Michigan Department of Treasury (Rev. 02-12)

2013 MI-1041ES, Michigan Estimated Income Tax for Fiduciaries

Issued under authority of Public Act 281 of 1967. See instructions for filing guidelines.

Payment Due Dates

Who Must File Estimated Tax Payments

Fiduciaries may pay in full with the first voucher, due

Fiduciaries of an estate or trust (resident or nonresident),

April 15, 2013. Fiduciaries may also pay in equal

generally must pay estimated tax if the estate or trust

is expected to owe more than $500 after subtracting

installments due on or before April 15, 2013, June 17, 2013,

September 16, 2013, and January 15, 2014.

withholding and credits.

Generally, all fiduciaries of trusts must report on a calendar

If the estate or trust owes more than $500, estimated

year. Report the same year that you report for federal

payments may not have to be made if the estate or trust

estimated payments.

expects the 2013 withholding to be at least:

Fiscal-year returns must be adjusted so all dates correspond

• 90 percent of the total tax for 2013, OR

with the fiscal year. The first estimate payment is due on

• 100 percent of the total tax shown on the 2012 return,

the 15th day of the fourth month after the fiscal year ends.

OR

• 110 percent of the total 2012 tax if the estate’s or trust’s

You will not receive reminder notices; save this set of

taxable income for 2012 is more than $150,000. To

forms for all 2013 payments.

figure the estate or trust’s federal taxable income, see the

instructions for line 22 of the U.S. Form 1041.

Where to Mail Payments

Make the check payable to “State of Michigan.” Write

Financial institutions that act as a fiduciary for 200 or

the FEIN of the estate or trust and “2013 MI-1041ES”

more trusts shall submit Michigan estimated payments

on the front of the check. To ensure accurate processing of

on magnetic tape. Institutions acting as fiduciary for more

your return, send one check for each return type. Mail your

than 49 and fewer than 200 trusts may make an irrevocable

check with the MI-1041ES form for that installment. Do not

agreement to file magnetically.

staple the check to the form.

Exceptions:

Send your check and voucher to:

• Generally, no estimated tax is due if the estate or trust is

due a refund or has a balance due of $500 or less.

Michigan Department of Treasury

P.O. Box 30774

• There is no estimated tax due on an estate or a trust that

Lansing, MI 48909-8274

had no tax liability for the full 12 months preceding the

tax year.

• Estates do not have to pay estimated tax for the first two

years.

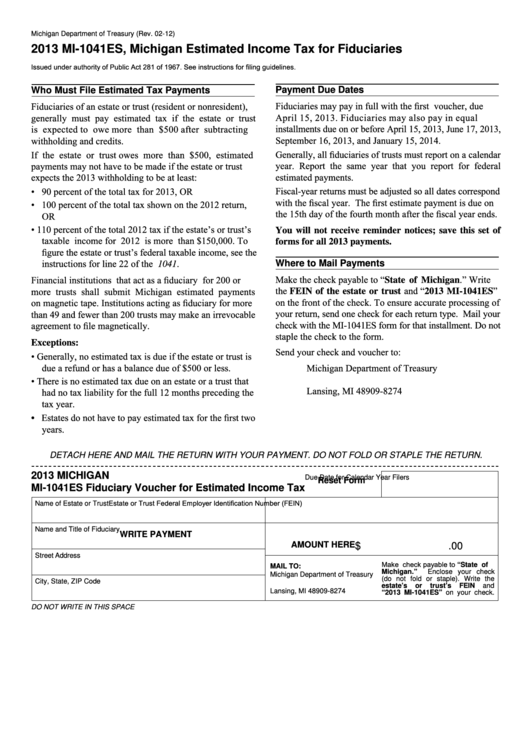

DETACH HERE AND MAIL THE RETURN WITH YOUR PAYMENT. DO NOT FOLD OR STAPLE THE RETURN.

2013 MICHIGAN

Due Date for Calendar Year Filers

Reset Form

MI-1041ES Fiduciary Voucher for Estimated Income Tax

Estate or Trust Federal Employer Identification Number (FEIN)

Name of Estate or Trust

Name and Title of Fiduciary

WRITE PAYMENT

AMOUNT HERE

$

.00

Street Address

Make check payable to “State of

MAIL TO:

Michigan.”

Enclose your check

Michigan Department of Treasury

(do not fold or staple). Write the

City, State, ZIP Code

P.O. Box 30774

estate’s

or

trust’s

FEIN

and

Lansing, MI 48909-8274

“2013 MI-1041ES” on your check.

DO NOT WRITE IN THIS SPACE

1

1 2

2