Form Ct-46-Att - Credit For Rehabilitation Expenses For Retail Enterprises And Historic Barns - 2014

ADVERTISEMENT

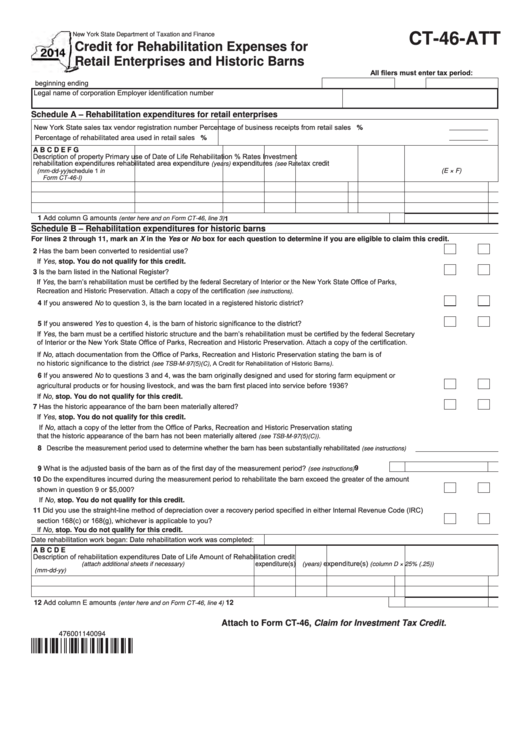

New York State Department of Taxation and Finance

CT-46-ATT

Credit for Rehabilitation Expenses for

Retail Enterprises and Historic Barns

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number

Schedule A – Rehabilitation expenditures for retail enterprises

New York State sales tax vendor registration number

Percentage of business receipts from retail sales .......................................

%

Percentage of rehabilitated area used in retail sales ...................................

%

A

B

C

D

E

F

G

Description of property

Primary use of

Date of

Life

Rehabilitation

% Rates

Investment

rehabilitation expenditures

rehabilitated area

expenditure

expenditures

(see Rate

tax credit

(years)

schedule 1 in

(E × F)

(mm-dd-yy)

Form CT-46-I)

1 Add column G amounts

...................................................................................

(enter here and on Form CT-46, line 3)

1

Schedule B – Rehabilitation expenditures for historic barns

For lines 2 through 11, mark an X in the Yes or No box for each question to determine if you are eligible to claim this credit.

2 Has the barn been converted to residential use? ........................................................................................................................ Yes

No

If Yes, stop. You do not qualify for this credit.

3 Is the barn listed in the National Register? .................................................................................................................................. Yes

No

If Yes, the barn’s rehabilitation must be certified by the federal Secretary of Interior or the New York State Office of Parks,

Recreation and Historic Preservation. Attach a copy of the certification

(see instructions).

4 If you answered No to question 3, is the barn located in a registered historic district? ............................................................... Yes

No

5 If you answered Yes to question 4, is the barn of historic significance to the district? ................................................................ Yes

No

If Yes, the barn must be a certified historic structure and the barn’s rehabilitation must be certified by the federal Secretary

of Interior or the New York State Office of Parks, Recreation and Historic Preservation. Attach a copy of the certification.

If No, attach documentation from the Office of Parks, Recreation and Historic Preservation stating the barn is of

no historic significance to the district

(see TSB-M-97(5)(C), A Credit for Rehabilitation of Historic Barns).

6 If you answered No to questions 3 and 4, was the barn originally designed and used for storing farm equipment or

agricultural products or for housing livestock, and was the barn first placed into service before 1936? ................................. Yes

No

If No, stop. You do not qualify for this credit.

7 Has the historic appearance of the barn been materially altered? .............................................................................................. Yes

No

If Yes, stop. You do not qualify for this credit.

If No, attach a copy of the letter from the Office of Parks, Recreation and Historic Preservation stating

that the historic appearance of the barn has not been materially altered

(see TSB-M-97(5)(C)).

8 Describe the measurement period used to determine whether the barn has been substantially rehabilitated

.....

(see instructions)

9 What is the adjusted basis of the barn as of the first day of the measurement period?

9

................

(see instructions)

10 Do the expenditures incurred during the measurement period to rehabilitate the barn exceed the greater of the amount

shown in question 9 or $5,000? ............................................................................................................................................... Yes

No

If No, stop. You do not qualify for this credit.

11 Did you use the straight-line method of depreciation over a recovery period specified in either Internal Revenue Code (IRC)

section 168(c) or 168(g), whichever is applicable to you? ....................................................................................................... Yes

No

If No, stop. You do not qualify for this credit.

Date rehabilitation work began:

Date rehabilitation work was completed:

A

B

C

D

E

Description of rehabilitation expenditures

Date of

Life

Amount of

Rehabilitation credit

expenditure(s)

expenditure(s)

(attach additional sheets if necessary)

(years)

(column D × 25% (.25))

(mm-dd-yy)

12 Add column E amounts

...................................................................................

12

(enter here and on Form CT-46, line 4)

Attach to Form CT-46, Claim for Investment Tax Credit.

476001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2