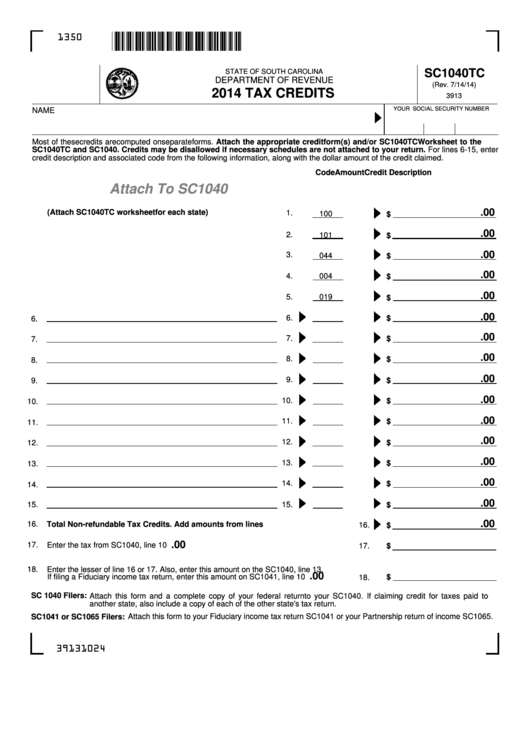

1350

SC1040TC

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

(Rev. 7/14/14)

2014 TAX CREDITS

3913

YOUR SOCIAL SECURITY NUMBER

NAME

Most of these credits are computed on separate forms. Attach the appropriate credit form(s) and/or SC1040TC Worksheet to the

SC1040TC and SC1040. Credits may be disallowed if necessary schedules are not attached to your return. For lines 6-15, enter

credit description and associated code from the following information, along with the dollar amount of the credit claimed.

Credit Description

Code

Amount

Attach To SC1040

1.

Total Credit for taxes paid to another state

.00

(Attach SC1040TC worksheet for each state) .............................

1.

100

$

.00

2.

Carryover of unused qualified credits ..............................................

2.

101

$

.00

3.

Excess Insurance Premium Credit ..................................................

3.

044

$

.00

4.

New Jobs Credit ..............................................................................

4.

004

$

.00

5.

019

$

5.

Qualified Conservation Contribution Credit......................................

.00

6.

$

6.

.00

7.

$

7.

.00

8.

$

8.

.00

9.

$

9.

.00

10.

10.

$

.00

11.

$

11.

.00

12.

$

12.

.00

13.

$

13.

.00

14.

$

14.

.00

15.

15.

$

.00

16.

Total Non-refundable Tax Credits. Add amounts from lines 1-15...............................

16.

$

.00

17.

Enter the tax from SC1040, line 10 ...................................................................................

17.

$

18.

Enter the lesser of line 16 or 17. Also, enter this amount on the SC1040, line 13.

.00

If filing a Fiduciary income tax return, enter this amount on SC1041, line 10 ...................

$

18.

SC 1040 Filers:

Attach this form and a complete copy of your federal return to your SC1040. If claiming credit for taxes paid to

another state, also include a copy of each of the other state's tax return.

SC1041 or SC1065 Filers:

Attach this form to your Fiduciary income tax return SC1041 or your Partnership return of income SC1065.

39131024

1

1 2

2 3

3 4

4 5

5