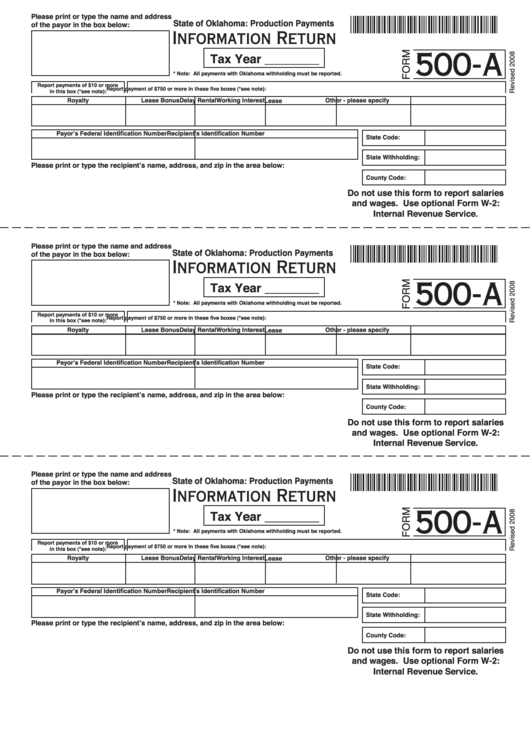

Please print or type the name and address

State of Oklahoma: Production Payments

of the payor in the box below:

Information Return

500-A

Tax Year ________

* Note: All payments with Oklahoma withholding must be reported.

Report payments of $10 or more

Report payment of $750 or more in these five boxes (*see note):

in this box (*see note):

Royalty

Lease Bonus

Delay Rental

Working Interest

Lease

Other - please specify

Payor’s Federal Identification Number

Recipient’s Identification Number

State Code:

State Withholding:

Please print or type the recipient’s name, address, and zip in the area below:

County Code:

Do not use this form to report salaries

and wages. Use optional Form W-2:

Internal Revenue Service.

Please print or type the name and address

State of Oklahoma: Production Payments

of the payor in the box below:

Information Return

500-A

Tax Year ________

* Note: All payments with Oklahoma withholding must be reported.

Report payments of $10 or more

Report payment of $750 or more in these five boxes (*see note):

in this box (*see note):

Royalty

Lease Bonus

Delay Rental

Working Interest

Other - please specify

Lease

Payor’s Federal Identification Number

Recipient’s Identification Number

State Code:

State Withholding:

Please print or type the recipient’s name, address, and zip in the area below:

County Code:

Do not use this form to report salaries

and wages. Use optional Form W-2:

Internal Revenue Service.

Please print or type the name and address

State of Oklahoma: Production Payments

of the payor in the box below:

Information Return

500-A

Tax Year ________

* Note: All payments with Oklahoma withholding must be reported.

Report payments of $10 or more

Report payment of $750 or more in these five boxes (*see note):

in this box (*see note):

Royalty

Lease Bonus

Delay Rental

Working Interest

Other - please specify

Lease

Payor’s Federal Identification Number

Recipient’s Identification Number

State Code:

State Withholding:

Please print or type the recipient’s name, address, and zip in the area below:

County Code:

Do not use this form to report salaries

and wages. Use optional Form W-2:

Internal Revenue Service.

1

1