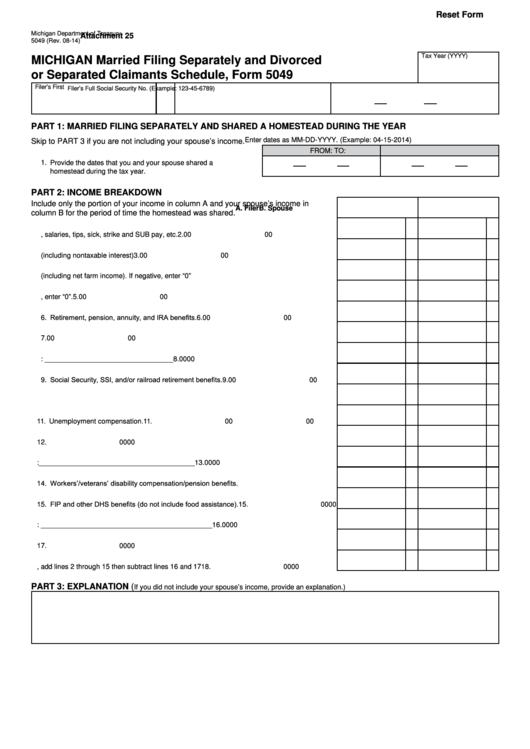

Reset Form

Michigan Department of Treasury

Attachment 25

5049 (Rev. 08-14)

Tax Year (YYYY)

MICHIGAN Married Filing Separately and Divorced

or Separated Claimants Schedule, Form 5049

Filer’s First Name

M.I.

Last Name

Filer’s Full Social Security No. (Example: 123-45-6789)

PART 1: MARRIED FILING SEPARATELY AND SHARED A HOMESTEAD DURING THE YEAR

Enter dates as MM-DD-YYYY. (Example: 04-15-2014)

Skip to PART 3 if you are not including your spouse’s income.

FROM:

TO:

1. Provide the dates that you and your spouse shared a

homestead during the tax year.

PART 2: INCOME BREAKDOWN

Include only the portion of your income in column A and your spouse’s income in

A. Filer

B. Spouse

column B for the period of time the homestead was shared.

2. Wages, salaries, tips, sick, strike and SUB pay, etc. .......................................................

2.

00

00

3. All interest and dividend income (including nontaxable interest) .....................................

3.

00

00

4. Net business income (including net farm income). If negative, enter “0”.........................

4.

00

00

5. Net royalty or rent income. If negative, enter “0”. ............................................................

5.

00

00

6. Retirement, pension, annuity, and IRA benefits. ..............................................................

6.

00

00

7. Capital gains less capital losses. .....................................................................................

7.

00

00

8. Alimony and other taxable income. Describe: _________________________________

8.

00

00

9. Social Security, SSI, and/or railroad retirement benefits. ................................................

9.

00

00

10. Child support and foster parent payments.......................................................................

10.

00

00

11. Unemployment compensation. ........................................................................................

11.

00

00

12. Gifts or expenses paid on your behalf. ............................................................................

12.

00

00

13. Other nontaxable income. Describe:________________________________________

13.

00

00

14. Workers’/veterans’ disability compensation/pension benefits..........................................

14.

00

00

15. FIP and other DHS benefits (do not include food assistance). ........................................

15.

00

00

16. Other adjustments. Describe: ____________________________________________

16.

00

00

17. Medical insurance/HMO premiums you paid for you and your family .............................

17.

00

00

18. Subtotal. For each column, add lines 2 through 15 then subtract lines 16 and 17 .........

18.

00

00

PART 3: EXPLANATION (

If you did not include your spouse’s income, provide an explanation.)

1

1 2

2