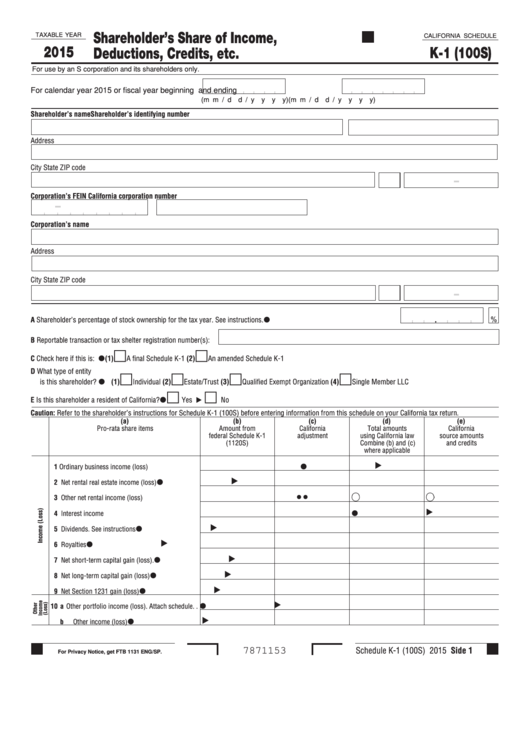

Schedule K-1 (100s) - California Shareholder'S Share Of Income, Deductions, Credits

ADVERTISEMENT

Shareholder’s Share of Income,

TAXABLE YEAR

CALIFORNIA SCHEDULE

2015

K-1 (100S)

Deductions, Credits, etc.

For use by an S corporation and its shareholders only.

For calendar year 2015 or fiscal year beginning

and ending

(m m / d d / y y y y)

(m m / d d / y y y y)

Shareholder’s name

Shareholder’s identifying number

Address

City

State

ZIP code

Corporation’s FEIN

California corporation number

Corporation’s name

Address

City

State

ZIP code

.

A Shareholder’s percentage of stock ownership for the tax year. See instructions.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

B Reportable transaction or tax shelter registration number(s):

C Check here if this is: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(1)

A final Schedule K-1 (2)

An amended Schedule K-1

D What type of entity

is this shareholder? . . . . . . . . . .

(1)

Individual (2)

Estate/Trust (3)

Qualified Exempt Organization (4)

Single Member LLC

E Is this shareholder a resident of California?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Caution: Refer to the shareholder’s instructions for Schedule K-1 (100S) before entering information from this schedule on your California tax return.

(a)

(b)

(c)

(d)

(e)

Pro-rata share items

Amount from

California

Total amounts

California

federal Schedule K-1

adjustment

using California law

source amounts

(1120S)

Combine (b) and (c)

and credits

where applicable

1 Ordinary business income (loss) . . . . . . . . . . . . . .

2 Net rental real estate income (loss) . . . . . . . . . . . .

3 Other net rental income (loss) . . . . . . . . . . . . . . . .

4 Interest income. . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Dividends. See instructions . . . . . . . . . . . . . . . . . .

6 Royalties. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Net short-term capital gain (loss). . . . . . . . . . . . . .

8 Net long-term capital gain (loss) . . . . . . . . . . . . . .

9 Net Section 1231 gain (loss) . . . . . . . . . . . . . . . . .

10 a Other portfolio income (loss). Attach schedule. .

b Other income (loss) . . . . . . . . . . . . . . . . . . . . . .

Schedule K-1 (100S) 2015 Side 1

7871153

For Privacy Notice, get FTB 1131 ENG/SP.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3