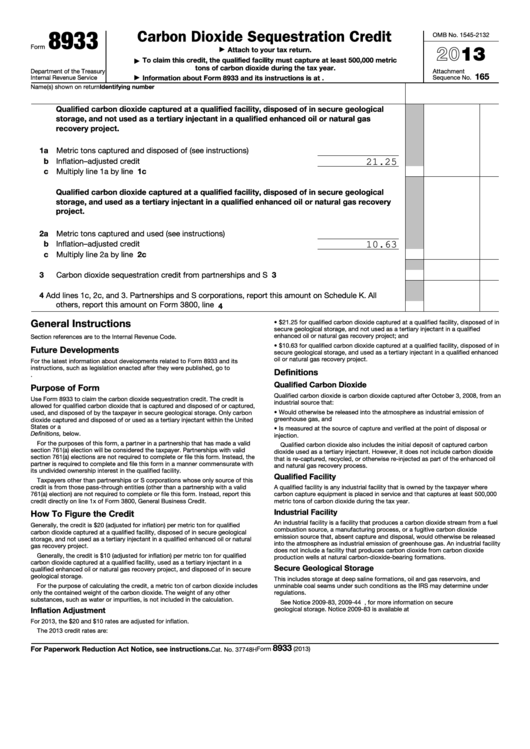

8933

Carbon Dioxide Sequestration Credit

OMB No. 1545-2132

2013

Form

Attach to your tax return.

▶

To claim this credit, the qualified facility must capture at least 500,000 metric

▶

tons of carbon dioxide during the tax year.

Department of the Treasury

Attachment

165

Internal Revenue Service

Information about Form 8933 and its instructions is at

Sequence No.

▶

Identifying number

Name(s) shown on return

Qualified carbon dioxide captured at a qualified facility, disposed of in secure geological

storage, and not used as a tertiary injectant in a qualified enhanced oil or natural gas

recovery project.

1a Metric tons captured and disposed of (see instructions) .

.

.

.

.

.

b Inflation–adjusted credit rate.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

21.25

c Multiply line 1a by line 1b .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1c

Qualified carbon dioxide captured at a qualified facility, disposed of in secure geological

storage, and used as a tertiary injectant in a qualified enhanced oil or natural gas recovery

project.

2a Metric tons captured and used (see instructions) .

.

.

.

.

.

.

.

b Inflation–adjusted credit rate.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10.63

c Multiply line 2a by line 2b .

2c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

Carbon dioxide sequestration credit from partnerships and S corporations

.

.

.

.

.

.

.

.

3

4

Add lines 1c, 2c, and 3. Partnerships and S corporations, report this amount on Schedule K. All

others, report this amount on Form 3800, line 1x .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

General Instructions

• $21.25 for qualified carbon dioxide captured at a qualified facility, disposed of in

secure geological storage, and not used as a tertiary injectant in a qualified

enhanced oil or natural gas recovery project; and

Section references are to the Internal Revenue Code.

• $10.63 for qualified carbon dioxide captured at a qualified facility, disposed of in

Future Developments

secure geological storage, and used as a tertiary injectant in a qualified enhanced

oil or natural gas recovery project.

For the latest information about developments related to Form 8933 and its

instructions, such as legislation enacted after they were published, go to

Definitions

Qualified Carbon Dioxide

Purpose of Form

Qualified carbon dioxide is carbon dioxide captured after October 3, 2008, from an

Use Form 8933 to claim the carbon dioxide sequestration credit. The credit is

industrial source that:

allowed for qualified carbon dioxide that is captured and disposed of or captured,

• Would otherwise be released into the atmosphere as industrial emission of

used, and disposed of by the taxpayer in secure geological storage. Only carbon

greenhouse gas, and

dioxide captured and disposed of or used as a tertiary injectant within the United

States or a U.S. possession is taken into account when figuring the credit. See

• Is measured at the source of capture and verified at the point of disposal or

Definitions, below.

injection.

For the purposes of this form, a partner in a partnership that has made a valid

Qualified carbon dioxide also includes the initial deposit of captured carbon

section 761(a) election will be considered the taxpayer. Partnerships with valid

dioxide used as a tertiary injectant. However, it does not include carbon dioxide

section 761(a) elections are not required to complete or file this form. Instead, the

that is re-captured, recycled, or otherwise re-injected as part of the enhanced oil

partner is required to complete and file this form in a manner commensurate with

and natural gas recovery process.

its undivided ownership interest in the qualified facility.

Qualified Facility

Taxpayers other than partnerships or S corporations whose only source of this

credit is from those pass-through entities (other than a partnership with a valid

A qualified facility is any industrial facility that is owned by the taxpayer where

761(a) election) are not required to complete or file this form. Instead, report this

carbon capture equipment is placed in service and that captures at least 500,000

credit directly on line 1x of Form 3800, General Business Credit.

metric tons of carbon dioxide during the tax year.

Industrial Facility

How To Figure the Credit

An industrial facility is a facility that produces a carbon dioxide stream from a fuel

Generally, the credit is $20 (adjusted for inflation) per metric ton for qualified

combustion source, a manufacturing process, or a fugitive carbon dioxide

carbon dioxide captured at a qualified facility, disposed of in secure geological

emission source that, absent capture and disposal, would otherwise be released

storage, and not used as a tertiary injectant in a qualified enhanced oil or natural

into the atmosphere as industrial emission of greenhouse gas. An industrial facility

gas recovery project.

does not include a facility that produces carbon dioxide from carbon dioxide

Generally, the credit is $10 (adjusted for inflation) per metric ton for qualified

production wells at natural carbon-dioxide-bearing formations.

carbon dioxide captured at a qualified facility, used as a tertiary injectant in a

Secure Geological Storage

qualified enhanced oil or natural gas recovery project, and disposed of in secure

geological storage.

This includes storage at deep saline formations, oil and gas reservoirs, and

For the purpose of calculating the credit, a metric ton of carbon dioxide includes

unminable coal seams under such conditions as the IRS may determine under

only the contained weight of the carbon dioxide. The weight of any other

regulations.

substances, such as water or impurities, is not included in the calculation.

See Notice 2009-83, 2009-44 I.R.B. 588, for more information on secure

geological storage. Notice 2009-83 is available at

Inflation Adjustment

For 2013, the $20 and $10 rates are adjusted for inflation.

The 2013 credit rates are:

8933

For Paperwork Reduction Act Notice, see instructions.

Form

(2013)

Cat. No. 37748H

1

1 2

2