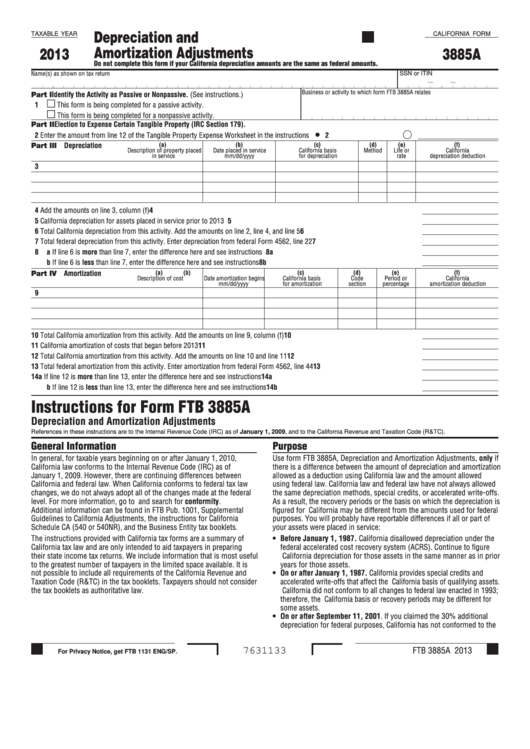

California Form 3885a - Depreciation And Amortization Adjustments - 2013

ADVERTISEMENT

Depreciation and

TAXABLE YEAR

CALIFORNIA FORM

Amortization Adjustments

2013

3885A

Do not complete this form if your California depreciation amounts are the same as federal amounts.

Name(s) as shown on tax return

SSN or ITIN

Business or activity to which form FTB 3885A relates

Part I Identify the Activity as Passive or Nonpassive. (See instructions.)

This form is being completed for a passive activity.

1

This form is being completed for a nonpassive activity.

Part II Election to Expense Certain Tangible Property (IRC Section 179).

2

Enter the amount from line 12 of the Tangible Property Expense Worksheet in the instructions . . . . . . . . . . . . . . . . . . . . . .

2

Part III Depreciation

(a)

(b)

(c)

(d)

(e)

(f)

Description of property placed

Date placed in service

California basis

Method

Life or

California

in service

mm/dd/yyyy

for depreciation

rate

depreciation deduction

3

4

Add the amounts on line 3, column (f) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5

California depreciation for assets placed in service prior to 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6

Total California depreciation from this activity. Add the amounts on line 2, line 4, and line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7

Total federal depreciation from this activity. Enter depreciation from federal Form 4562, line 22. . . . . . . . . . . . . . . . . . . . . . . . . 7

8

a If line 6 is more than line 7, enter the difference here and see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8a

b If line 6 is less than line 7, enter the difference here and see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8b

Part IV Amortization

(a)

(b)

(c)

(d)

(e)

(f)

Description of cost

Date amortization begins

California basis

Code

Period or

California

mm/dd/yyyy

for amortization

section

percentage

amortization deduction

9

10

Total California amortization from this activity. Add the amounts on line 9, column (f) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11

California amortization of costs that began before 2013. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12

Total California amortization from this activity. Add the amounts on line 10 and line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13

Total federal amortization from this activity. Enter amortization from federal Form 4562, line 44 . . . . . . . . . . . . . . . . . . . . . . . . 13

14

a If line 12 is more than line 13, enter the difference here and see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14a

b If line 12 is less than line 13, enter the difference here and see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14b

Instructions for Form FTB 3885A

Depreciation and Amortization Adjustments

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and to the California Revenue and Taxation Code (R&TC).

General Information

Purpose

In general, for taxable years beginning on or after January 1, 2010,

Use form FTB 3885A, Depreciation and Amortization Adjustments, only if

California law conforms to the Internal Revenue Code (IRC) as of

there is a difference between the amount of depreciation and amortization

January 1, 2009. However, there are continuing differences between

allowed as a deduction using California law and the amount allowed

California and federal law. When California conforms to federal tax law

using federal law. California law and federal law have not always allowed

changes, we do not always adopt all of the changes made at the federal

the same depreciation methods, special credits, or accelerated write-offs.

level. For more information, go to ftb.ca.gov and search for conformity.

As a result, the recovery periods or the basis on which the depreciation is

Additional information can be found in FTB Pub. 1001, Supplemental

figured for California may be different from the amounts used for federal

Guidelines to California Adjustments, the instructions for California

purposes. You will probably have reportable differences if all or part of

Schedule CA (540 or 540NR), and the Business Entity tax booklets.

your assets were placed in service:

The instructions provided with California tax forms are a summary of

• Before January 1, 1987. California disallowed depreciation under the

California tax law and are only intended to aid taxpayers in preparing

federal accelerated cost recovery system (ACRS). Continue to figure

their state income tax returns. We include information that is most useful

California depreciation for those assets in the same manner as in prior

to the greatest number of taxpayers in the limited space available. It is

years for those assets.

not possible to include all requirements of the California Revenue and

• On or after January 1, 1987. California provides special credits and

Taxation Code (R&TC) in the tax booklets. Taxpayers should not consider

accelerated write-offs that affect the California basis of qualifying assets.

the tax booklets as authoritative law.

California did not conform to all changes to federal law enacted in 1993;

therefore, the California basis or recovery periods may be different for

some assets.

• On or after September 11, 2001. If you claimed the 30% additional

depreciation for federal purposes, California has not conformed to the

FTB 3885A 2013

7631133

For Privacy Notice, get FTB 1131 ENG/SP.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2