Form 4974 - Michigan Schedule Of Corporate Income Tax Liability For A Michigan Business Tax Insurance Filer - 2014

ADVERTISEMENT

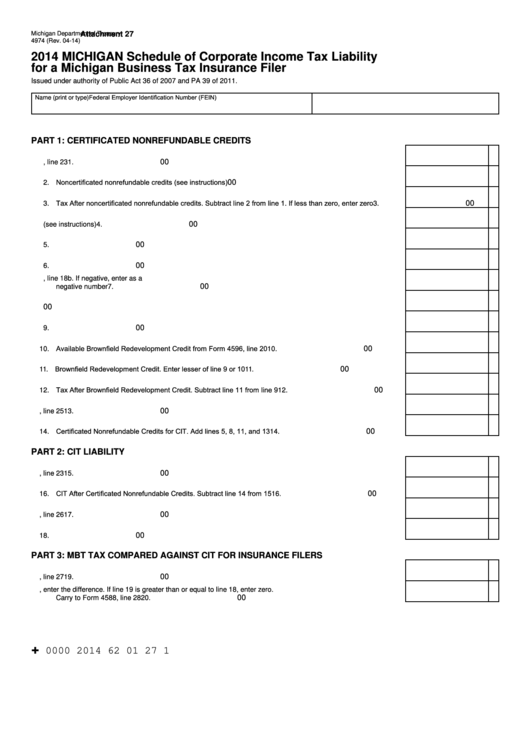

Michigan Department of Treasury

Attachment 27

4974 (Rev. 04-14)

2014 MICHIGAN Schedule of Corporate Income Tax Liability

for a Michigan Business Tax Insurance Filer

Issued under authority of Public Act 36 of 2007 and PA 39 of 2011.

Federal Employer Identification Number (FEIN)

Name (print or type)

PART 1: CERTIFICATED NONREFUNDABLE CREDITS

00

1. Tax Before Nonrefundable Credits from Form 4588, line 23 .............................................................................

1.

2. Noncertificated nonrefundable credits (see instructions)...................................................................................

00

2.

3. Tax After noncertificated nonrefundable credits. Subtract line 2 from line 1. If less than zero, enter zero ........

00

3.

00

4. Available Renaissance Zone Credit (see instructions) ......................................................................................

4.

00

5. Renaissance Zone Credit. Enter lesser of line 3 or 4 ........................................................................................

5.

00

6. Tax After Renaissance Zone Credit. Subtract line 5 from line 3 ........................................................................

6.

7. Available Historic Preservation Credit Net of Recapture from Form 4596, line 18b. If negative, enter as a

00

negative number ................................................................................................................................................

7.

00

8. Historic Preservation Credit Net of Recapture. Enter lesser of line 6 or 7.........................................................

8.

00

9. Tax After Historic Preservation Credit Net of Recapture. Subtract line 8 from line 6 .........................................

9.

10. Available Brownfield Redevelopment Credit from Form 4596, line 20 ..............................................................

00

10.

11. Brownfield Redevelopment Credit. Enter lesser of line 9 or 10 .........................................................................

00

11.

12. Tax After Brownfield Redevelopment Credit. Subtract line 11 from line 9 .........................................................

00

12.

00

13. Film Infrastructure Credit from Form 4596, line 25 ............................................................................................

13.

14. Certificated Nonrefundable Credits for CIT. Add lines 5, 8, 11, and 13 .............................................................

00

14.

PART 2: CIT LIABILITY

00

15. MBT Tax Before Miscellaneous Nonrefundable Credits from Form 4588, line 23 .............................................

15.

16. CIT After Certificated Nonrefundable Credits. Subtract line 14 from 15 ............................................................

00

16.

00

17. Total Recapture of Certain Business Tax Credits for CIT from Form 4588, line 26 ...........................................

17.

00

18. CIT After Recapture. Add lines 16 and 17 .........................................................................................................

18.

PART 3: MBT TAX COMPARED AGAINST CIT FOR INSURANCE FILERS

00

19. Total MBT liability from Form 4588, line 27 .......................................................................................................

19.

20. If line 18 is greater than line 19, enter the difference. If line 19 is greater than or equal to line 18, enter zero.

00

Carry to Form 4588, line 28 ...............................................................................................................................

20.

+

0000 2014 62 01 27 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3