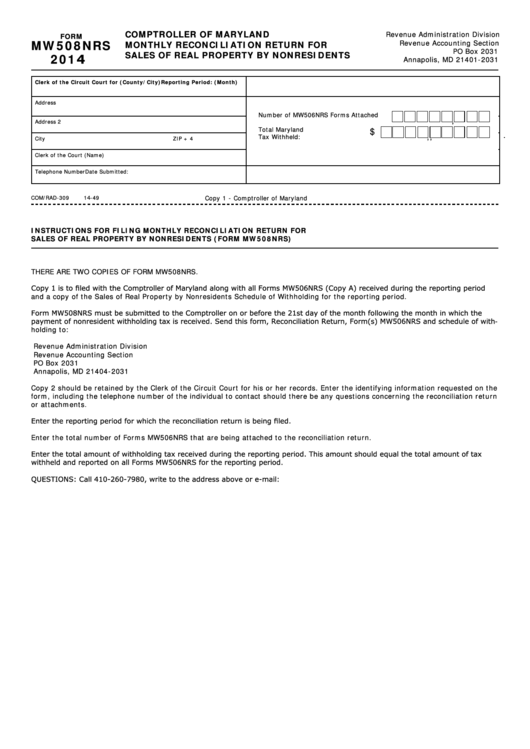

COMPTROLLER OF MARYLAND

Revenue Administration Division

FORM

MW508NRS

Revenue Accounting Section

MONTHLY RECONCILIATION RETURN FOR

PO Box 2031

SALES OF REAL PROPERTY BY NONRESIDENTS

2014

Annapolis, MD 21401-2031

Clerk of the Circuit Court for (County/City)

Reporting Period: (Month)

Address

Number of MW506NRS Forms Attached

,

Address 2

Total Maryland

$

.

,

,

Tax Withheld:

City

ZIP + 4

Clerk of the Court (Name)

Telephone Number

Date Submitted:

Copy 1 - Comptroller of Maryland

COM/RAD-309

14-49

INSTRUCTIONS FOR FILING MONTHLY RECONCILIATION RETURN FOR

SALES OF REAL PROPERTY BY NONRESIDENTS (FORM MW508NRS)

THERE ARE TWO COPIES OF FORM MW508NRS.

Copy 1 is to filed with the Comptroller of Maryland along with all Forms MW506NRS (Copy A) received during the reporting period

and a copy of the Sales of Real Property by Nonresidents Schedule of Withholding for the reporting period.

Form MW508NRS must be submitted to the Comptroller on or before the 21st day of the month following the month in which the

payment of nonresident withholding tax is received. Send this form, Reconciliation Return, Form(s) MW506NRS and schedule of with-

holding to:

Revenue Administration Division

Revenue Accounting Section

PO Box 2031

Annapolis, MD 21404-2031

Copy 2 should be retained by the Clerk of the Circuit Court for his or her records. Enter the identifying information requested on the

form, including the telephone number of the individual to contact should there be any questions concerning the reconciliation return

or attachments.

Enter the reporting period for which the reconciliation return is being filed.

Enter the total number of Forms MW506NRS that are being attached to the reconciliation return.

Enter the total amount of withholding tax received during the reporting period. This amount should equal the total amount of tax

withheld and reported on all Forms MW506NRS for the reporting period.

QUESTIONS: Call 410-260-7980, write to the address above or e-mail: nrshelp@comp.state.md.us

1

1