to Page 1:

2006

.24

Add the True Cash Value totals from Table

G-1, Table G-2 and Table G-3 on this page

2005

.18

and enter Total True Cash Value on this line.

This amount should also be carried to

2004

.14

Page 2 of this form (if the taxpayer has utility

2003

.10

assets) OR to Line 15b of Form L-4175 (if the

taxpayer has no public utility assets)

Prior

.10

Totals

1

1 2

2