Schedule Cc - Alternative Tax Schedule-Schedule Cc

ADVERTISEMENT

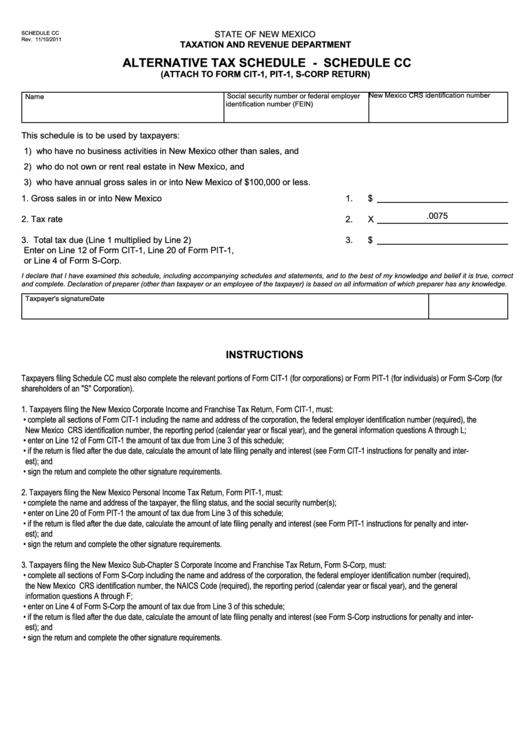

STATE OF NEW MEXICO

SCHEDULE CC

Rev. 11/10/2011

TAXATION AND REVENUE DEPARTMENT

ALTERNATIVE TAX SCHEDULE - SCHEDULE CC

(ATTACH TO FORM CIT-1, PIT-1, S-CORP RETURN)

New Mexico CRS identification number

Social security number or federal employer

Name

identification number (FEIN)

This schedule is to be used by taxpayers:

1) who have no business activities in New Mexico other than sales, and

2) who do not own or rent real estate in New Mexico, and

3) who have annual gross sales in or into New Mexico of $100,000 or less.

1. Gross sales in or into New Mexico ....................................................................

1.

$

.0075

2. Tax rate .............................................................................................................

2.

X

3. Total tax due (Line 1 multiplied by Line 2) .........................................................

3.

$

Enter on Line 12 of Form CIT-1, Line 20 of Form PIT-1,

or Line 4 of Form S-Corp.

I declare that I have examined this schedule, including accompanying schedules and statements, and to the best of my knowledge and belief it is true, correct

and complete. Declaration of preparer (other than taxpayer or an employee of the taxpayer) is based on all information of which preparer has any knowledge.

Taxpayer's signature

Date

INSTRUCTIONS

Taxpayers filing Schedule CC must also complete the relevant portions of Form CIT-1 (for corporations) or Form PIT-1 (for individuals) or Form S-Corp (for

shareholders of an "S" Corporation).

1.

Taxpayers filing the New Mexico Corporate Income and Franchise Tax Return, Form CIT-1, must:

•

complete all sections of Form CIT-1 including the name and address of the corporation, the federal employer identification number (required), the

New Mexico CRS identification number, the reporting period (calendar year or fiscal year), and the general information questions A through L;

•

enter on Line 12 of Form CIT-1 the amount of tax due from Line 3 of this schedule;

•

if the return is filed after the due date, calculate the amount of late filing penalty and interest (see Form CIT-1 instructions for penalty and inter-

est); and

•

sign the return and complete the other signature requirements.

2.

Taxpayers filing the New Mexico Personal Income Tax Return, Form PIT-1, must:

•

complete the name and address of the taxpayer, the filing status, and the social security number(s);

•

enter on Line 20 of Form PIT-1 the amount of tax due from Line 3 of this schedule;

•

if the return is filed after the due date, calculate the amount of late filing penalty and interest (see Form PIT-1 instructions for penalty and inter-

est); and

•

sign the return and complete the other signature requirements.

3.

Taxpayers filing the New Mexico Sub-Chapter S Corporate Income and Franchise Tax Return, Form S-Corp, must:

•

complete all sections of Form S-Corp including the name and address of the corporation, the federal employer identification number (required),

the New Mexico CRS identification number, the NAICS Code (required), the reporting period (calendar year or fiscal year), and the general

information questions A through F;

•

enter on Line 4 of Form S-Corp the amount of tax due from Line 3 of this schedule;

•

if the return is filed after the due date, calculate the amount of late filing penalty and interest (see Form S-Corp instructions for penalty and inter-

est); and

•

sign the return and complete the other signature requirements.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1