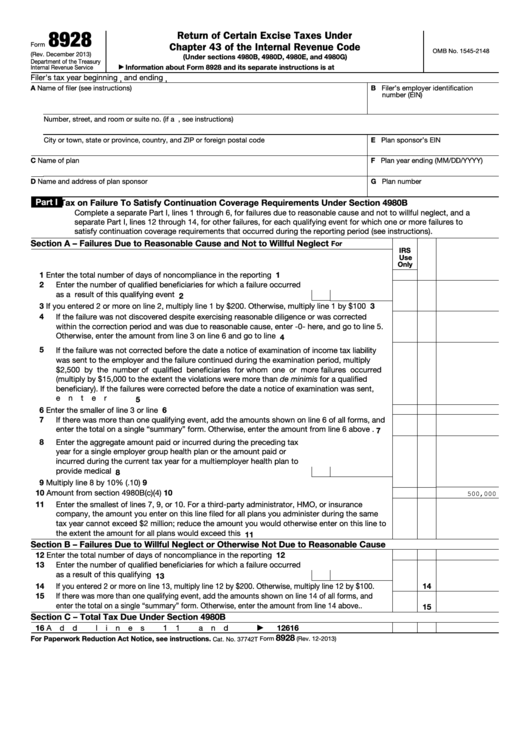

8928

Return of Certain Excise Taxes Under

Form

Chapter 43 of the Internal Revenue Code

OMB No. 1545-2148

(Rev. December 2013)

(Under sections 4980B, 4980D, 4980E, and 4980G)

Department of the Treasury

Information about Form 8928 and its separate instructions is at

Internal Revenue Service

▶

Filer's tax year beginning

and ending

,

,

A

Name of filer (see instructions)

B Filer’s employer identification

number (EIN)

Number, street, and room or suite no. (if a P.O. box, see instructions)

City or town, state or province, country, and ZIP or foreign postal code

E Plan sponsor’s EIN

C

Name of plan

F Plan year ending (MM/DD/YYYY)

D

Name and address of plan sponsor

G Plan number

Part I

Tax on Failure To Satisfy Continuation Coverage Requirements Under Section 4980B

Complete a separate Part I, lines 1 through 6, for failures due to reasonable cause and not to willful neglect, and a

separate Part I, lines 12 through 14, for other failures, for each qualifying event for which one or more failures to

satisfy continuation coverage requirements that occurred during the reporting period (see instructions).

Section A – Failures Due to Reasonable Cause and Not to Willful Neglect

For

IRS

Use

Only

1

Enter the total number of days of noncompliance in the reporting period .

.

.

.

.

.

.

1

2

Enter the number of qualified beneficiaries for which a failure occurred

as a result of this qualifying event .

.

.

.

.

.

.

.

.

.

.

.

2

3

If you entered 2 or more on line 2, multiply line 1 by $200. Otherwise, multiply line 1 by $100

3

4

If the failure was not discovered despite exercising reasonable diligence or was corrected

within the correction period and was due to reasonable cause, enter -0- here, and go to line 5.

Otherwise, enter the amount from line 3 on line 6 and go to line 7

.

.

.

.

.

.

.

.

.

4

5

If the failure was not corrected before the date a notice of examination of income tax liability

was sent to the employer and the failure continued during the examination period, multiply

$2,500 by the number of qualified beneficiaries for whom one or more failures occurred

(multiply by $15,000 to the extent the violations were more than de minimis for a qualified

beneficiary). If the failures were corrected before the date a notice of examination was sent,

enter -0- .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6

Enter the smaller of line 3 or line 5 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

7

If there was more than one qualifying event, add the amounts shown on line 6 of all forms, and

enter the total on a single “summary” form. Otherwise, enter the amount from line 6 above .

7

8

Enter the aggregate amount paid or incurred during the preceding tax

year for a single employer group health plan or the amount paid or

incurred during the current tax year for a multiemployer health plan to

provide medical care .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9

Multiply line 8 by 10% (.10) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

10

10

Amount from section 4980B(c)(4) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

500,000

11

Enter the smallest of lines 7, 9, or 10. For a third-party administrator, HMO, or insurance

company, the amount you enter on this line filed for all plans you administer during the same

tax year cannot exceed $2 million; reduce the amount you would otherwise enter on this line to

the extent the amount for all plans would exceed this limit .

.

.

.

.

.

.

.

.

.

.

.

11

Section B – Failures Due to Willful Neglect or Otherwise Not Due to Reasonable Cause

12

Enter the total number of days of noncompliance in the reporting period .

.

.

.

.

.

.

12

13

Enter the number of qualified beneficiaries for which a failure occurred

as a result of this qualifying event .

.

.

.

.

.

.

.

.

.

.

.

13

14

If you entered 2 or more on line 13, multiply line 12 by $200. Otherwise, multiply line 12 by $100.

14

15

If there was more than one qualifying event, add the amounts shown on line 14 of all forms, and

enter the total on a single “summary” form. Otherwise, enter the amount from line 14 above .

.

15

Section C – Total Tax Due Under Section 4980B

16

126

16

Add lines 11 and 15

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

8928

For Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 12-2013)

Cat. No. 37742T

1

1 2

2