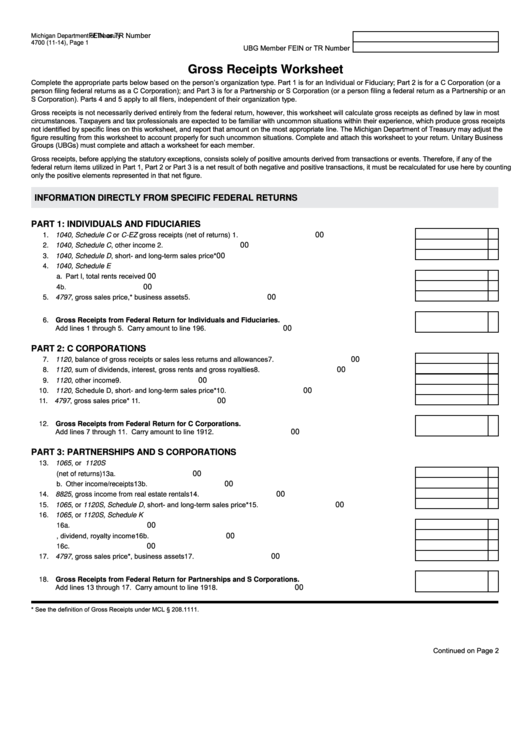

Form 4700 - Gross Receipts Worksheet

ADVERTISEMENT

FEIN or TR Number

Michigan Department of Treasury

4700 (11-14), Page 1

UBG Member FEIN or TR Number

Gross Receipts Worksheet

Complete the appropriate parts below based on the person’s organization type. Part 1 is for an Individual or Fiduciary; Part 2 is for a C Corporation (or a

person filing federal returns as a C Corporation); and Part 3 is for a Partnership or S Corporation (or a person filing a federal return as a Partnership or an

S Corporation). Parts 4 and 5 apply to all filers, independent of their organization type.

Gross receipts is not necessarily derived entirely from the federal return, however, this worksheet will calculate gross receipts as defined by law in most

circumstances. Taxpayers and tax professionals are expected to be familiar with uncommon situations within their experience, which produce gross receipts

not identified by specific lines on this worksheet, and report that amount on the most appropriate line. The Michigan Department of Treasury may adjust the

figure resulting from this worksheet to account properly for such uncommon situations. Complete and attach this worksheet to your return. Unitary Business

Groups (UBGs) must complete and attach a worksheet for each member.

Gross receipts, before applying the statutory exceptions, consists solely of positive amounts derived from transactions or events. Therefore, if any of the

federal return items utilized in Part 1, Part 2 or Part 3 is a net result of both negative and positive transactions, it must be recalculated for use here by counting

only the positive elements represented in that net figure.

INFORMATION DIRECTLY FROM SPECIFIC FEDERAL RETURNS

PART 1: INDIVIDUALS AND FIDUCIARIES

1. U.S. Form 1040, Schedule C or C-EZ gross receipts (net of returns) ..................................................................

00

1.

2. U.S. Form 1040, Schedule C, other income .........................................................................................................

00

2.

3. U.S. Form 1040, Schedule D, short- and long-term sales price*...........................................................................

00

3.

4. U.S. Form 1040, Schedule E

a. Part I, total rents received ...............................................................................................................................

00

4a.

b. Total royalties received ...................................................................................................................................

4b.

00

5. U.S. Form 4797, gross sales price,* business assets ...........................................................................................

00

5.

6. Gross Receipts from Federal Return for Individuals and Fiduciaries.

Add lines 1 through 5. Carry amount to line 19 .....................................................................................................

00

6.

PART 2: C CORPORATIONS

7. U.S. Form 1120, balance of gross receipts or sales less returns and allowances ................................................

00

7.

8. U.S. Form 1120, sum of dividends, interest, gross rents and gross royalties ........................................................

00

8.

9. U.S. Form 1120, other income ...............................................................................................................................

00

9.

10. U.S. Form 1120, Schedule D, short- and long-term sales price* ...........................................................................

00

10.

11. U.S. Form 4797, gross sales price* ......................................................................................................................

00

11.

12. Gross Receipts from Federal Return for C Corporations.

Add lines 7 through 11. Carry amount to line 19 ...................................................................................................

00

12.

PART 3: PARTNERSHIPS AND S CORPORATIONS

13. U.S. Form 1065, or U.S. Form 1120S

00

a. Gross receipts (net of returns) .........................................................................................................................

13a.

b. Other income/receipts ...................................................................................................................................... 13b.

00

14. U.S. Form 8825, gross income from real estate rentals ........................................................................................

00

14.

15. U.S. Form 1065, or 1120S, Schedule D, short- and long-term sales price* ..........................................................

00

15.

16. U.S. Form 1065, or 1120S, Schedule K

00

a. Gross other rental income ...............................................................................................................................

16a.

b. Interest, dividend, royalty income ....................................................................................................................

16b.

00

00

c. Other income ...................................................................................................................................................

16c.

17. U.S. Form 4797, gross sales price*, business assets ...........................................................................................

00

17.

18. Gross Receipts from Federal Return for Partnerships and S Corporations.

Add lines 13 through 17. Carry amount to line 19 ................................................................................................

00

18.

* See the definition of Gross Receipts under MCL § 208.1111.

Continued on Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5