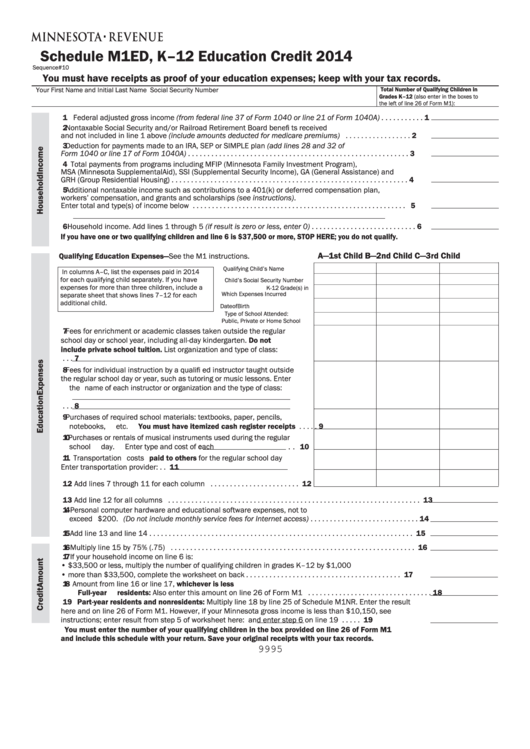

Schedule M1ED, K–12 Education Credit 2014

Sequence # 10

You must have receipts as proof of your education expenses; keep with your tax records.

Your First Name and Initial

Last Name

Social Security Number

Total Number of Qualifying Children in

Grades K–12 (also enter in the boxes to

the left of line 26 of Form M1):

1 Federal adjusted gross income (from federal line 37 of Form 1040 or line 21 of Form 1040A) . . . . . . . . . . . 1

2 Nontaxable Social Security and/or Railroad Retirement Board benefi ts received

and not included in line 1 above (include amounts deducted for medicare premiums) . . . . . . . . . . . . . . . . . 2

3 Deduction for payments made to an IRA, SEP or SIMPLE plan (add lines 28 and 32 of

Form 1040 or line 17 of Form 1040A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Total payments from programs including MFIP (Minnesota Family Investment Program),

MSA (Minnesota Supplemental Aid), SSI (Supplemental Security Income), GA (General Assistance) and

GRH (Group Residential Housing) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Additional nontaxable income such as contributions to a 401(k) or deferred compensation plan,

workers’ compensation, and grants and scholarships (see instructions).

Enter total and type(s) of income below . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Household income. Add lines 1 through 5 (if result is zero or less, enter 0) . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

If you have one or two qualifying children and line 6 is $37,500 or more, STOP HERE; you do not qualify.

A—1st Child

B—2nd Child

C—3rd Child

Qualifying Education Expenses—See the M1 instructions.

Qualifying Child’s Name

In columns A–C, list the expenses paid in 2014

for each qualifying child separately. If you have

Child’s Social Security Number

expenses for more than three children, include a

K-12 Grade(s) in

Which Expenses Incurred

separate sheet that shows lines 7–12 for each

additional child.

Date of Birth

Type of School Attended:

Public, Private or Home School

7 Fees for enrichment or academic classes taken outside the regular

school day or school year, including all-day kindergarten. Do not

include private school tuition. List organization and type of class:

. . . 7

8 Fees for individual instruction by a qualifi ed instructor taught outside

the regular school day or year, such as tutoring or music lessons. Enter

the name of each instructor or organization and the type of class:

. . . 8

9 Purchases of required school materials: textbooks, paper, pencils,

notebooks, etc. You must have itemized cash register receipts . . . . . 9

10 Purchases or rentals of musical instruments used during the regular

school day. Enter type and cost of each:

. . 10

11 Transportation costs paid to others for the regular school day

Enter transportation provider:

. . 11

12 Add lines 7 through 11 for each column . . . . . . . . . . . . . . . . . . . . . . . 12

13 Add line 12 for all columns . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Personal computer hardware and educational software expenses, not to

exceed $200. (Do not include monthly service fees for Internet access) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Add line 13 and line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Multiply line 15 by 75% (.75) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 If your household income on line 6 is:

• $33,500 or less, multiply the number of qualifying children in grades K–12 by $1,000

• more than $33,500, complete the worksheet on back . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Amount from line 16 or line 17, whichever is less.

Full-year residents: Also enter this amount on line 26 of Form M1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Part-year residents and nonresidents: Multiply line 18 by line 25 of Schedule M1NR. Enter the result

here and on line 26 of Form M1. However, if your Minnesota gross income is less than $10,150, see

instructions; enter result from step 5 of worksheet here:

and enter step 6 on line 19 . . . . . 19

You must enter the number of your qualifying children in the box provided on line 26 of Form M1

and include this schedule with your return. Save your original receipts with your tax records.

9995

1

1 2

2