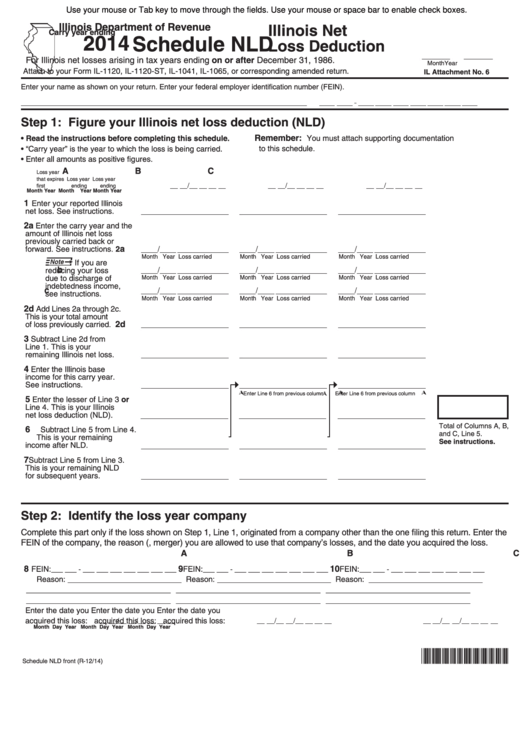

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Illinois Net

Carry year ending

2014 Schedule NLD

Loss Deduction

For Illinois net losses arising in tax years ending on or after December 31, 1986.

Month

Year

Attach to your Form IL-1120, IL-1120-ST, IL-1041, IL-1065, or corresponding amended return.

IL Attachment No. 6

Enter your name as shown on your return.

Enter your federal employer identification number (FEIN).

Step 1: Figure your Illinois net loss deduction (NLD)

Remember:

•

Read the instructions before completing this schedule.

You must attach supporting documentation

to this schedule.

•

“Carry year” is the year to which the loss is being carried.

•

Enter all amounts as positive figures.

A

B

C

Loss year

that expires

Loss year

Loss year

first

ending

ending

Month

Year

Month

Year

Month

Year

1

Enter your reported Illinois

net loss. See instructions.

2a

Enter the carry year and the

amount of Illinois net loss

previously carried back or

a

forward. See instructions. 2

Month Year Loss carried

Month Year Loss carried

Month Year Loss carried

If you are

b

reducing your loss

due to discharge of

Month Year Loss carried

Month Year Loss carried

Month Year Loss carried

indebtedness income,

c

see instructions.

Month Year Loss carried

Month Year Loss carried

Month Year Loss carried

2d

Add Lines 2a through 2c.

This is your total amount

2d

of loss previously carried.

3

Subtract Line 2d from

Line 1. This is your

remaining Illinois net loss.

4

Enter the Illinois base

income for this carry year.

See instructions.

Enter Line 6 from previous column

Enter Line 6 from previous column

5

Enter the lesser of Line 3 or

Line 4. This is your Illinois

net loss deduction (NLD).

Total of Columns A, B,

6

Subtract Line 5 from Line 4.

and C, Line 5.

This is your remaining

See instructions.

income after NLD.

7

Subtract Line 5 from Line 3.

This is your remaining NLD

for subsequent years.

Step 2: Identify the loss year company

Complete this part only if the loss shown on Step 1, Line 1, originated from a company other than the one filing this return. Enter the

FEIN of the company, the reason (e.g., merger) you are allowed to use that company’s losses, and the date you acquired the loss.

A

B

C

8

9

10

FEIN:

FEIN:

FEIN:

___ ___ - ___ ___ ___ ___ ___ ___ ___

___ ___ - ___ ___ ___ ___ ___ ___ ___

___ ___ - ___ ___ ___ ___ ___ ___ ___

Reason: __________________________

Reason: __________________________

Reason: __________________________

_________________________________

_________________________________

_________________________________

_________________________________

_________________________________

_________________________________

Enter the date you

Enter the date you

Enter the date you

acquired this loss:

acquired this loss:

acquired this loss:

Month

Day

Year

Month

Day

Year

Month

Day

Year

*433201110*

Schedule NLD front (R-12/14)

1

1 2

2