Form Nc K-1 - Partner'S Share Of North Carolina Income, Adjustments, And Credits - 2013

ADVERTISEMENT

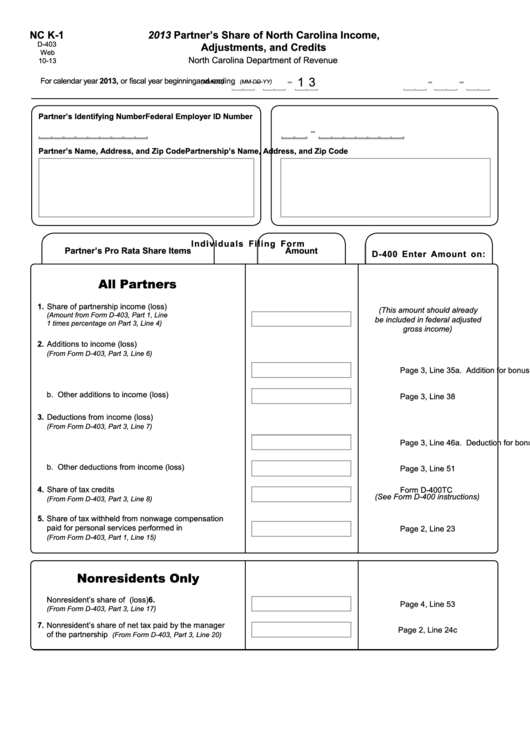

NC K-1

2013 Partner’s Share of North Carolina Income,

D-403

Adjustments, and Credits

Web

North Carolina Department of Revenue

10-13

1 3

For calendar year 2013, or fiscal year beginning

and ending

(MM-DD-YY)

(MM-DD)

Partner’s Identifying Number

Federal Employer ID Number

Partner’s Name, Address, and Zip Code

Partnership’s Name, Address, and Zip Code

Individuals Filing Form

Partner’s Pro Rata Share Items

Amount

D-400 Enter Amount on:

All Partners

1. Share of partnership income (loss)

(This amount should already

(Amount from Form D-403, Part 1, Line

be included in federal adjusted

1 times percentage on Part 3, Line 4)

gross income)

2. Additions to income (loss)

(From Form D-403, Part 3, Line 6)

a. Addition for bonus depreciation

Page 3, Line 35

b. Other additions to income (loss)

Page 3, Line 38

3. Deductions from income (loss)

(From Form D-403, Part 3, Line 7)

a. Deduction for bonus depreciation

Page 3, Line 46

b. Other deductions from income (loss)

Page 3, Line 51

4. Share of tax credits

Form D-400TC

(See Form D-400 instructions)

(From Form D-403, Part 3, Line 8)

5.

Share of tax withheld from nonwage compensation

paid for personal services performed in N.C.

Page 2, Line 23

(From Form D-403, Part 1, Line 15)

Nonresidents Only

6.

Nonresident’s share of N.C. taxable income (loss)

Page 4, Line 53

(From Form D-403, Part 3, Line 17)

7.

Nonresident’s share of net tax paid by the manager

Page 2, Line 24c

of the partnership

(From Form D-403, Part 3, Line 20)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1