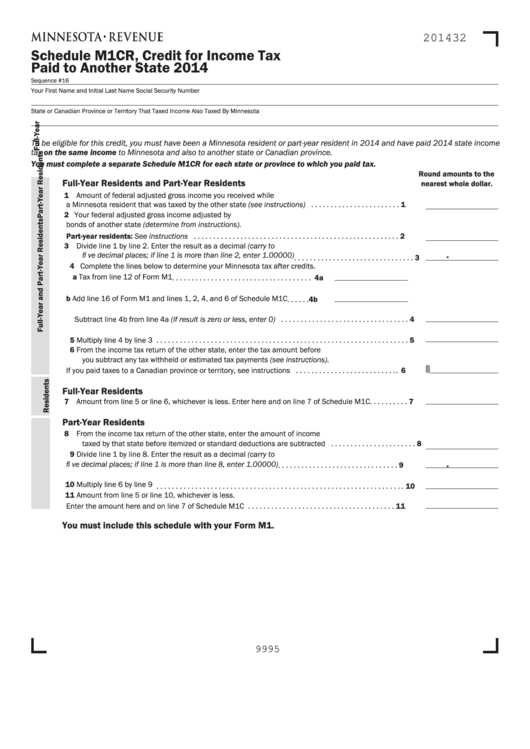

201432

Schedule M1CR, Credit for Income Tax

Paid to Another State 2014

Sequence #16

Your First Name and Initial

Last Name

Social Security Number

State or Canadian Province or Territory That Taxed Income Also Taxed By Minnesota

To be eligible for this credit, you must have been a Minnesota resident or part-year resident in 2014 and have paid 2014 state income

tax on the same income to Minnesota and also to another state or Canadian province.

You must complete a separate Schedule M1CR for each state or province to which you paid tax.

Round amounts to the

Full-Year Residents and Part-Year Residents

nearest whole dollar.

1 Amount of federal adjusted gross income you received while

a Minnesota resident that was taxed by the other state (see instructions) . . . . . . . . . . . . . . . . . . . . . . . 1

2 Your federal adjusted gross income adjusted by U.S. bond interest and/or

bonds of another state (determine from instructions).

Part-year residents: See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Divide line 1 by line 2. Enter the result as a decimal (carry to

.

fi ve decimal places; if line 1 is more than line 2, enter 1.00000) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Complete the lines below to determine your Minnesota tax after credits.

a Tax from line 12 of Form M1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4a

b Add line 16 of Form M1 and lines 1, 2, 4, and 6 of Schedule M1C . . . . . .4b

Subtract line 4b from line 4a (if result is zero or less, enter 0) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Multiply line 4 by line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 From the income tax return of the other state, enter the tax amount before

you subtract any tax withheld or estimated tax payments (see instructions).

If you paid taxes to a Canadian province or territory, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Full-Year Residents

7 Amount from line 5 or line 6, whichever is less. Enter here and on line 7 of Schedule M1C . . . . . . . . . . 7

Part-Year Residents

8 From the income tax return of the other state, enter the amount of income

taxed by that state before itemized or standard deductions are subtracted . . . . . . . . . . . . . . . . . . . . . . 8

9 Divide line 1 by line 8. Enter the result as a decimal (carry to

.

fi ve decimal places; if line 1 is more than line 8, enter 1.00000) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Multiply line 6 by line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Amount from line 5 or line 10, whichever is less.

Enter the amount here and on line 7 of Schedule M1C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

You must include this schedule with your Form M1.

9995

1

1 2

2